Ahead Today

G3: US Initial Jobless Claims, Bank of England Policy rate.

Asia: China trade, Philippines GDP, BNM Malaysia Policy Rate

Market Highlights

Bank of Japan Governor Kazuo Ueda fired a series of warnings on a potential BOJ policy move, as he beefed up language regarding a weak Yen. He mentioned that abrupt and one-sided weak yen moves makes it hard for companies to formulate their business plans, and it’s natural for the BOJ to consider taking action. Meanwhile, Japan’s top currency official Masato Kanda said Japan is ready to take appropriate action on the currency at anytime, and it could be “tomorrow, or the day after tomorrow”. Overall JPY has continued to weaken to 155.39, albeit at a more controlled pace since suspected FX intervention.

In the G10 space, we will have the Bank of England’s policy meeting later today. This will be scrutinized closely to see how much closer BOE has moved to cutting rates. While the BOE is expected to hold rates, one MPC member could vote in favour of a rate cut, with Deputy Governor Ramsden saying he now judges risks as tilted to the downside for inflation. We will also get BOE’s updated inflation projections, which could signal less concern over upside inflation risks. This also comes on the back of the Swedish central bank’s decision yesterday to cut rates and signal more rate cuts in 2H2024. The Dollar was somewhat stronger while equities fell as markets digested these developments.

Regional FX

Regional FX

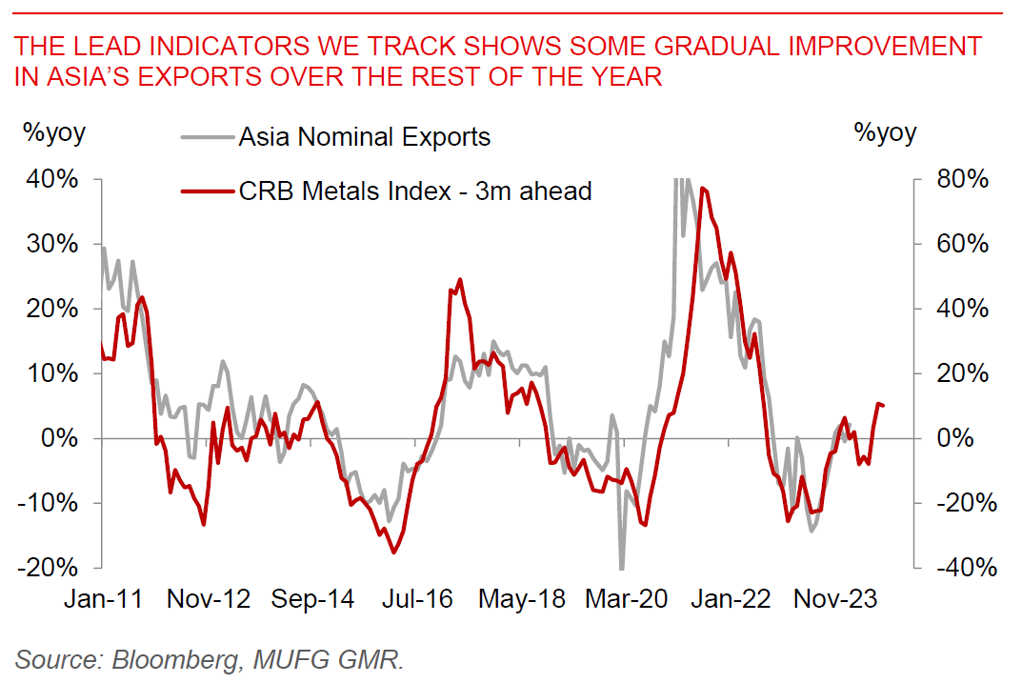

Asian FX generally traded slightly weaker, with KRW (-0.4%), PHP (-0.3%) and TWD (-0.2%) underperforming. We will get export data out of China later today, which is expected to show some further improvement in trade activity in April. We note that the rise in offshore and onshore Chinese equity markets have taken a little bit of a breather, with around US$560mn of Northbound outflows yesterday. Meanwhile, there was decent data out of the Philippines, with a smaller trade deficit for the month of March of US$3.2bn, from US$3.6bn the previous month driven by weaker imports. We will get 1Q GDP numbers, which is expected to show some improvement in growth to 5.9%yoy from 5.6%yoy previously. We remain neutral on PHP and see the moves in April as too fast too furious. We forecast USDPHP at 57.00 by 4Q2024 and 56.5.0 in 1Q2025.