Ahead Today

G3: Germany, France and Eurozone PMI, US S&P Manufacturing and Services PMI

Asia: Thailand Trade

Market Highlights

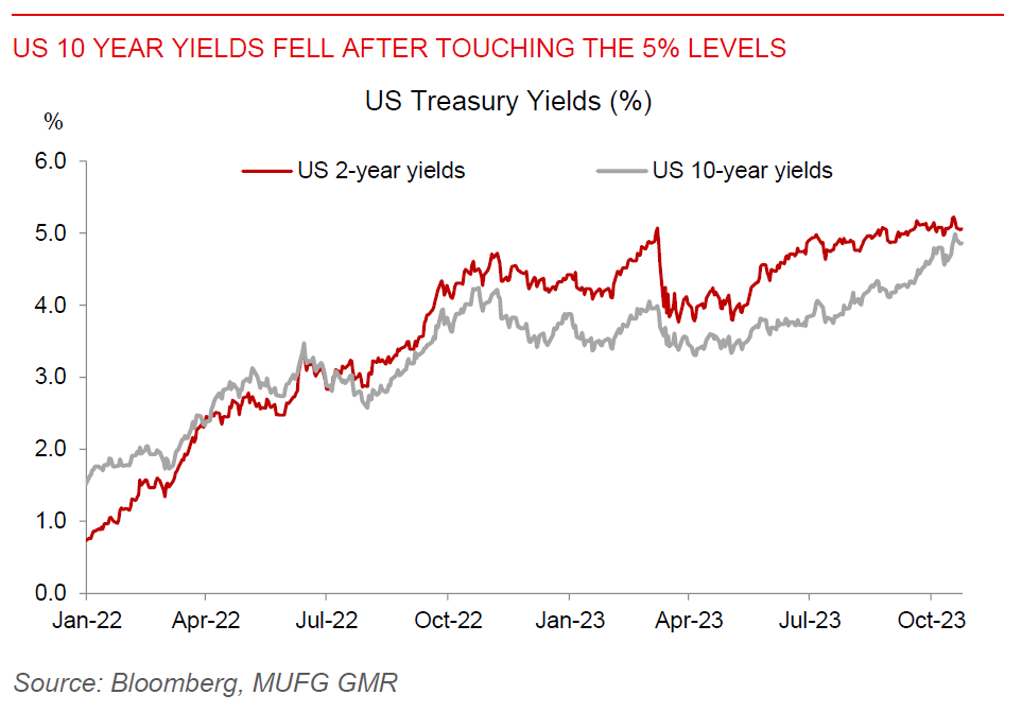

US 10-year Treasury yields touched 5% briefly overnight, before declining meaningfully to 4.85% as the bond market finally managed to find buyers. This filtered through into risk assets as well, with both the S&P500 and Eurostoxx recovering earlier losses, while Bitcoin surged as much as 10% to 32,950. Meanwhile Brent oil prices fell below $90/bbl, while the Dollar weakened led by strength in the Euro.

The exact catalyst for these moves were unclear given the lack of Tier 1 data, but could have included small signs of progress in the Israel-Hamas war. Hamas freed two more of the dozens of hostages captured, following mediation from Qatar and Egypt, with the captives released for “humanitarian reasons and poor health grounds”.

Meanwhile, China is set to approve slightly over 1 trillion yuan (~0.7% of GDP) of additional central government debt, according to Reuters, indicating greater risk sharing between the central and local governments in funding economic support. Almost half of the proceeds will go to long-term infrastructure such as water conservation and flood prevention, with the balance for post-disaster rebuilding and farmland creation.

Looking ahead, markets will focus on PMIs out of Eurozone and the US

Regional FX

Asian FX markets were generally stronger against the Dollar, with IDR (-0.7%) and THB (-0.6%) the key underperformers in the region. Bank Indonesia’s Executive Director for Monetary Management Edi Susianto said that the central bank is intervening in FX spot and domestic non-deliverable forward markets to support the Rupiah, confirming that BI was in the market to smooth volatility in IDR. Meanwhile, Singapore released the September CPI print. Messages were mixed with an upside surprise in headline print to 4.1%yoy but a downside surprise to underlying MAS core inflation at 3%yoy. The divergence was not a surprise, and came down to skyrocketing COE premiums (which is not included in MAS core inflation). Moving forward, the fight against inflation in Singapore has not yet been won, with still sticky elements of inflation such as public transport fare hikes, water tariff increases and 1pp GST increase. As such, we think MAS should be on hold for now in its upcoming in Jan 2024, notwithstanding a more volatile and uncertain global outlook for 2024. We forecast USDSGD to move in line with the Dollar at 1.375 in 3m and 1.32 in 12m.