Ahead Today

G3: US initial jobless claims

Asia: China loan prime rate decisions, Indonesia Q4 current account balance, Malaysia exports

Market Highlights

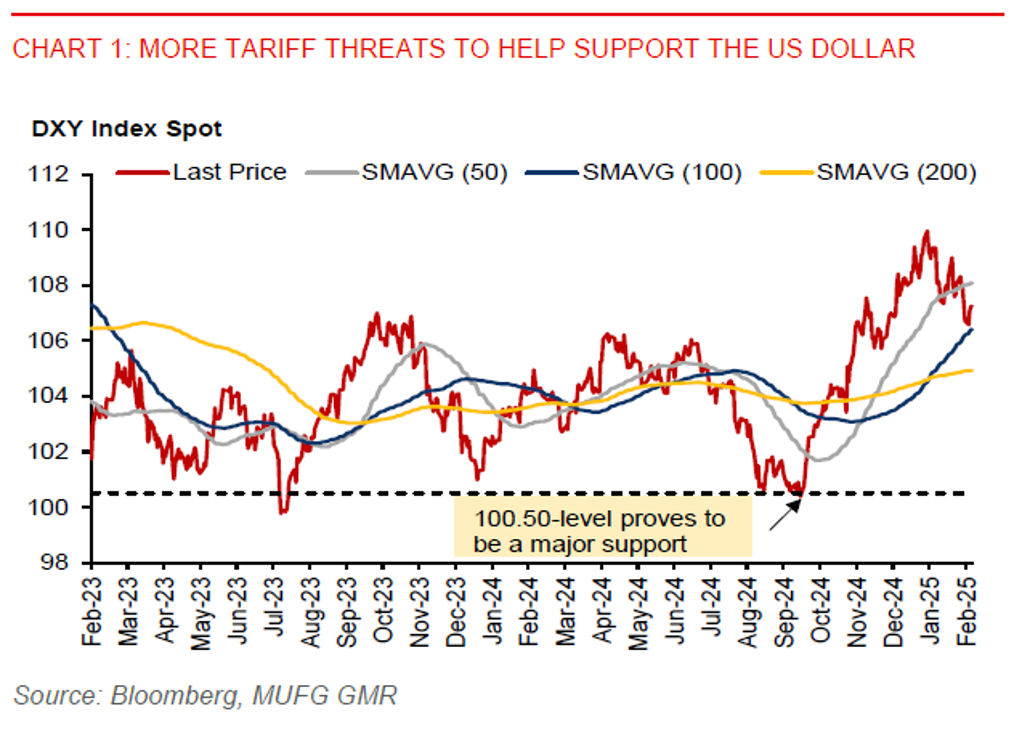

The US dollar (DXY) has found near-term support following President Donald Trump’s latest threat to impose 25% tariffs on autos, pharmaceuticals, and semiconductors. This could be implemented as early as 2 April, after an ongoing US review of its trade relations with trading partners, which is set to conclude on 1 April. DXY rose 0.1% to the 107.20 level in Wednesday’s session, extending gains for a second day. Meanwhile, US Treasury bond yields have not moved much, with the US 10-year yield still staying elevated at above 4.50%.

The FOMC minutes for the 28-29 January meeting shows the Fed is in no hurry to adjust policy rate. This is consistent with what we have recently heard from Fed chairman Powell. Policymakers would like to see more progress in inflation before lowering policy rate. They are also concerned that Trump’s trade and immigration policies could keep US inflation above their 2% target. Markets have continued to price in less than 2 US rate cuts this year. The minutes also indicate the Fed is considering slowing the pace of quantitative tightening.

Meanwhile, BoJ Board member Hajime Takata has said authorities should raise rates further to contain inflation. This sends a hawkish signal to markets. The yen was up 0.4% against the US dollar, while Japan’s 10-year bond yield has risen to 1.435%.

Regional FX

Asian ex-Japan currencies were broadly stable against the US dollar in Wednesday’s session, with the Indonesian rupiah (-0.3%) being a notable exception. Bank Indonesia kept the policy rate unchanged at 5.75% yesterday, refraining from doing back-to-back rate cuts as we had expected, given the risks of more US tariffs and policymakers’ concern about the rupiah. BI is still looking for opportunities to cut the policy rate to support the economy. We look for a 25bps cut in Q2 and another 25bps cut in Q3, bringing the policy rate down to 5.25% by end-2025. We also anticipate USDIDR rising to 16400 by Q2 on the back of potential tariff increase from April onwards. BI’s ongoing FX intervention could have slow the pace of rupiah depreciation. Also, the new policy requiring commodity exporters to keep all their foreign export proceeds onshore for at least one year could help support the rupiah.