Ahead Today

G3: US: Trump’s inauguration; Japan industrial production, tertiary industry index

Asia: China loan prime rate, Malaysia trade

Market Highlights

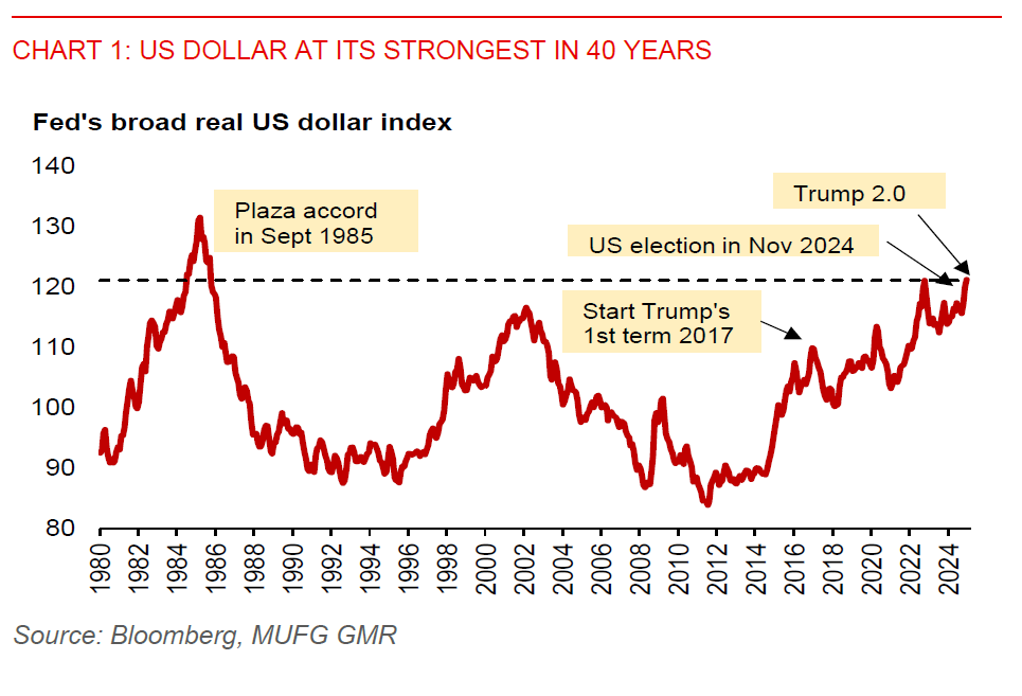

Donald Trump will be inaugurated as the 47th US President on 20 January, at a time when the Fed’s trade-weighted real broad US dollar index is at its strongest level in 40 years. The US dollar is also stronger today than when Trump took office during his first term in 2017. Indeed, the US dollar has gained sharply since Trump’s election victory on 5 November, with markets adjusting to partly take account of potential tariff hikes.

The US dollar’s recent rally has also exceeded what yield differentials versus the rest of the G10 currencies would suggest. Still, the US dollar could be supported amid global uncertainties. News reports suggest Trump has prepared about 100 executive orders, which would include changes to immigration, energy, and government hiring policies. While there seems to be no news of tariffs, Trump could still implement them soon. Meanwhile, the US labour market has stayed resilient, allowing the Fed to adopt a careful approach to rate cuts this year, which will help support the US dollar.

During his confirmation hearing, US Treasury nominee Scott Bessent has said that for every 10% US tariff increase, the US dollar would appreciate by 4% to adjust for its impact. With USDCNH rising by 3.4% since the US election, markets appear to be close to pricing in the first 10% of US tariff hikes on Chinese imports.

Regional FX

Several Asian ex-Japan currencies gained against the US dollar last week, except for INR (-0.7%), IDR (-1.1%), MYR (-0.2%), and PHP (-0.4%). With Trump likely to move quickly with tariff hikes soon after taking office, market sentiment in the Asia region will remain weak. There may still be scope for further declines in several Asian currencies in response to higher US tariffs.

China remains in the crosshairs of Trump's tariff policy. We expect China's growth will slow to 4.5%yoy this year, from 5%yoy in 2024, implying more government’s stimulus measures are needed. USDCNY could also rise to 7.5000 level in response to a potential 20ppt increase in the effective US tariff rate on Chinese imports. China’s latest GDP data shows growth of 5.4%yoy in Q4, up from 4.6%yoy in Q3. This brings full-year growth to 5% in 2024, meeting the government’s growth target.

Meanwhile, we keep our outlook for USDMYR to rise to 4.57 in Q1 2025. Advance GDP estimates show Malaysia’s Q4 GDP growth had slowed to 4.8%yoy, from 5.3%yoy in Q3, though this was still in line with the pre-covid pace of growth.