Ahead Today

G3: UK GDP, ECB Account of April Meeting, US University of Michigan Sentiment

Asia: India industrial production, Malaysia industrial production

Market Highlights

The US dollar generally weakened while risk assets rose, as higher than expected jobless claims raised bets that the Fed will be able to cut rates this year. Initial claims rose to 231k from 209k, although more than half of this was due to a jump in New York probably due to public school worker applications during the school break, and as such could reflect some residual seasonality. Meanwhile, the Bank of England moved another step closer to cutting rates, with Deputy Governor Ramsden joining MPC member Dhingra in voting for a rate cut, with updated projections signalling less concern over upside inflation risks (see BOE FX Focus).

The BOJ has released its Summary of Opinions for the April 25-26 policy meeting, which does not provide much catalyst for a JPY upmove. The summary indicates the BOJ could reduce the degree of monetary easing if trend inflation accelerates or if inflation forecasts in the quarterly report are met. But overall, an accommodative financial environment will likely persist.

With these developments, markets have moved to increase its pricing for the 1st BOE rate cut in June, while the Fed Fund Futures markets have slightly raised their expectations to 1.8 rate cuts this year. This week has been a reasonably quiet week for markets relative to the JPY induced gyrations previously, but certainly markets will look forward to next week’s US CPI data for better clarity and direction.

Regional FX

Regional FX

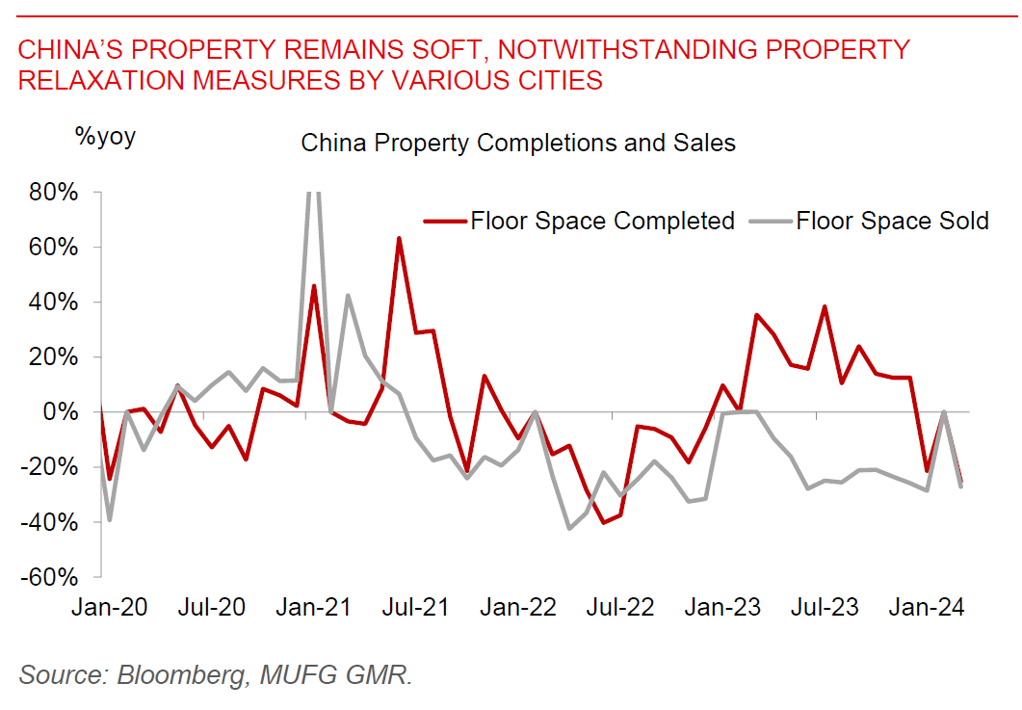

Asian FX generally traded slightly stronger into Asia open, with KRW (+0.16%), THB (-0.3%) and MYR (-0.16%) strengthening. We are seeing more big cities out of China announce property easing measures. Hangzhou, the capital of eastern Zhejiang province, said it will remove eight-year-old restrictions on residential purchases and no longer review the qualifications of homebuyers. Xi’an, the capital of Shaanxi province, announced similar steps hours later. These follows other property easing steps by other provinces such as Hunan and Changsha. China also released export data which showed some gradual recovery to 1.5%yoy, but we think this will not be sufficient to offset headwinds from weak consumer confidence and falling residential prices, notwithstanding property relaxation measures. Overall, we saw US$1.1bn of Northbound inflows yesterday, following some selling over the past two days, with CSI300 rising 0.95% and MSCI China rising 1.56%. Meanwhile, Bank Negara Malaysia held its policy rate at 3% on 9 May, with BNM optimistic about growth picking up while inflation remains contained.