Ahead Today

G3: US: Dallas Fed Manufacturing Activity, Eurozone consumer confidence, Germany inflation

Asia: Vietnam: trade, retail sales, industrial production, inflation; Thailand trade

Market Highlights

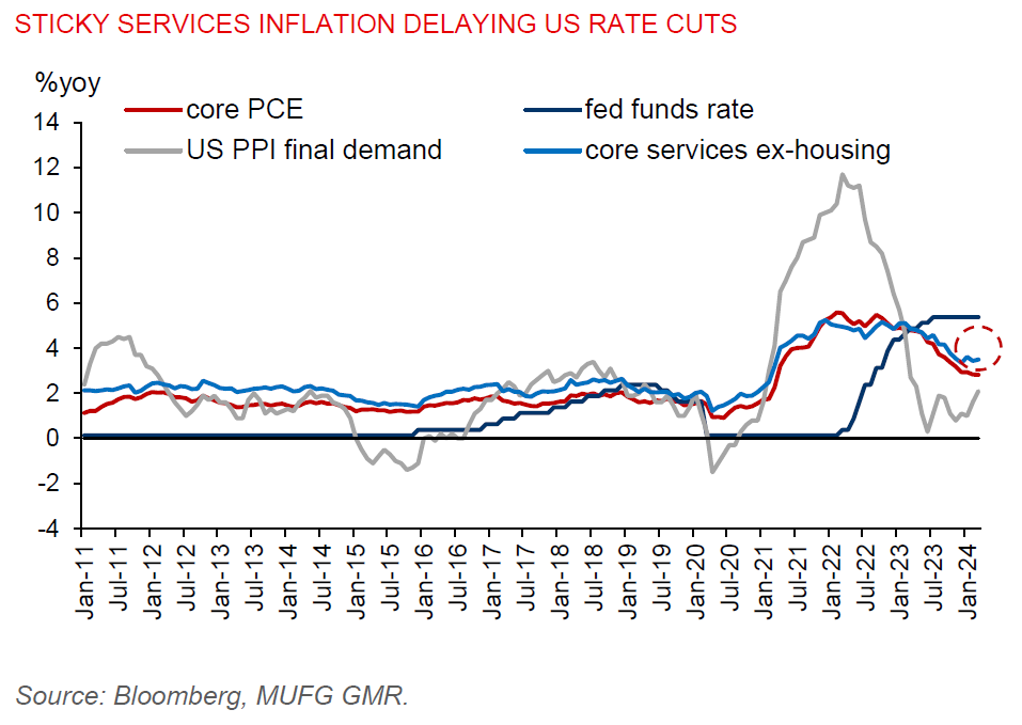

US core PCE deflator rose 0.3%mom (2.8%yoy) in March, unchanged from the pace seen in March. But the annual change in core PCE deflator is higher than Bloomberg consensus for 2.7%yoy. Notably, core services excluding housing was sticky at 3.5%yoy. Meanwhile, inflation-adjusted consumer spending rose 0.5%mom in March, up from 0.4%mom in February. The University of Michigan consumer sentiment index eased to 77.2 in April, from 79.4 in March, but it is still at the highest level since July 2021. At the upcoming FOMC meeting on 30April/1May, we think the US Fed is likely to signal for continued patience with regards to rate cuts. Markets are now pricing in only one or at most two US rate cuts this year. The broad US dollar index (DXY) has consolidated at around the 106 level, while US yields have stayed relatively high at 4.66%, albeit retreating 4bps from year-to-date high of 4.70%.

The BOJ has left its policy rate and the pace of bond buying unchanged at its April meeting, while reiterating that monetary policy will remain accommodative. USDJPY moved above the 158.00 level, increasing the risk that a rapid yen depreciation would likely invite FX intervention by Japanese authorities.

Regional FX

Asian currencies have been under downward pressure against the US dollar, none more acute than the yen (-2.4% last week). CNH fell 0.2% to 7.2687 per US dollar, while TWD fell 0.1% to 32.58 per US dollar. Several other regional currencies, like the KRW (+0.5%), took a breather last week, but only retraced a bit of their losses against the US dollar.

A “high for longer” US interest rate, along with recent sharp Asian currency weakness driven by a flare-up of geopolitical tensions in the Middle East, are likely to delay rate cuts in the Asia region till next year or even lead to potential rate hikes this year.

Singapore’s economic outlook remains fraught with downside risks. Industrial production fell 16%mom in March, after a 14.5%mom increase in February, dragged down by pharmaceuticals, electronics, and transport engineering. Singapore’s economic will depend on when global interest rates will decline and a tech upswing, according to a biannual Macroeconomic Review published by MAS last Friday.