Ahead Today

G3: US initial jobless claims, PMI, new home sales; eurozone PMI

Asia: Malaysia CPI, India PMI

Market Highlights

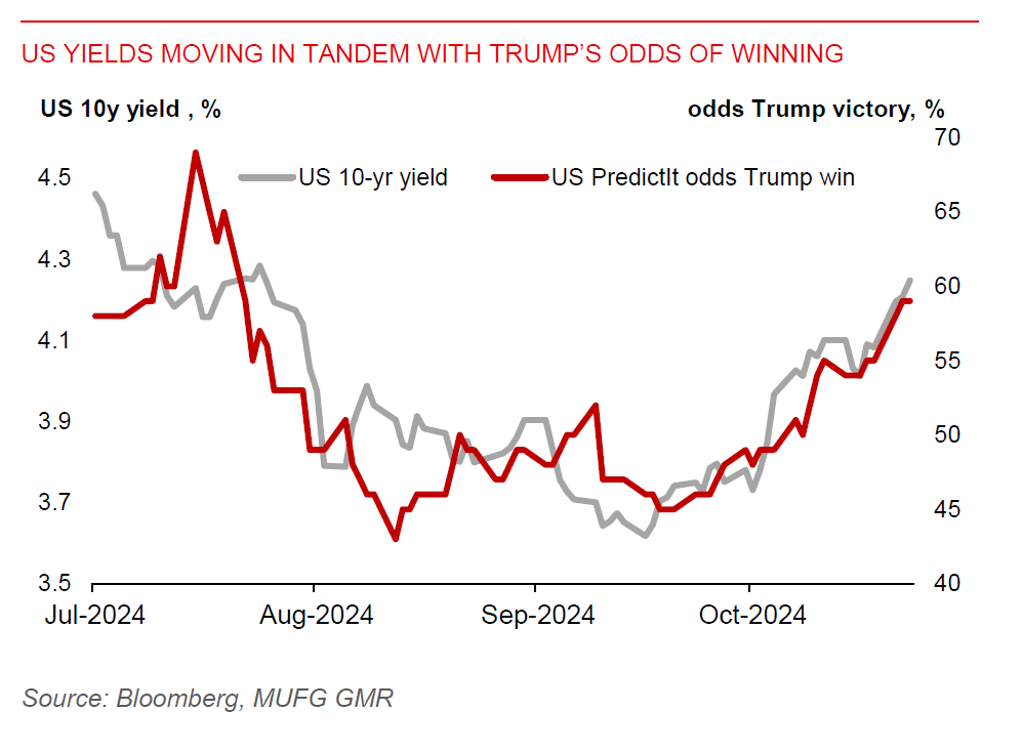

It’s less than 2 weeks away from the US presidential election on 5 November and Trump trade is roaring back to life again. Indeed, markets continue to price in the risk of a second Trump presidency. Based on PredictIt betting market, Trump has regained the lead from Harris since 10 October, with the odds of him becoming US president rising to 59%. His proposed economic policies, including imposing 60% tariff on all Chinese imports and 10% tariff on everyone else, as well as running a relatively larger fiscal deficit versus a Harris administration, could have inflationary consequences.

This month, the broad DXY US dollar index has already gained 3.6% this month, the US 2-year Treasury yield has risen by 40bps, while the 10-year was up by 45bps to above 4%. EURUSD fell below 1.0800-level for the first time since August, amid a faster pace of ECB rate cuts. The move lower in EURUSD has been in tandem with the narrowing 2-year yield differential with the US. USDJPY rose 1.3% to 153.00-level as Japan’s 10-year yield differential with the US has narrowed since mid-September.

The US dollar demand has also been fuelled by investors reducing their exposure to China-linked currencies. In Asia, MYR (-5.3%), KRW, (-5%) and THB (-4.1%) have been leading losses against the US dollar so far in October.

Regional FX

Asian ex-Japan currencies have weakened against the US dollar again in October, averaging a 3% decline. US tariff risk is growing, given rising odds of Trump winning. Trump’s tariff would have a huge negative impact on the outlook for Asian economies and pose downside risk to our forecasts for Asian currencies. Asian economies that could be more susceptible to higher US-China tensions include Singapore, Malaysia, Taiwan, and Vietnam, given their higher exposure of goods exports to the Chinese market, while India and Philippines could be less impacted.

In Singapore, core CPI inflation was 2.8%yoy in September, higher than the 2.7% in August and Bloomberg consensus of a 2.7% increase. But we maintain our outlook for core inflation to step down to around 2%yoy by end-2024, paving the way for the MAS to start loosening its exchange rate policy setting slightly in January 2025.