Ahead Today

G3: US House Prices, US durable goods, US Consumer Confidence, US Richmond Fed Index

Asia: Thailand Trade, Singapore Industrial Production

Market Highlights

Risk assets took a breather while the Dollar weakened slightly, as markets waited for clearer direction from upcoming macro data, coupled with some relief from a stronger CNY fix on Monday. There were a couple of Fed speakers yesterday, including Lisa Cook, Goolsbee and Bostic. Atlanta Fed President Bostic said his decision to shift to one rate cut from two was a “close call”, and that as long as the economy is strong, and people have jobs, he is not in a hurry to get inflation down to 2%. Meanwhile, Governor Lisa Cook emphasized need for a cautious approach to cutting rates, while saying that risks to job, inflation goals are moving into better balance. Across the Atlantic, ECB’s Chief Economist Philip Lane said there’s good progress to contain inflation and wage growth is returning to more normal levels.

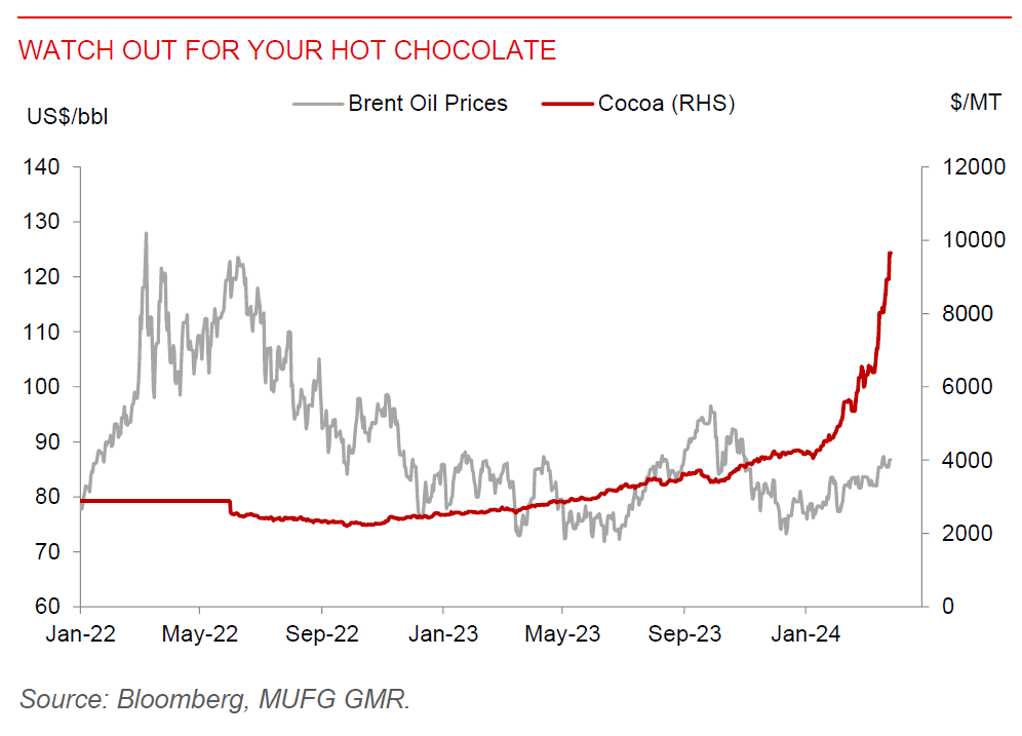

One key risk to watch out for is on commodity prices and its potential impact on global inflation moving forward. Brent oil prices have been inching up closer to US$87/bbl, with OPEC+ delegates reported by Bloomberg News to see no need in proposing policy changes in its meeting next week. On that front, the UN Security Council also finally passed a resolution calling for a ceasefire in Gaza, with the US abstaining. While most other commodity prices have been quite well behaved, we have seen some pickup in agriculture prices such as cocoa and palm oil.

Regional FX

Asian FX markets traded mixed against the Dollar, with CNH in particular rising 0.33% against the Dollar. This comes as authorities set a stronger fix of 7.0996 for USDCNY yesterday, down from 7.1004. Markets will continue to watch closely for the trend of CNY onshore fix this week to gauge the PBOC’s reaction function. Meanwhile, China’s key officials continued to push through messages of positivity of the economy, with PBOC Governor Pan Gongsheng saying that the property market has a “solid foundation” for long-term healthy and stable development, and that efforts to resolve local debt risk are showing effect. Premier Li Qiang said that China is off to a good start on 2024 economic goals with improvement in exports and industrial production, while also addressing business concerns on market access, public tendering and cross border flows. Singapore’s inflation came in higher than expected at 3.4%yoy for the headline rate, and 3.6%yoy for the core rate, in part boosted by timing effects on the Lunar New Year. While inflation should continue to come off gradually in Singapore this year, the path forward is still quite bumpy given the various administrative measures such as GST increase, water tariff hikes, and carbon taxes in the pipeline. We continue to expect the MAS to keep its exchange rate policy on hold.