Ahead Today

G3: Germany ZEW Expectations, US Empire Manufacturing

Asia: India trade, India CPI, India WPI, Philippines Remittances

Market Highlights

The Trump administration has initiated trade probes into semiconductor and pharmaceutical imports, under so-called Section 232 probes. The results of these investigations could play out for months, but should ultimately lead to tariffs at some point in time. Nonetheless, what’s just as important for markets and the global economy in the meantime are the exemptions granted on electronics imports (see Electronics tariff exemptions important for many Asian markets), coupled with news overnight that Trump is exploring possible exemptions for certain low-cost car components to give auto companies more time to set up US manufacturing.

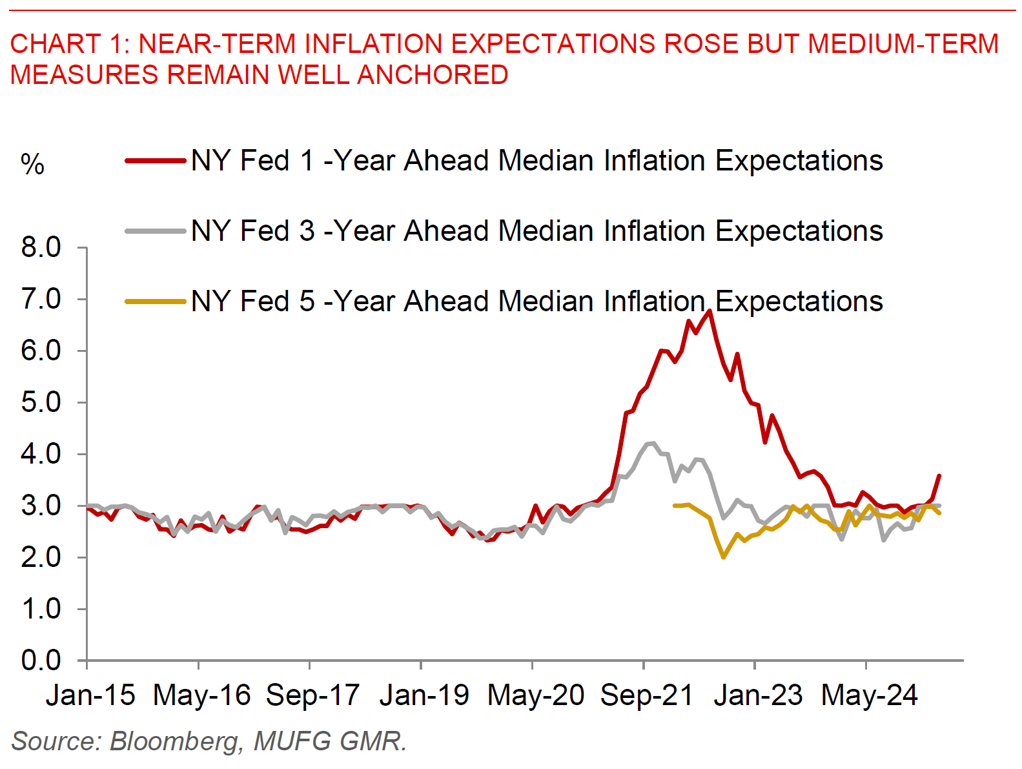

Meanwhile, in dovish remarks, Fed Governor Waller said that even if new tariffs sharply raise prices, the resulting inflation spike is likely to be “transitory”, invoking a term last used during the pandemic while also emphasizing his key view that this time is different. Governor Waller said that with a rapidly slowing economy, even if inflation were running well above 2%, he expects the risk of recession would outweigh the risk of escalating inflation. On that front, the NY Fed inflation expectations measure released yesterday pointed to a rise in near-term inflation expectations, but for what it’s worth longer-term measures remain well-anchored at least so far.

Regional FX

Overall, risk sentiment was strong overnight with the tariff exemptions on electronics, with key US tech names together with Asian equity markets rising together. From an FX perspective, the Dollar weakened further before some rebound through Asia time, with mixed performance across Asia. USD/CNH remained around 7.311 partially underperforming, while the likes of TWD and THB outperformed on the back of tariff exemptions. China’s trade data for March showed that exports rose sharply by 12.4%yoy, and likely due to US buyers rushing to ship in goods before higher tariffs started in April. Meanwhile, China’s imports remained weak declining 4.3%yoy likely due to soft domestic demand. The data suggests that traditional export goods such as textiles, furniture and toys, together with mechanical and electrical products rose sharply to the US, highlighting the front-loading effect. Meanwhile, inbound shipments such as iron ore dropped, likely reflecting US tariffs on metals, while other materials such as plastics, copper and coal also fell from their year-earlier level, suggesting that manufacturers reduced orders, while imports of consumer goods also declined. Markets will focus on India’s inflation and trade deficit numbers out later today. High frequency food inflation indicators have thus far been low in India, although there is some risk that current heatwaves could result in some price spike in volatile vegetable components moving forward. Meanwhile, India’s trade deficit is expected to remain manageable at US$15.5bn in March, partly helped by seasonal factors.