Ahead Today

G3: US: PPI, initial jobless claims; ECB policy decision, Spain CPI

Asia: India CPI and industrial production

Market Highlights

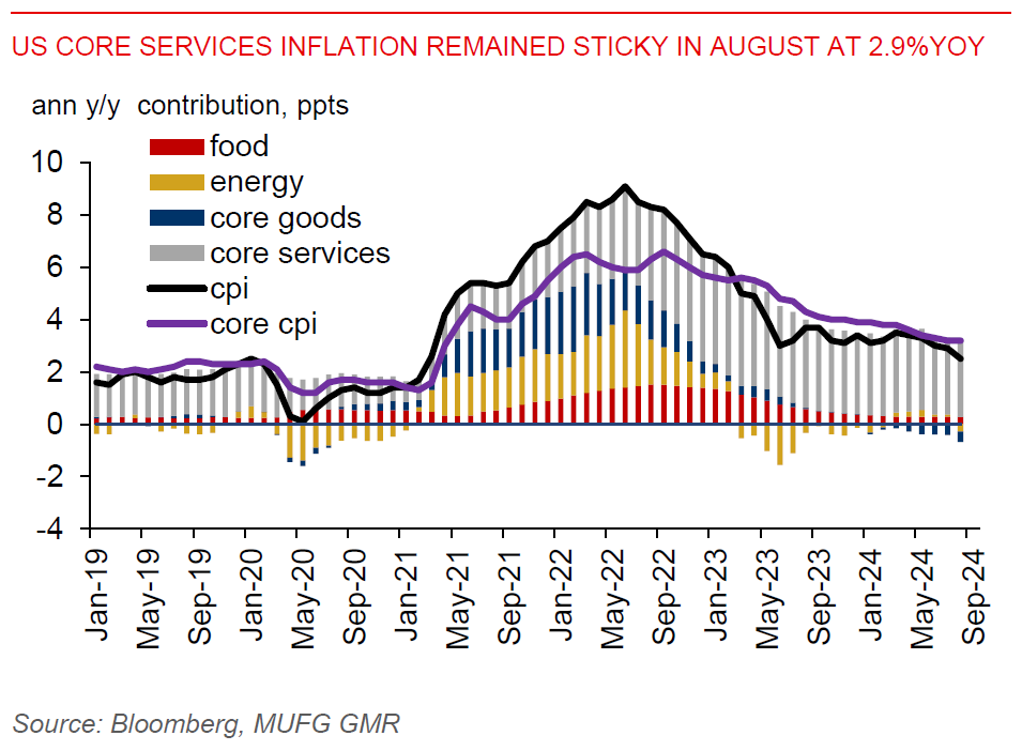

The DXY US dollar index was flat on Wednesday’s session, with the 102.00 resistance level stalling its upward momentum. JPY reversed its Wednesday Asia morning session gains against the US dollar. EUR has been in a soft patch of late on the back of weak industrial activity data and market expectations for another 25bps ECB rate cut that would bring the deposit facility rate to 3.50% later today. GBP also fell as m/m GDP growth stagnated in July for the second straight month, while manufacturing and construction activity declined by 1%m/m and 0.4%m/m, respectively, in that month. Meanwhile, US CPI rose 0.2%mom (2.5%yoy) in August, in line with market expectation, but core inflation (ex-food and energy items) rose 0.3%mom (3.2%yoy), faster than market expectation for a 0.2% increase, reducing odds of a larger 50bps rate cut in the September FOMC meeting. The first (and probably the only) US presidential debate between Trump and Harris has ended with odds still favouring the latter to win the November election. Market focus will next turn to the ECB policy decision later today, as well as its latest growth and inflation outlook.

Regional FX

Most Asia ex-Japan (AXJ) currencies regained strength against the US dollar on Wednesday’s trading session, partly underpinned by yen strength. PHP (+0.8%) led gains in the region, reversing most of its losses on Monday. This was despite a 29%y/y drop in FDI in June and a bearish close in Philippine shares. The economic data docket is light for Asia today, with only India CPI and industrial production of note, while eyes will be on the ECB meeting later today. With markets already pricing in a 25bps ECB rate cut, there shouldn't be much surprise. Asian FX could continue to consolidate, while Asian equities could perform well tracking gains in Wall Street overnight. Meanwhile, we look for the USDSGD to consolidate between 1.3000-1.31000 level today. The quarterly MAS survey shows professional forecasters raised their 2024 Singapore GDP growth outlook to 2.6% from 2.4%, underpinned by a stronger outlook for finance, construction, and wholesale and retail trade. Majority of forecasters also expect the MAS to keep the slope of the S$NEER unchanged at the October meeting, speaking to the resilience of the Singapore dollar. Singapore shares have also surged to a 6-year high, reflecting optimism about the growth outlook and lower global interest rates ahead.