Ahead Today

G3: US JOLTS Job Openings, Eurozone CPI

Asia: Philippines CPI, Taiwan CPI, India Full Year GDP estimate

Market Highlights

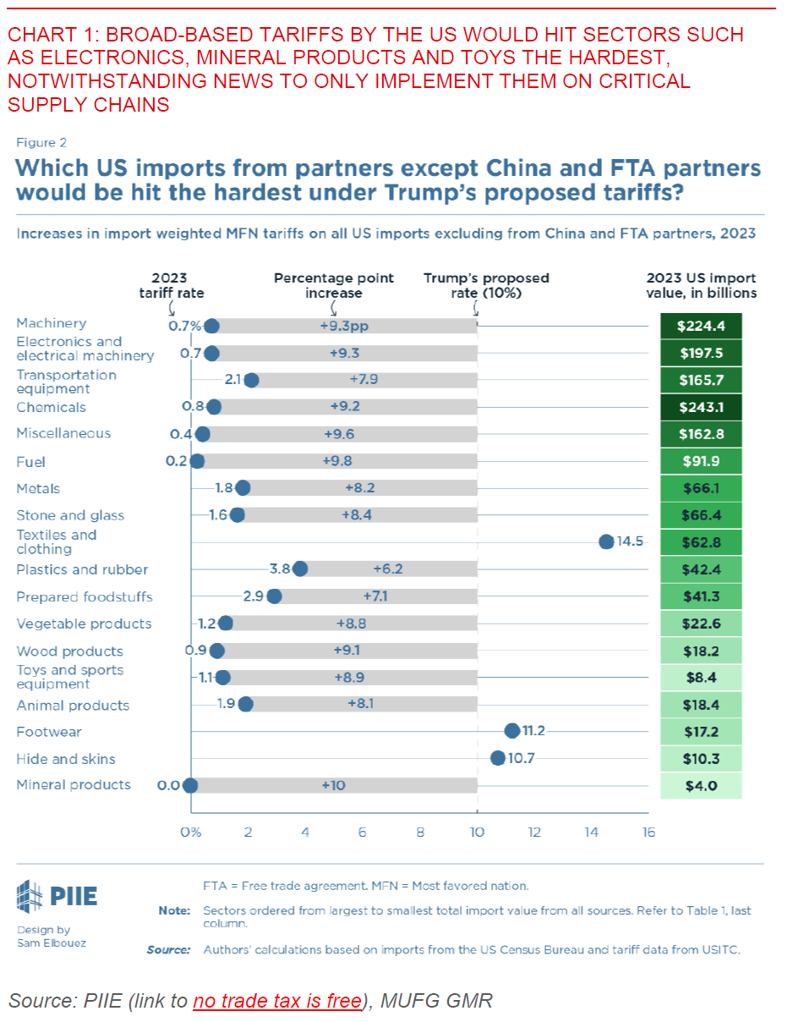

Markets whipsawed with the Dollar weakening as a Washington Post news report suggests that Donald Trump’s team is exploring broad-based tariffs but which will only cover sectors deemed critical to national or economic security. The exact industries that will be impacted are not immediately clear, but according to the article includes key sectors the Trump team wants to reshore production including the defense industrial supply chain (steel, iron, aluminum and copper), critical medical supplies (syringes, needles, vials and pharmaceutical materials), and energy production (batteries, rare earth and solar panels). Post the article, Trump came out to criticise the news, saying that his tariff policy will not be pared back and in effect denying plans to keep broad-based tariffs to just critical supply chains.

All this points to the difficulty in how exactly Trump may implement his tariffs, even as we continue to think that swift and broad-based implementation is the most likely path. The ultimate impact of this move to our minds is less so about whether the sectors are deemed critical, but whether there are realistic opportunities to find alternative supply domestically in the short-run and as such reshore production, and also how sensitive demand in these sectors are to tariffs. Overall, volatility in markets will likely continue as we head into Trump’s inauguration and beyond if yesterday was a harbinger of things to come.

Regional FX

Asian currencies were mixed with KRW (+0.54%), VND (+0.12%), and SGD (+0.4%) outperforming, while PHP (-0.65%) underperformed. CNH and onshore CNY remained under pressure to weaken even as Trump’s tariffs whipsawed FX markets, with USD/CNY in particular rising to 7.328 at the time of writing. Chinese authorities have been trying to manage the pace of CNY weakness since the start of the year even as the onshore USD/CNY rate broke above 7.30 levels. Authorities fixed the USDCNY effectively stable at 7.1876 yesterday and with the onshore rate quite close to upper FX band of around 7.33 it’ll be important to see how the central bank fixes it again this morning to gauge their comfort on FX weakness. Meanwhile, USD/INR saw some brief relief with the news article on Trump’s tariffs, but ultimately retraced higher in the NDF market above the 86 levels for 1m NDF. We think the path of least resistance is for USD/INR to continue to climb higher given a weaker outlook for capital inflows coupled with wider current account deficit trajectory (see INR – Let it go?).