Ahead Today

G3: Germany industrial production, Japan’s leading index

Asia: Foreign reserves data from several Asian countries

Market Highlights

This time is different, with trade war 2.0 larger and more pervasive than the first trade war in 2018-2019. World equities have continued to plunge after China has intensified its trade retaliation against the US. In response to Trump’s 34% reciprocal tariff hikes, China has announced a 34% tariff on all US goods last Friday. This notably departs from its earlier measured responses, of 15% tariffs on US coal and LNG, 10% on US crude, agricultural machinery, displacement cars, and pickup trucks, impose export controls on 25 rare earth metals, and 10%-15% on certain US agro products.

The chance of a full-blown global trade war is growing, and the negative impact of higher global tariffs and uncertainty will hurt the global economy through lower global trade and investments. Brent prices have fallen by more than 6% in each of the last 2 trading sessions, reflecting concerns about a global growth slowdown.

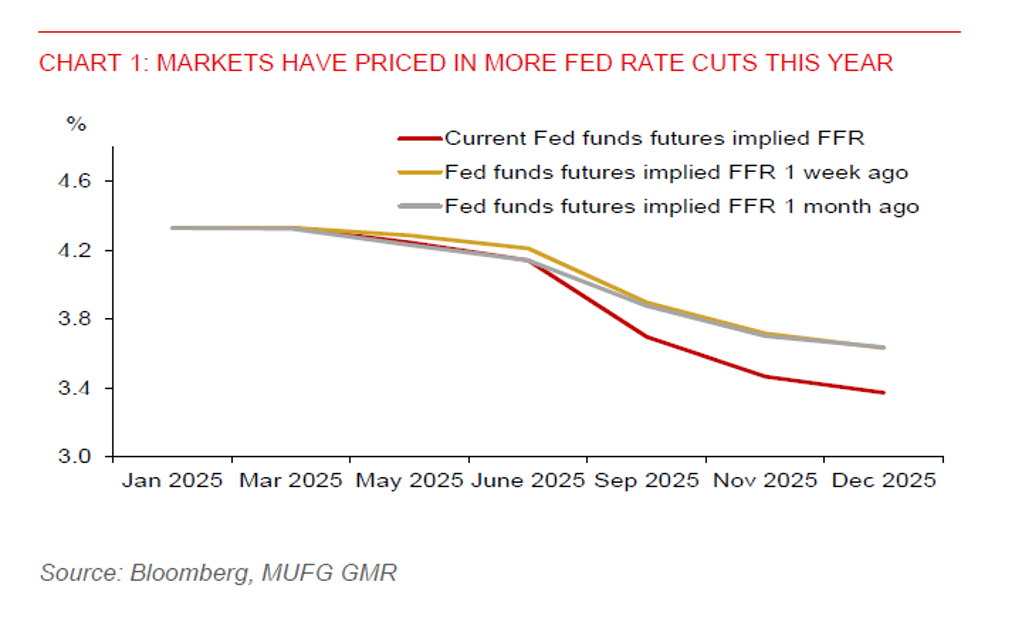

Markets are also concerned about the US economic outlook, pricing in 100bps of Fed rate cuts in 2025. The US 10-year yield has also fallen by 3bps to slightly below 4% last Friday. But the broad US dollar index (DXY) gained 0.9% last Friday, partially reversing the 1.7% drop in the prior day. US jobs data have been robust, with nonfarm payrolls adding 228k jobs, from 117k in February, beating market expectations of 140k. Average hourly wage growth was also still firm at 3.8%yoy, albeit easing from 4%yoy in February. The unemployment rate ticked up to 4.2% from 4.1%, but mainly due to a rise in labour force participation rate.

Regional FX

Asian currencies weakened against the US dollar following China’s tariff retaliation last Friday, with SGD (-1%) and KRW (-0.8%) leading losses in the Asia region, while CNH also fell 0.2%. The PBOC set a higher USDCNY daily fixing rate of 7.1889 last Friday, with an upper bound of the policy band at 7.3326. It will be key to watch if the fixing rate will be set higher today, which would signal PBOC's willingness to allow for further currency depreciation. Rising US-China trade frictions won’t bode well for the economic outlook in the Asia region. SGD, TWD, MYR, and THB are several currencies that will be highly vulnerable to the trade war, while PHP and INR could be relatively less exposed. Apart from China, other Asian governments have refrained from retaliating to avoid further adding to business costs.

South Korea’s constitutional court has upheld the impeachment of Yoon Suk Yeol, ending his presidency. This paves the way for a presidential election in the next 60 days.

Meanwhile, Philippines inflation slowed to 1.8%yoy in March from 2.1%yoy in February, paving the way for BSP policy rate cut this week. Thailand’s inflation has also slowed to 0.8%yoy from 1.1% in February, falling below the BoT’s inflation target range of 1%-3%. This, along with the impact of earthquake and the 36% US reciprocal tariff hike, lead us to expect a 25bps BoT rate cut this month.

Elsewhere, Vietnam’s GDP growth was robust at 6.9%yoy in Q1, though slowing from 7.6%yoy in Q4 2024. Exports grew 14.5%yoy in March, industrial production slowed to 8.6%yoy from 17.2%yoy in February, while retail sales growth picked up to 10.8%yoy from 9.4%yoy in February.