Ahead Today

G3: US Mortgage Applications, Eurozone Consumer Confidence, Governor Waller Speaks

Asia: China Industrial Profits

Market Highlights

A Singapore registered container ship - the Dali - collided into a bridge in Baltimore causing it to collapse, and raising concerns about the potential impact to supply chains and the spillover to goods inflation. The incident has shut the Port of Baltimore, the number one port for US automobile and farm equipment imports, resulted in a closure of a major highway, and has resulted in significant diversion in container traffic to other ports across the US. This development also comes at a time of existing trade disruptions in the Red Sea and due to droughts in the Panama Canal. It's important to note that the starting point of supply chains are far better today, but it's nonetheless a key risk to watch and whether it remains localised.

The US macro data continued to paint a picture of decent growth in the economy thus far, with a recovery in core durable goods orders by 0.5%mom from -0.3%mom, although this was coupled with a fall in US consumer confidence. US house prices rose steadily by 0.14%mom and 6%yoy, which could raise some concerns about the impact to rental inflation further down in 2025 if this is sustained.

Overall markets traded mixed, with a decline in US 10-year yields, slight correction in US equity markets, together with a roughly flat US Dollar.

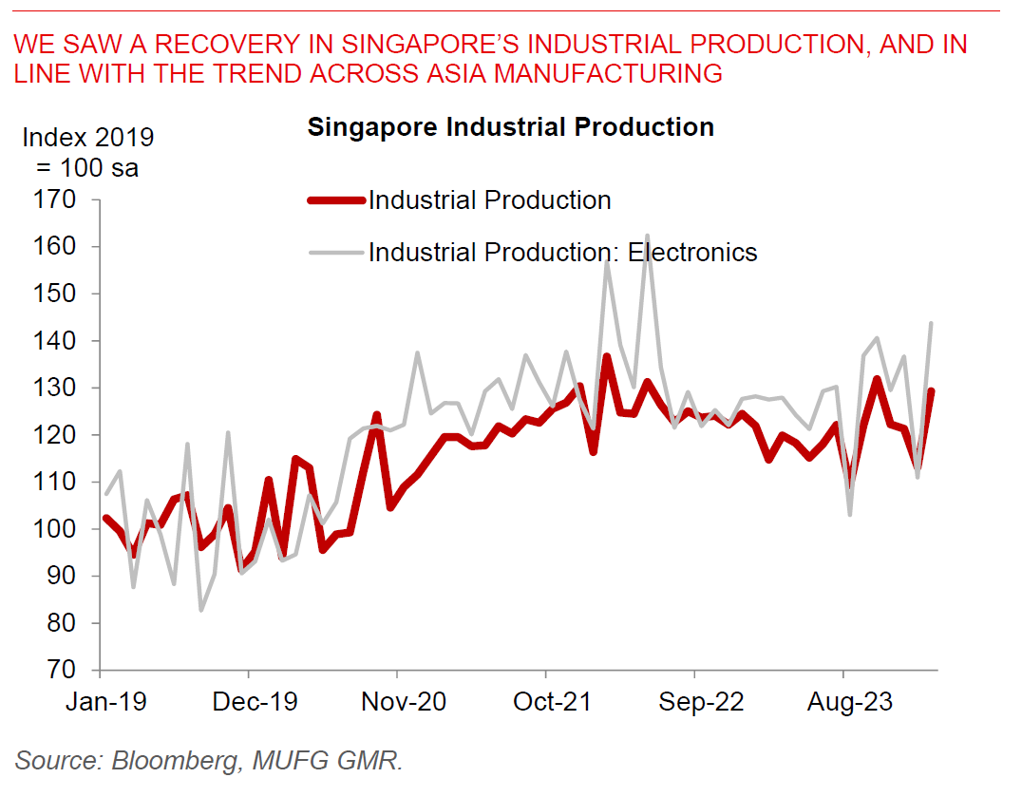

Regional FX

Asian FX markets traded mixed against the Dollar. Chinese authorities continued the trend at the start of the week, setting a stronger onshore fix of 7.0943 for USDCNY, from 7.0996 the previous day. Singapore’s industrial production rose sharply by 14%mom sa in February. This was driven by a 30%mom rise in electronics production, coupled with a 19%mom rise in general manufacturing activity. Overall these numbers are in line with the regional recovery in exports and manufacturing we see across Asia, including out of Korea and Taiwan. Meanwhile, India released data showing a smaller than expected 4Q current account deficit of US$10.5bn, although this was accompanied by an upwardly revised deficit for 3Q of US$11.4bn. The narrowing was driven by an improvement in services trade, coupled with a pickup in remittances, which more than offset a larger goods deficit. Overall, we maintain our constructive view on INR, and see the recent spike in USDINR as somewhat odd. Our forecast remains for USDINR at 83.0 in the near-term, before declining to 81.5 by year-end as bond index inclusion flows kick in.