Ahead Today

G3: US PPI

Asia: Briefing by China’s MOF (Saturday), Bank of Korea

Market Highlights

US CPI inflation was higher than expected while initial jobless claims rose, a somewhat unhelpful combination for risk assets, and as such also presenting a more complicated path for the Fed. On the latest inflation print, the good news is that we are starting to see some of the long-awaited moderation in shelter inflation that reflects softer spot rentals already seen in the market. The bad news on that front is that some services components such as car insurance and healthcare remain sticky, while core goods disinflation showed some signs of bottoming out. Meanwhile, the weekly initial jobless claims numbers rose quite meaningfully to 258k from 225k the previous month, some of which was caused by disruptions from Hurricane Helene, but could also reflect some layoffs in the auto sector in the state of Michigan.

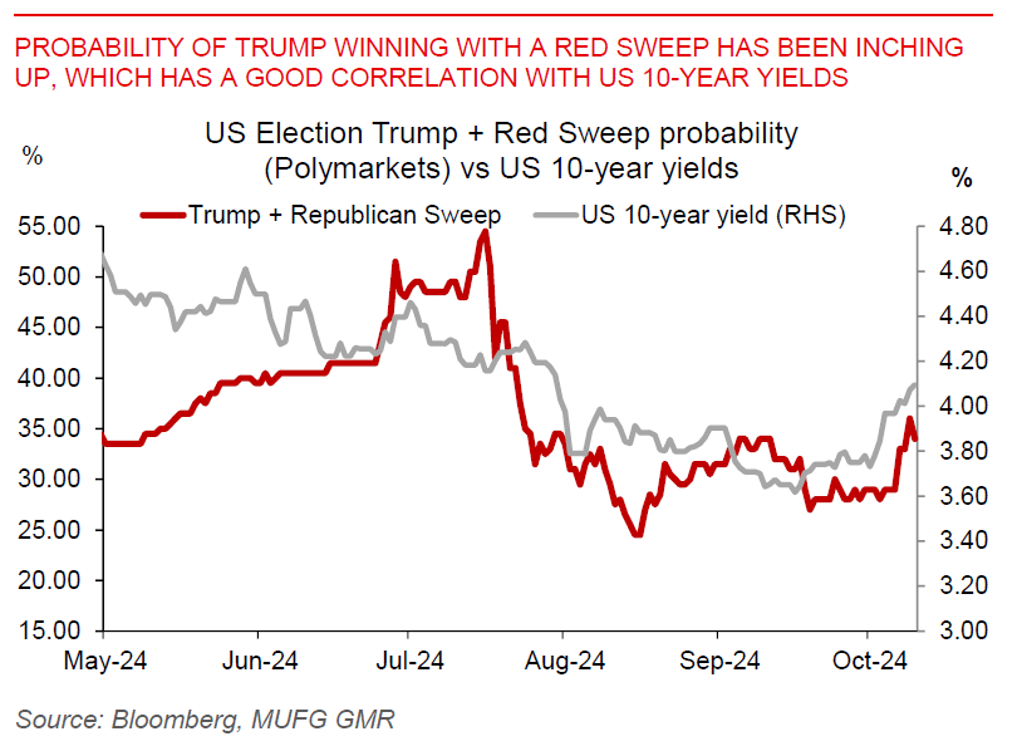

Overall, the key message from Fed speakers overnight including from Austan Goolsbee, John Williams and Thomas Barkin was to shrug off the higher-than expected CPI print and to suggest the central bank can still continue easing. With the focus of the Fed still squarely on preserving labour market gains, the path of least resistance remains of rate cuts – even if not at the same pace. Meanwhile, the probability of Trump winning with a Red sweep has been inching up in recent weeks, and may partly explain recent moves in US rates and the Dollar.

Regional FX

Asian FX markets remained somewhat on the backfoot with a stronger Dollar. PHP (-0.7%), KRW (-0.6%) and THB (-0.3%) underperformed while USD/CNH rose closer to the 7.084 levels. Markets will watch closely for the briefing by China’s Finance Minister Lan Fo’an on Saturday, where the theme of the news conference will be “intensifying countercyclical adjustment of fiscal policy to promote high-quality economic development”. It is yet to be seen whether this briefing will meet markets expectations of obtaining more concrete details on China’s fiscal stimulus package, but it’s worth noting that any official changes to the headline fiscal deficit targets may have to be approved in the National People’s Standing Committee (NPSC) which is likely to be held at the end of this month. Meanwhile, the Bank of Korea will hold its monetary policy decision, where we together with the markets are expecting a 25bps rate cut in this meeting.