Ahead Today

G3: US ISM services index, eurozone services PMI

Asia: Indonesia Q2 GDP, China Caixin PMI, Singapore retail sales

Market Highlights

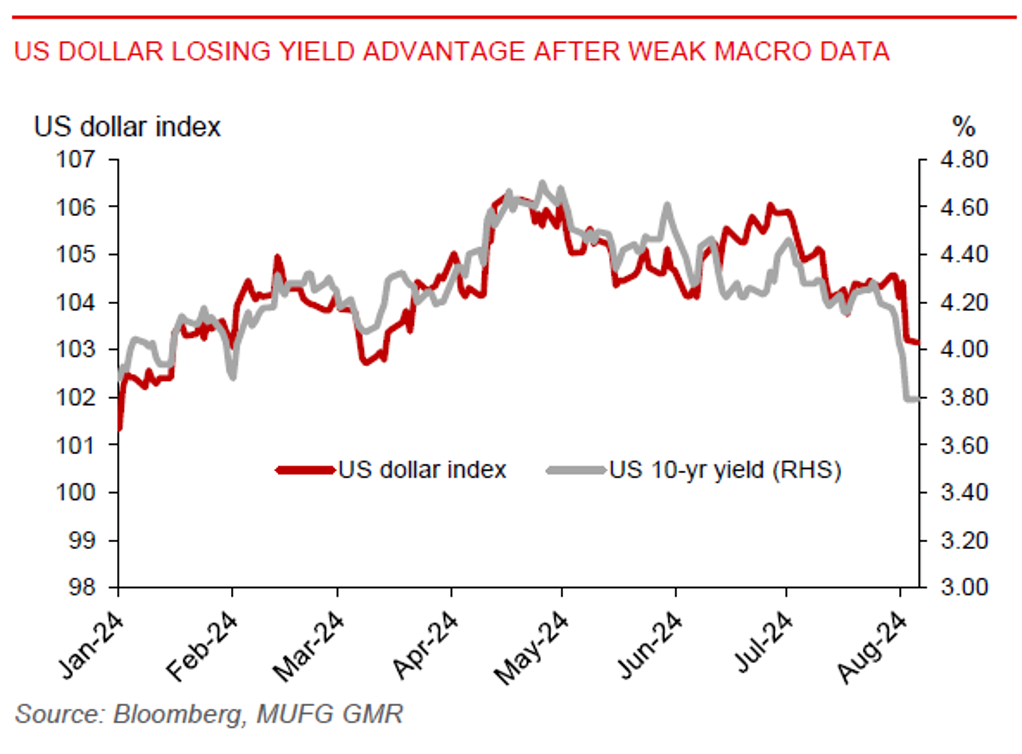

Weak US jobs data and fears of a hard landing triggered a shock to US markets on 2 August, with the US dollar down by 1.2%, S&P500 sold off by 1.8%, while US 10-year yields fell by 19bps. Volatilities in bond and equity markets are now back again.

The US economy only added 114,000 jobs in July, lower than the downward revised 179,000 jobs in June and well below market consensus of 175,000 jobs. The US unemployment rate also climbed to 4.3% from 4.1% in June, marking the highest level in 3 years. The average hourly wage growth slowed to 3.6%yoy from 3.9%yoy in June.

The rise in the unemployment rate has triggered the Sahm rule, which signals a possible start of recession when the three-month average in the unemployment rate exceeds the lowest three-month average seen over the last 12 months by 0.5ppt. The only comfort is that the unemployment increase was mainly due to rising labour supply.

Markets are worried about recession and think the Fed may now be behind the curve. As such, markets are pricing for a larger size and faster pace of US interest rate cuts ahead. About 110-120bps of US rate cuts are now being priced for this year. The US dollar weakness has led to gains across major currencies. Notably, the yen strengthened by 4.7% against the US dollar last week and is extending its gains by another 0.6% to start the week trading below 146-level.

Regional FX

Asian currencies have strengthened against the US dollar amid falling US yields and broad US dollar weakness. Notably, CNH has strengthened sharply to below the 7.1500-level, and is now below the onshore CNY rate, which is currently at the 7.1700-level. In addition, the ringgit has been an outperformer, driven by government efforts to encourage state linked firms to repatriate their foreign income, while the largest pension fund has reportedly stopped its plans to invest overseas. The Indonesian rupiah has also gotten reprieve from a weaker dollar, with the Indonesian 10y bond yield falling below 7%. However, a potentially weaker Q2 GDP data from Indonesia, which will be due later today, could still somewhat weigh on market sentiment. Bank Indonesia remains wary about capital outflows risks and still high (albeit declining) US yields. The central bank thinks global risks need to become manageable before policy rate cuts can come.