Ahead Today

G3: US Richmond Fed Manufacturing Index, US Existing Home Sales

Asia: India FY2024/25 Union Budget, Singapore CPI

Market Highlights

The People’s Bank of China cut the 7-day reverse repo rate, together with the 1-year and 5-year loan prime rate yesterday. CNH weakened to 7.29 against the Dollar, China bond yields fell by 2-5bps across the curve, while MSCI China equities rose modestly by 1.3% overnight. The move was somewhat of a dovish surprise to markets, given that most participants expected the PBOC to wait for better clarity from the Fed or the July Politburo meeting before cutting, and was also somewhat unusual given it was announced much earlier at 8am (instead of the usual 9am). These moves also come on the back of comments out of the Third Plenum to support growth and expand domestic demand, potentially indicating the top leadership’s concerns around growth prospects (see Third Plenum Our Interpretation). The next catalyst to watch for will be the end-July Politburo and we could get specific policies then.

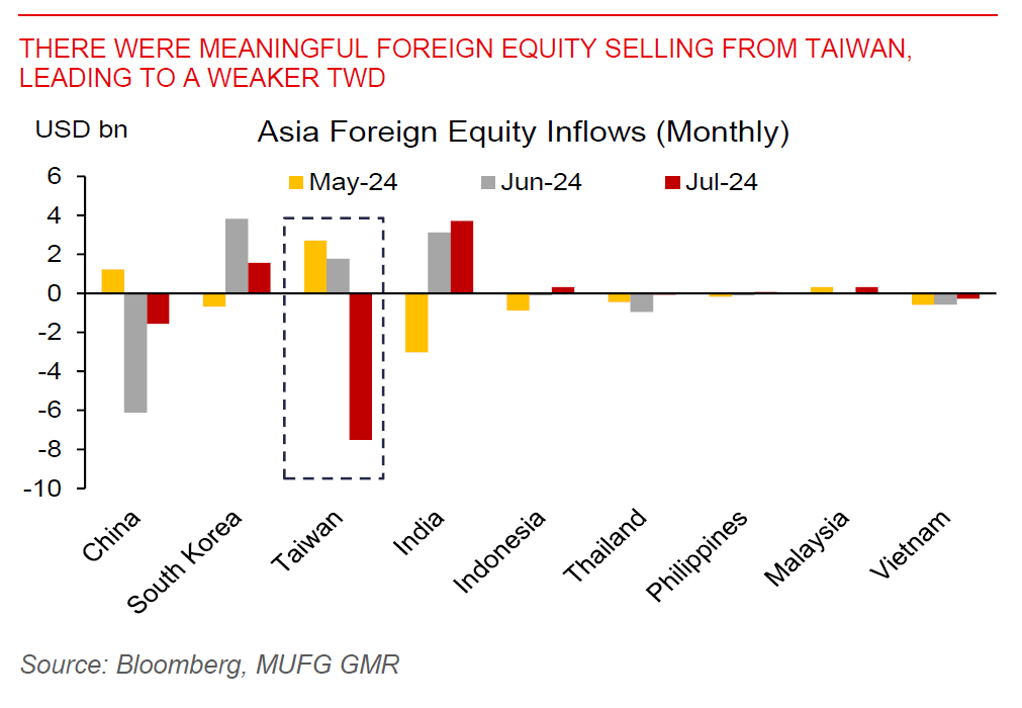

Overall, the Dollar weakened slightly as equity risk sentiment recovered with the S&P up 1.1% following the technology-led sell-offs since last week, even as there will be some key company earnings with Alphabet and Tesla. These trends in the tech sector could continue to have spillovers to Asian currencies including TWD, where there has been a correction in the equity markets with a hefty US$5.4bn foreign selling seen in last week alone. Meanwhile, Bloomberg reported that some Bank of Japan officials see weak consumption spending complicating calls for a rate hike in its July meeting, with more “leaks” potentially likely in the lead up to next week’s BOJ policy meeting.

Regional FX

Regional FX

Asian FX markets were mixed on the back of the Dollar trend and weighed down by the weaker CNY and also China rate cuts, with TWD (-0.7%) and THB (-1.1%) underperforming. India will announce its FY2024/25 full Union Budget today. We expect the government to keep the structural reform and fiscal consolidation momentum intact, while tilting the policy focus towards making growth more inclusive. We expect Budget FY2024/25 to target a fiscal deficit of 5% of GDP, down from 5.1% of GDP in the Interim Budget, and effectively using some but not all of the extra fiscal space afforded by higher RBI dividends and better fiscal outturns (see IndiaPulse: Towards More Inclusive Growth). Latest news suggests that the government has not officially granted its key coalition ally from the state of Bihar Special Category Status, but will ultimately increase transfers to both Bihar and Andhra Pradesh in the Budget in our view. Overall, if this is right, this should continue to keep a lid on government yields, allow for steady bond and equity inflows, and as such also help finance the current account deficit and support the Indian Rupee. We continue to think that INR can remain a low volatility currency and keep a constructive outlook on INR FX and rates markets. Meanwhile, the Philippines President Marcos has outlawed Philippine Offshore Gaming Operators (POGOs), a move which could help combat alleged crimes such as money laundering, but which could also have some impact at the margin on BPO and government revenues.