Ahead Today

G3: Eurozone June PMI, US S&P PMI

Asia: China CNY fix, India Manufacturing and Services PMI, Thailand Trade

Market Highlights

Central bank decisions globally tilted somewhat dovish. The Bank of England kept rates on hold 5.25%, but more importantly, some members of the MPC indicated the decision was “finely balanced”, with a willingness to look past recent services inflation pickup. Our G10 team continues to see BOE cutting rates in August. Meanwhile, Swiss National Bank cut rates again to 1.25% to stem gains in the Swiss Franc and given that inflation pressures have been lower than expected. Among Asian central banks, China and Indonesia both kept their key rates unchanged, with Bank Indonesia in particular having a reasonably neutral tone despite the recent weakness in the Rupiah.

With several central banks globally turning more dovish, the eyes also turn towards what the Fed will do next. US data overnight was generally softer with weaker US housing starts and higher than expected initial and continuing claims, and continue to indicate some softness in the economy. We continue to think that the Fed will have space to recalibrate rates lower this year with a softer labour market coupled with moderating wage growth and inflation. If this is right, this should provide some breathing room for Emerging Market FX, with the sum of global rate cuts also greater than its parts for supporting global risk appetite.

Regional FX

Regional FX

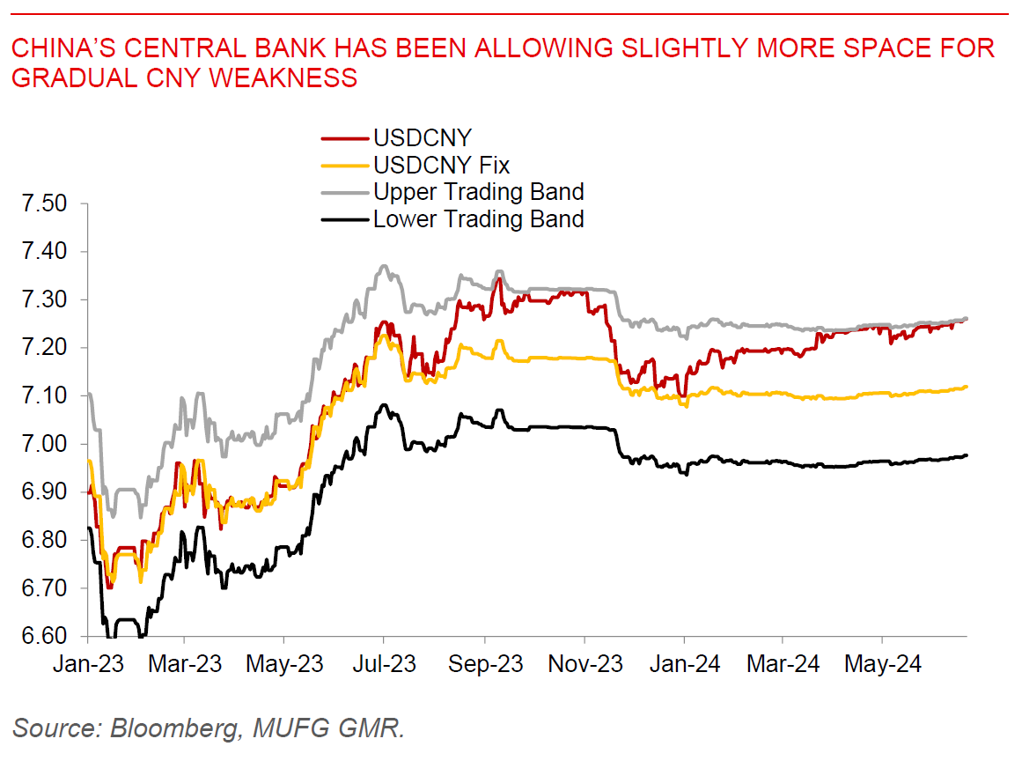

Asian FX markets were weaker on the back of a stronger Dollar and slightly weaker risk sentiment. Asian FX were also weighed down by weaker CNY, with the CNY-mid fixing was somewhat weaker than expected at 7.1192 yesterday, up from 7.1159 the previous day. The fixing strategy will be watched closely by markets. More broadly, the fixing since May by the PBOC seems to be facilitating gradual weakness in CNY and allowing slightly more space for depreciation, with CNY fixing weaker even when the Dollar was weaker to stable overnight. We think big moves are still unlikely, and controlled and managed movements for CNY are the name of the game for now. Last but not least, Bank Indonesia kept rates on hold and indicated that IDR should over time reach its fundamental levels of below 16,000, while acknowledging recent concerns in the market on Indonesia’s fiscal outlook together with the impact of higher for longer US rates.