Ahead Today

G3: US mortgage applications, eurozone industrial production

Asia: South Korea unemployment rate

Market Highlights

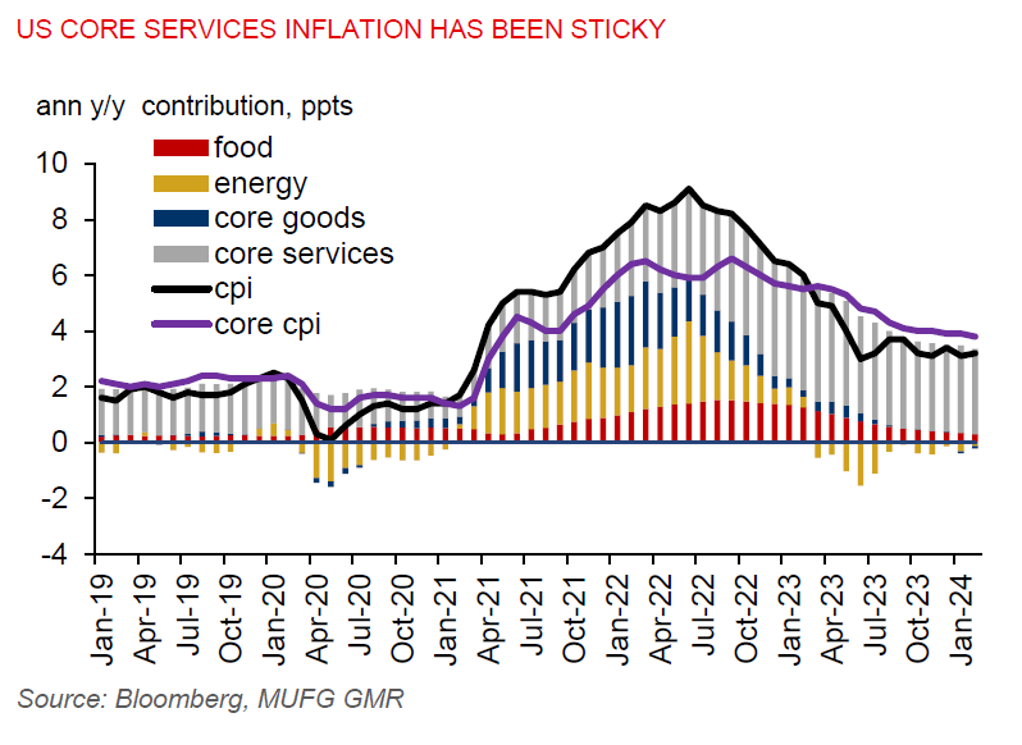

US sticky core CPI prices for February have reinforced the US Fed’s decision to be patient and cautious about cutting rates too early. US core CPI rose 0.4%mom (3.8%yoy), from 0.3%mom (3.7%yoy) in January. The supercore CPI (core services ex-shelter) was also up by 0.5%mom (4.3%yoy) in February from 0.85% gain in January, doubling the pre-covid pace. This has kept US rate cut bets in check at about 80-90bps for this year, close to the Fed’s 75bp rate cut outlook. The dollar index has remained firm, while US 10-year yields have remained sticky at 4.15%.

Meanwhile, the NFIB Small business Optimism Index inched lower to 89.4 in February from 89.9 in January, pointing to still weak sentiment among small businesses. This provided further signs of softening labour market conditions, which could help contain services inflation.

BOJ governor Ueda has reiterated that the Japanese economy is recovering gradually, despite some signs of weakening. This signals that the BOJ is on track to exit its negative interest rate policy. We think the rate lift-off could happen in the March meeting, following the annual wage negotiation outcome to be announced this Friday. JPY is consolidating its recent strength versus the US dollar at around 147.60 level.

Regional FX

Asian currencies have largely continued to hold on to their gains against the dollar, with USDCNH trading below the 7.20 level for the second straight day. Philippine exports rose 9.1%yoy In January, while imports fell 7.6%yoy. Philippine exports rose 9.1%yoy In January, while imports fell 7.6%yoy. This resulted in the Philippines’ trade deficit to narrow to US$4.2bn from US$5.6bn a year ago. Malaysia’s seasonally adjusted industrial production rose 1.1%mom in January, only partially reversing the 2.1%mom fall in December. India’s CPI was at 5.1%yoy in February, the same pace seen in January.