Ahead Today

G3: US PCE inflation

Asia: Thailand Trade, Singapore industrial production

Market Highlights

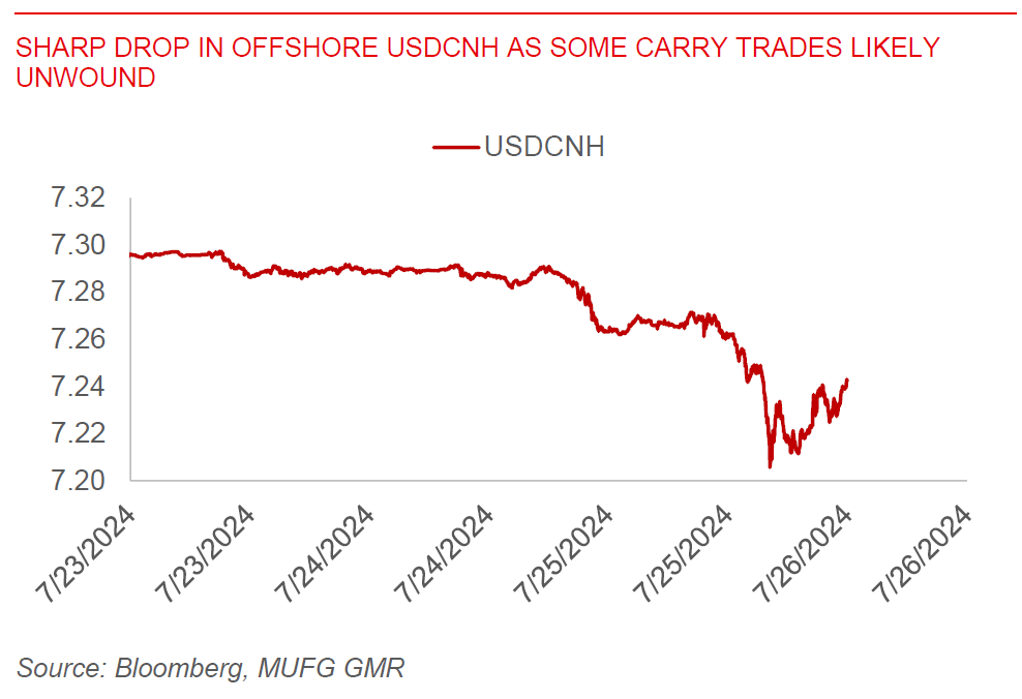

The big moves in markets continued, with global equity markets selling off further, weak trends in industrial metals, together with the sharp strengthening in JPY against the Dollar. In Asia, all these trends have also interestingly spilled more recently into the offshore Chinese renminbi, with USDCNH dropping sharply from 7.26 to 7.20 at one point in time yesterday, before recovering somewhat post the stronger than expected US GDP data. It’s hard to know exactly what caused these moves, but some positioning unwinds perhaps of FX hedges and carry trades in CNH/CNY probably make sense to our minds. Moving forward, the fundamental story of China and CNY remains one where more stimulus is needed to support the economy, and over here, while we think there will be more forthcoming, end-July’s Politburo meeting will be important in this regard.

Overnight, US 2Q GDP data was stronger than expected at 2.8% annualized, up from 1.4% the previous quarter. The details showed that this was driven by an acceleration in private consumption, with a pickup in goods consumption offsetting weakness in services consumption, together with a pickup in inventories. More broadly, the higher frequency indicators coupled with US earnings releases such as out of Tesla and regional banks point to some softening in US growth momentum. We continue to think that the Fed will start its rate cut cycle from September, and this month’s Fed meeting could be important to watch to see if there are any hints.

Regional FX

Regional FX

Asian FX markets were mixed, with the biggest outperformers being CNH (+0.34%) and MYR (+0.18%), while KRW (-0.4%) and TWD (+0.3%) underperformed. The Monetary Authority of Singapore left its monetary policy setting unchanged in July, as widely expected. There is no change to the slope, width, or level of the S$NEER policy band. The central bank continued to expect growth to improve further over 2024, while also expects MAS core inflation to fall further to around 2% in 2025 while stepping down more discernibly in 4Q2024. The forecast for headline inflation was lowered to 2-3% for 2024 but core inflation forecast was kept unchanged at 2.5-3.5%. Given our outlook for the policy setting to remain tight this year, we expect the SGD nominal effective exchange rate will move in the upper part of the policy band. We maintain our forecast for SGD to gain modestly to 1.3200 per USD level by end this year. Meanwhile KRW and TWD underperformed on the back of the global tech sell-off. South Korea’s 2Q advance GDP estimate was weaker than expected at 2.3%yoy and -0.2% qoq sa, with the weakness driven by a decline in private consumption and construction and facilities investment.