Ahead Today

G3: US durable goods orders, initial jobless claims, existing home sales; Germany IFO business climate

Asia: Thailand trade

Market Highlights

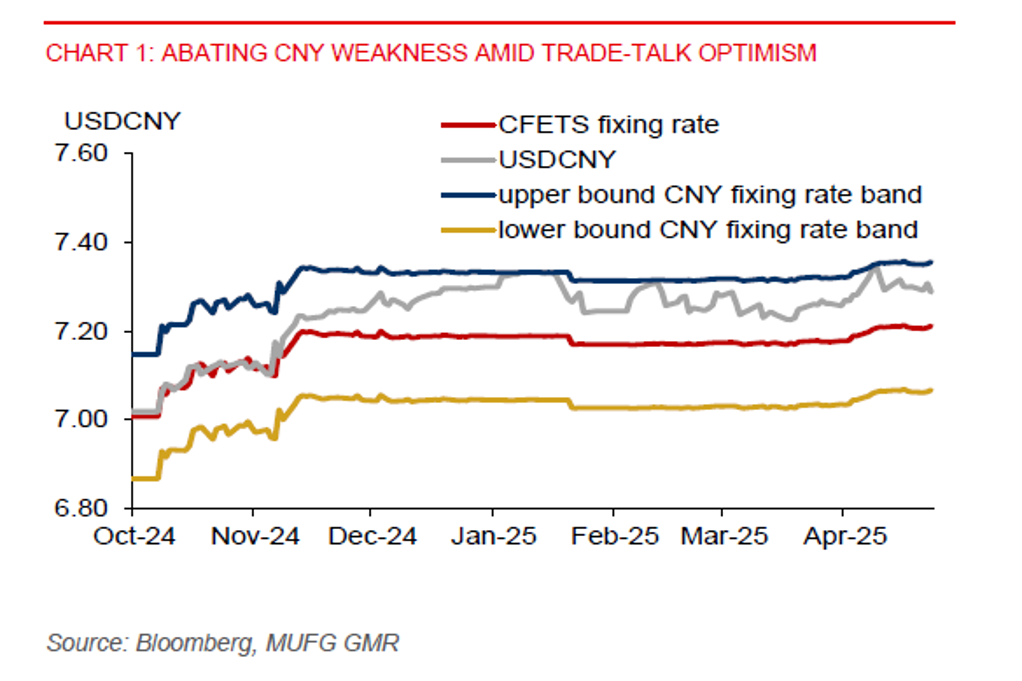

US-China trade-talk optimism, along with US President Trump’s reassurance that he won’t be firing Fed Chair Powell, have provided reprieve for US equities, Treasury bonds, and the US dollar. The Trump administration has reportedly mulled lowering tariffs on China to de-escalate trade tensions, which have weighed on global trade and investment. Trump has suggested that tariffs on China may be “substantially” lowered if a trade deal is reached. One senior White House official said tariffs on China could come down to around 50%-65%, from current 145%. Also, another option being mulled by the administration is to adopt a tiered tariff approach, whereby there will be 35% levies on strategic items and 100% on those goods tied to national security, to be phased in over 5 years. There appears to be a level of financial market instability that the Trump administration may not be willing to tolerate. China has signalled that the door for trade talks is “wide open”. However, US Treasury Secretary Scott Bessent said a US-China trade deal could take 2-3 years and there’s no unilateral offer from Trump to cut tariffs on China. This has somewhat pared back market optimism.

Meanwhile, US economic data shows some signs of a slowdown in the services sector, while manufacturing activity gathered pace in April. Services PMI slowed to 51.4 in April from 54.4 in March, below market expectation for 52.6 but still in expansion. The manufacturing PMI rose to 50.7 from 50.2, beating market expectation for 49.0.

Regional FX

The broad US dollar index (DXY) has continued to rebound on signs of potential trade de-escalation between US and China. Notably, THB (-0.6%) led losses in the Asia region, partly amid falling gold prices, while the rest of Asian currencies have had a mixed performance.

Bank Indonesia (BI) held its policy rate unchanged at 5.75% yesterday, in line with our and market expectations. Concerns about rupiah stability have likely led to the rate hold. We maintain our forecast for Bank Indonesia to cut the policy rate by 50bps in the rest of this year, bringing the policy rate to 5.25% by end-2025. This will be consistent with the Fed’s March median dot plot of 2 rate cuts this year and Fed Chair Powell’s cautious stance on rate cuts. The next 25bps BI rate cut could still come this quarter, possibly in June, when the Fed could cut rates. There may still be some modest rupiah weakness over the coming weeks, but sharp depreciation from current levels looks unlikely, with the BI also intervening in the offshore NDF market.

Meanwhile, Singapore’s headline inflation was 0.9%yoy in March, unchanged from the pace in February. The core gauge slowed to 0.5%yoy, from 0.6% in February, below market expectations for 0.7%yoy. This was underpinned by slower price increases in utilities, household goods, and services.