Ahead Today

G3: US CPI, initial jobless claims

Asia: China CPI, BSP policy rate decision, Taiwan trade

Market Highlights

Equities have surged after President Trump paused reciprocal tariffs for 90 days on trade partners who have not retaliated in any shape and form thus far. But a minimum floor of 10% tariffs will still apply during this period of time. This has come about 13 hours after Trump’s reciprocal tariffs kicked in. It isn’t immediately clear which trade partners will receive this tariff relief. Given most Asian economies have not retaliated against the US, we believe they could be among the recipients of this tariff relief. There’s not much difference for Singapore, though, given it has been taxed at the lower 10%.

However, Trump has raised import levies on China to 125%, given China’s retaliatory measures and its refusal to negotiate with the US. Trump had previously imposed 104% tariffs on Chinese imports, which China had retaliated with 84% tariffs on all US goods. Earlier, the EU has approved targeted tariffs of up to 25% on $21bn of US goods, including soybeans, diamonds, agricultural products, poultry, and motorcycles.

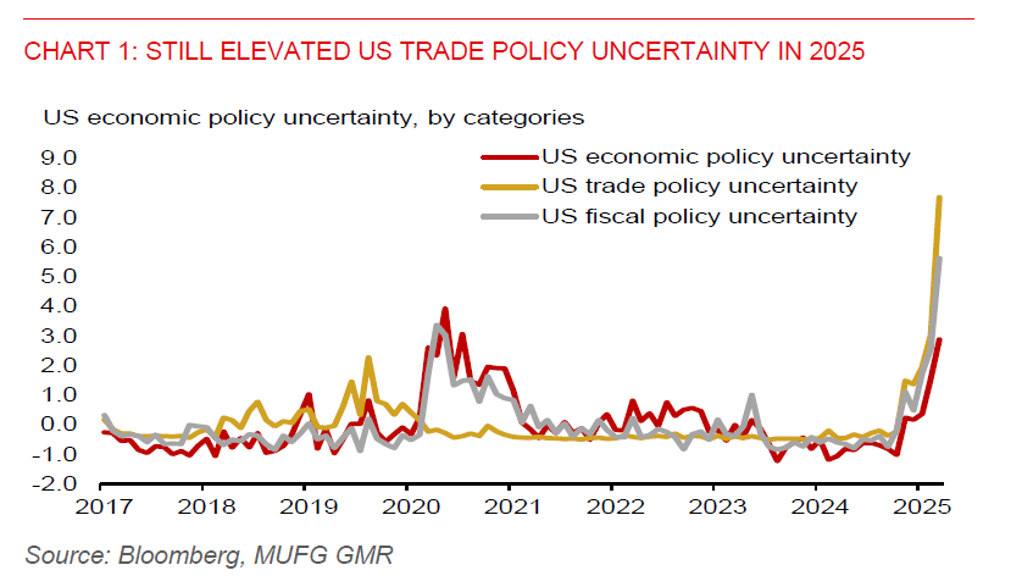

Despite the tariff easing, global trade uncertainty remains very high, given the unpredictability of Trump’s protectionist policies. This will likely continue to weigh on business confidence, putting investments on hold as firms wait for clarity about US trade policies. Amazon has reportedly cancelled some of its inventory orders for several products that are made in China to avoid tariffs. Tariff uncertainty could also weigh on companies that are considering to relocating their production to the US. It’s difficult to imagine many companies moving their production to the US to avoid the 10% universal tariffs, considering the relative differentials in wage costs, among others.

Meanwhile, FOMC minutes show a majority of policymakers see inflation could be more persistent and that inflation risks are tilted to the upside. Policymakers also added they are “well positioned” to respond to developments. This, along with the tariff relief, has led to markets paring back some of their fed rate cut expectation.

Regional FX

Offshore CNH gained nearly 1% against the US dollar, despite tariff easing not being directed at China. Currencies that are closely linked to CNH have also strengthened, including KRW (+0.6%), SGD (0.9%), and THB (+0.7%).

The key highlight today is the BSP policy rate decision. We expect the BSP to cut rates by 25bps today, amid slowing inflation, a relatively resilient PHP, and rising risks to growth.

RBI cut rates by 25bps to 6.00% yesterday as expected and shifted its policy stance to “accommodative” from “neutral”. The central bank has also signalled for more rate cuts in the face of US tariffs, lowered growth for the year that started 1 April to 6.5% from 6.7% previously, while inflation was lowered to 4% from 4.2% previously.