Ahead Today

G3: US third estimate of Q4 GDP, wholesale inventories, initial jobless claims

Asia: China industrial profits

Market Highlights

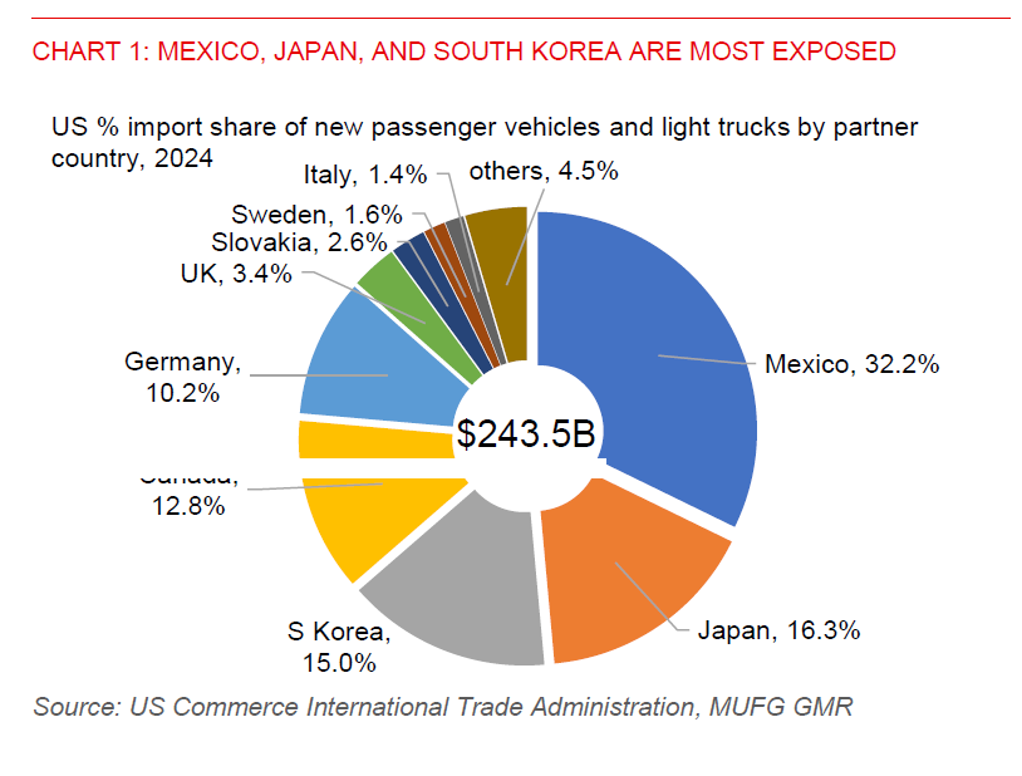

US President Trump has announced 25% tariffs on all cars not made in the US, broadening the trade war with the rest of the world. Mexico, Japan, and South Korea are the most exposed, accounting for more than 60% of US imports of new passenger vehicles and light trucks. For now, USMCA-compliant automobile parts will remain tariff free. Trump has said that the auto tariffs will remain throughout his 4-year term, and that he’s not interested in any negotiations for exemptions. Auto tariffs will take effect on 2 April.

Fed’s Kashkari has said that there are lots of tariff uncertainty and market sentiment shifts around tariffs. The hit to confidence could be larger than the tariffs themselves. Fed’s Musalem has also warned about the risks of persistent tariff inflation with second-round effects that could keep the Fed on a prolonged rate hold.

US durable goods orders rose 0.9%mom in February, following an upward revised 3.3%mom in January, as manufacturing firms frontloaded their procurement ahead of tariff hikes. This beats market expectation of a 1% decline.

The US dollar has bounced back by 0.3%, the US Treasury 2-year yield has barely moved, while 10-year yields have risen by 3bps. USDJPY has also partially reversed some of their prior day’s losses, rising by 0.4% following a 0.5% drop, amid a broad US dollar rebound. BoJ Governor Ueda has said he is keeping optionality ahead of next policy meeting, without hinting at when the bank will raise rates. That said, he has reiterated that the bank will normalise rates if the economic and inflation outlook is realized.

Regional FX

President Trump’s 25% auto tariff announcement could extend the broad decline in Asian currencies. It’s not just the direct impact on auto exporters like Japan and South Korea. There will also be ripple effects throughout the auto supply chains in the region.

Most Asian currencies were down against the US dollar in Wednesday’s session. SGD led losses with a 0.4% decline, with seasonally adjusted industrial production falling 7.5%mom in February following a 2.8%mom rise in January. From a year ago, Singapore’s industrial production was down by 1.3%, from a downward revised 8.0% growth in January, missing market expectations of a 7% increase. SGD weakness has also been in tandem with the rebound in the US dollar index. KRW was also down by 0.3%, with auto tariffs likely to further weigh on the currency, given Korea is a major car exporter to the US.