Ahead Today

G3: US New Home Sales, US Consumer Confidence

Asia: China MLF, Taiwan Industrial Production

Market Highlights

Brent oil prices jumped to US$73/bbl while the Dollar strengthened, as President Trump threatened a 25% tariff on any nation purchasing oil and gas from Venezuela. This tariff would go into effect on 2 April, and according to Trump would be on top of existing tariffs. According to the EIA, more than 60% of Venezuelan crude oil exports went to China in 2023. In Asia, the top buyers likely includes India as well which ramped up imports of Venezuelan oil in 2024 according to news reports. In theory, this would mean that China may get another 25% tariff on top of the 20% already imposed, although in practice some rerouting of official oil flows globally may occur.

Meanwhile, President Trump said that he might soften reciprocal tariffs he plans to impose next week, by signalling that trading partners would receive possible exemptions or reductions. According to Trump, he is “embarrassed to charge countries what they have charged the US”, although he mentioned that the tariffs will still be substantial, with auto import tariffs still in the pipeline and to be announced soon.

Overall, while these pronouncements are softer relative to what was mentioned previously, in absolute terms we do not yet know the exact level of tariff increases. We would remain cautious on how risk sentiment on Asian FX develops from here.

Regional FX

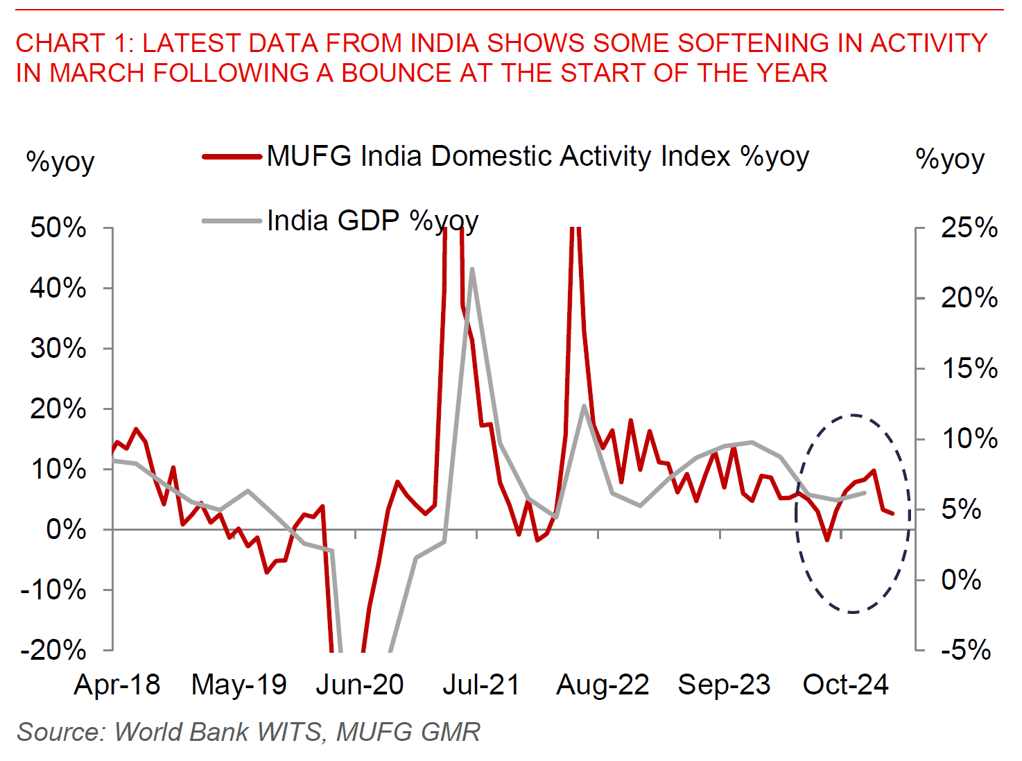

Asia FX pairs were generally weaker with the stronger Dollar overnight. USD/CNH rose to 7.2655 while in Asia, the key underperformers were MYR (-0.5%), IDR (-0.5%), and THB (-0.35%). INR continued to outperform rising 0.5% yesterday before Asia markets opened this morning. News reports suggest that India’s government is trying to seek an exemption from Trump’s reciprocal tariffs during talks with US trade officials when they visit for bilateral trade negotiations from 25-29 March. India’s government has also taken some initial steps to meet trade demands by the US by lowering import tariffs on certain goods, while latest reports also suggest that it may remove its “digital tax” on some online advertisement services and reduce tariffs further on other goods. It remains to be seen whether these moves will ultimately result in an exemption of tariffs by the US on India come 2 April, and we do think that INR markets are right now likely underpricing the risks from reciprocal tariffs. The PMI data released yesterday shows some softening in activity in India in March, and in line with the high frequency indicators that we track, and as such we are biased to see the RBI continue to pivot towards growth and cut rates from here.

Meanwhile, the Indonesian Rupiah continued to weaken and underperformed other Asian currencies. The adage that there is no free lunch continues to hold true, with Indonesia’s local equity markets declining sharply due to perceived uncertainty around the government’s sovereign wealth fund and the impact of transfers of stakes of state-owned enterprises to Danatara among other key policies.