Ahead Today

G3: Fed Governor Waller discusses US economy

Asia: South Korea Household Credit

Market Highlights

Equity markets rose further while the dollar strengthened somewhat, as markets digested the flow of Fedspeak together with property market measures announced by China’s government. Overnight, we had Fed members including Atlanta Fed President Bostic saying that the US economy seems to be slowing, but doing so very gradually. Most Fed officials including Jefferson mentioned that it is too soon to think that inflation will continue to come off further quickly after the latest datapoint, while Mester said that labour market rebalancing will put downward pressure on inflation. Tonight, we will have Governor Waller discussing the US economy, and this could be market moving, given his previous seminal and ultimately prescient speeches on the job vacancy rates and there being no rush to cut rates.

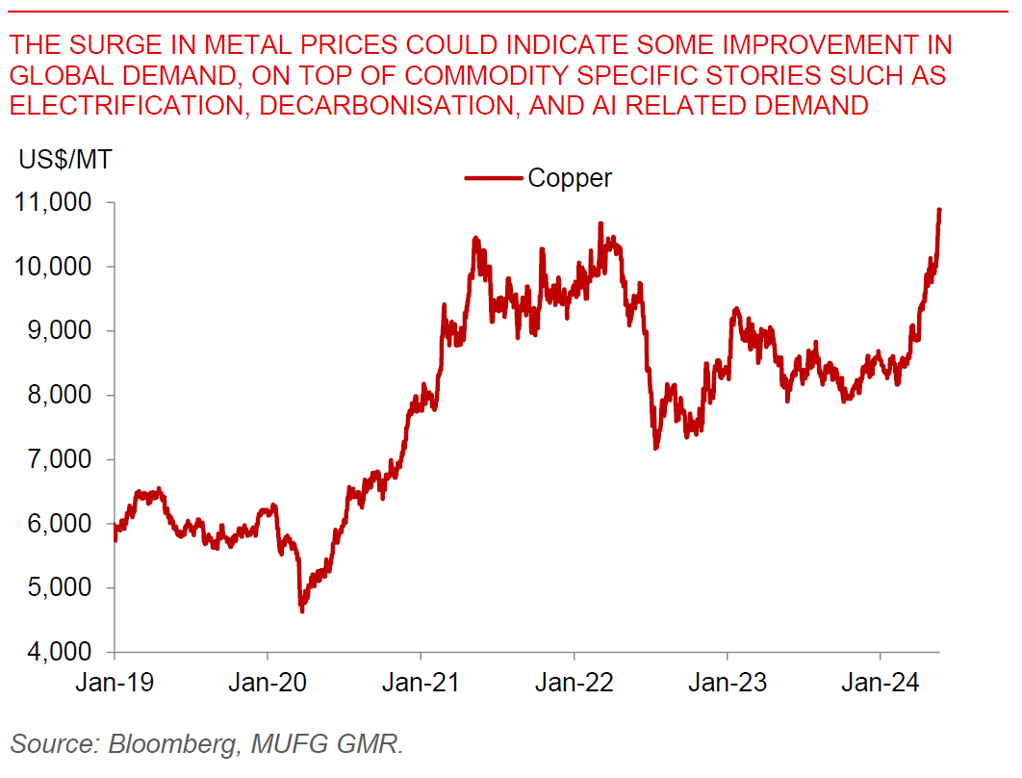

One key development to highlight as well is the sharp rise in several commodity prices over the past three months, and in particular metals such as copper and nickel, together with the rise in container freight rates. The good news for Asia is that Brent oil prices have been quite well-behaved hovering around US$84/bbl so far, but certainly the pickup in metals could indicate an improvement in global goods demand, together with some sector specific stories such as surging demand for electrification and AI in copper’s case.

Regional FX

Regional FX

Asian FX markets were generally weaker on the back of the stronger Dollar, with PHP underperforming (-0.72%), while THB outperformed (+0.3%). For Thailand, GDP growth came in better than expected for 1st quarter, rising 1.5%yoy vs consensus for a 0.8%yoy rise, driven by a pickup in private consumption and tourism. This eased the urgency on the central bank to respond to the government’s continued prodding to cut interest rates, at the same time as it looks as fiscal spending is finally starting to improve following the approval of the delayed budget coupled with more additional spending likely in the pipeline. Meanwhile, the PHP likely underperformed on the back of last week’s more dovish comments from BSP, which could continue until we get clearer signs that the BSP starts to intervene perhaps at the 58 level and/or clearer commitments from the central bank to have a slow and shallow rate cut cycle.