Ahead Today

G3:

Asia: Malaysia IP

Market Highlights

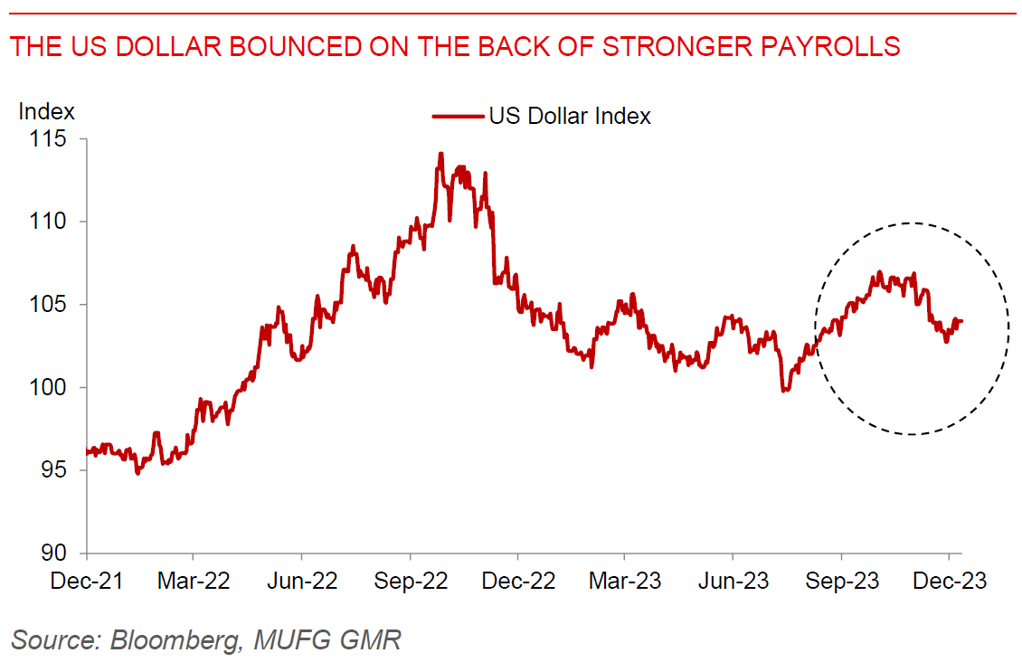

US non-farm payrolls rose by more than expected at 199k, leading to a recovery in the Dollar and rise in US yields. Hourly earnings bounced by 0.35%, from 0.2% previously, while the unemployment rate dropped to 3.7%, allaying fears of a sharper labour market dislocation. Looking at the details, around 35k of the rise in NFP can be attributed to auto workers who returned from strikes, which will not be repeated in the next print, while the gains were relatively narrow in health care and hospitality.

China’s Politburo announced that fiscal policy will be “stepped up appropriately”, while also no longer describing monetary policy as “forceful”, but rather “targeted” now. There was also a focus on “economic progress” in the statement. Overall, the language may suggest a greater reliance on fiscal policy, while also raising expectations of a GDP growth goal of around 5% for 2024. This announcement also came on the back of a weak CPI print of -0.5%yoy announced over the weekend, raising further concerns about the strength of demand in China.

It’s a massive week ahead in markets, to help us round out the calendar year. The Fed, ECB, and BOE meet, while PBOC announces the 1-year MLF decision. We expect no rate changes, but the semantics and tone will be closely scrutinised. Meanwhile, markets will watch out for any hints from Bank of Japan perhaps through news articles on policy changes ahead of its meeting next week.

Regional FX

Asian FX pairs were generally weaker against the Dollar on the back of USD strength, with USDCNH rising to 7.18. The Reserve Bank of India kept its key repo rate on hold at 6.50% in its December 2023 meeting as expected, while keeping its policy stance unchanged. There were no major hawkish surprises. This was unlike what we saw in the October policy meeting, when the central bank surprised markets by talking about potential Open Market Operation (OMO) sales of government bonds, and also prudential measures on fast-growing unsecured personal loans. If anything, RBI’s tone on liquidity in this meeting seemed to have eased slightly, We remain cautious over the next 3-6 months on INR, given a widening current account deficit, and slowing FDI inflows. This comes even as equity portfolio flows are getting a boost from recent strong result in state assembly elections by the BJP – Prime Minister Modi’s Party. Meanwhile, Taiwan’s exports rose by 3.8%yoy, slightly slower than consensus expectations for a 4.6%yoy rise, with machinery exports rising 13.5%yoy.