Ahead Today

G3: Housing Starts, U Mich Sentiment, U Mich Inflation Expectations

Asia: Hong Kong GDP, Malaysia GDP, Taiwan GDP

Market Highlights

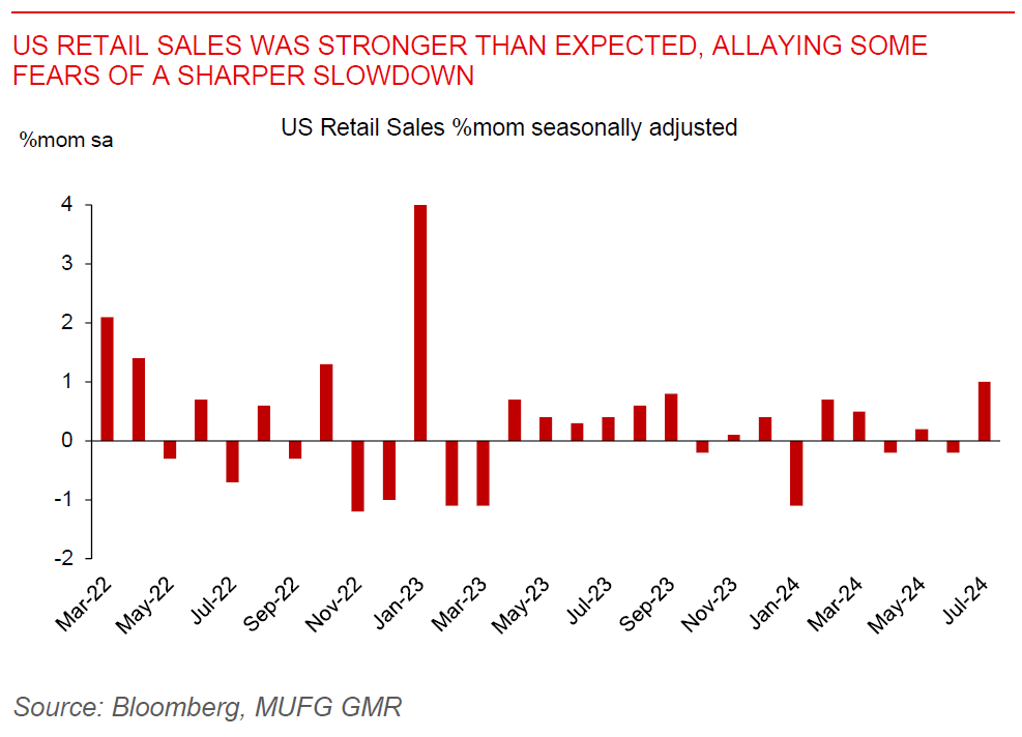

Stronger than expected US retail sales, coupled with declines in initial jobless claims helped to allay some concerns about a sharply slowing US economy. This led to the Dollar strengthening, with USDJPY above the 149.00 handle, EURUSD consequently down below 1.100, while USDCNH rose above 7.18. Details for retail sales showed the rebound was largely driven by a reversal in weakness in motor vehicle and parts the previous month, but more generally the underlying trend was still decent with the “control group” rising a more modest but larger than expected 0.3%mom. While the focus was very much on these two indicators, we note that other datapoints were mixed, with a moderation in the NAHB Housing Market Index and weakness in industrial production showcasing some weakness in the US housing market and manufacturing activity.

Overall, all these were enough to boost risk sentiment and sell recession assets, with the S&P500 rising 1.6% as was the case with most other equity markets globally, while US 10-year yields rose to 3.91% from 3.84% previously. Nonetheless, China’s monthly macro data for July pointed to a mixed picture for the economy, with softer industrial production, weak property investment, but marginally better than expected retail sales. We think that China’s economy probably needs more stimulus moving forward, and we expect more announcements in the months ahead.

Regional FX

Asian FX was weaker heading into the open, with SGD (-0.46%), CNH (-0.51%), KRW (-0.2%), and MYR (-0.9%) weaker against the Dollar given the better-than-expected US data and higher US yields. The Philippines central bank cut rates by 25bps in its August policy meeting, bringing the key reverse repo rate to 6.25% from 6.50% previously, and in line with our expectations. The key message we got from the statement and the post-policy press conference is that gradual BSP rate cuts into 2025 is the path of least resistance. Moving forward, we continue to expect the BSP to cut rates by another 25bps this year (likely in the December meeting), and by another 50bps in 2025. Overall, we lower our end-year USD/PHP forecast to 56.50 but keep our 2Q2025 forecast at 57.50. In the near-term, there is probably some space for PHP to strengthen modestly further against the Dollar towards the 56.00-56.50 handle with helpful current account and remittances seasonality in 4Q, expectations for FDI to improve, and as the Fed cuts rates. Nonetheless, a sharp and sustained PHP rebound akin to what we saw from 4Q2018 to 2019 is unlikely as we look into 2025 (see BSP: Firing the first salvo). Meanwhile, we will have Malaysia and Taiwan’s 2Q GDP numbers released later today. Consensus is expected a strong pickup in Malaysia’s 2Q GDP by 3% qoq sa, and 5.8%yoy, which if right, could help sustain momentum in the Malaysian ringgit.