Ahead Today

G3: Australia Retail Sales, US S&P Core Logic Home Prices, US Conference Board Consumer Confidence, US Dallas Fed Manufacturing

Asia: South Korea Retail Sales

Market Highlights

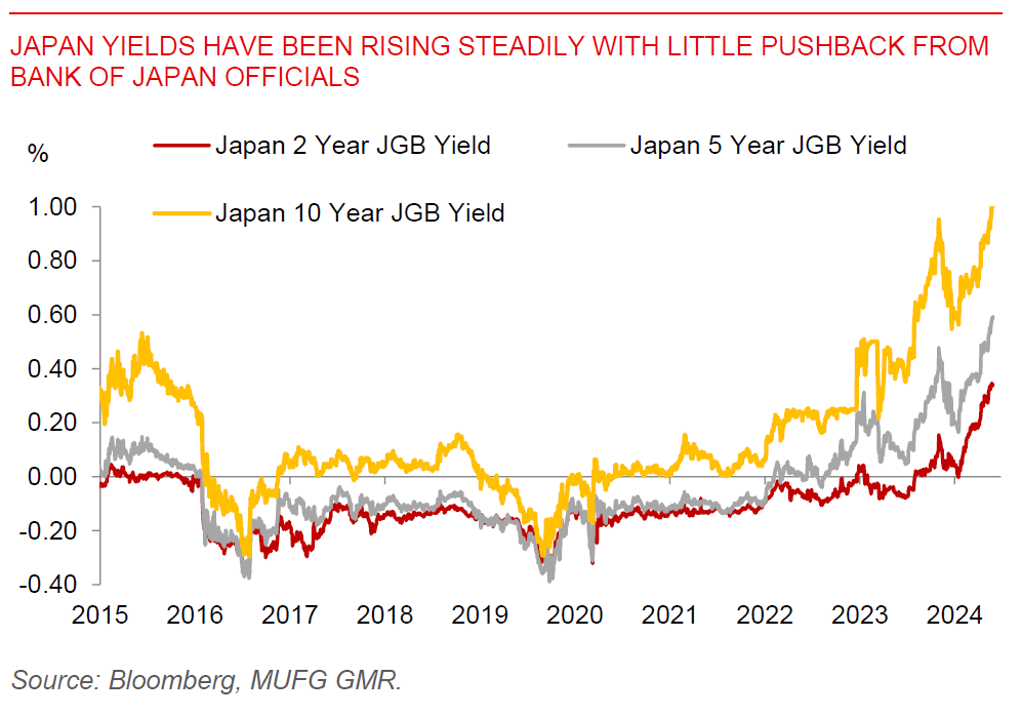

With several key markets including the US and UK out on holiday, the focus shifted to other markets, including comments from key Bank of Japan and European Central Bank officials. Bank of Japan held its annual international conference, with both BOJ Governor Ueda and Deputy Governor Uchida speaking. BOJ Governor Ueda pledged that the bank will “proceed cautiously” after making progress in moving away from zero-inflation expectations. Deputy Governor Uchida was more equivocal, pronouncing that “this time is different” with the battle to end deflation in sight, notwithstanding the big challenge still to anchor inflation expectations at 2%. He highlighted that deflation was a both an economic phenomenon and a “social norm”, both of which were likely to change as labour supply constraints bite and as Japanese employers turn more willing to raise wages.

Meanwhile ECB Chief Economist Philip Lane said that while the ECB is on track to start cutting interest rates in June, the central bank will still need to be restrictive all year long. This raises the obvious question of what exactly is restrictive, but to be fair to the ECB, the long-term neutral rate is still an enigma unanswered and greatly mulled upon by global central banks right now including the Fed and the Bank of Japan.

Overall, markets were reasonably quiet, with better risk sentiment spilling over to the FX markets with a weaker US Dollar.

Regional FX

Regional FX

Asian FX markets performed decently on the back of better risk sentiment, with KRW, MYR and TWD outperforming. USDCNH inched slightly higher. China’s trade practices were criticized by G-7, saying that the country’s trade practices were hurting economies of its trade partners through its “comprehensive use of non-market policies and practices”, adding that members would continue to monitor the ‘negative impacts of overcapacity”. The statement drew a strong rebuke from the Chinese Foreign Ministry, saying that the G-7 hypes up overcapacity issue in China and is essentially protectionism and not in the interest of any party. The good news was that the recent summit between China, Japan and South Korea – the 1st since 2019 - seemed modestly cordial, while latest data showed China’s industrial profits returning to growth in April, growing 4%yoy.