Ahead Today

G3: US initial jobless claims, FOMC rate decision, University of Michigan sentiment index; Germany industrial production

Asia: Philippines Q3 GDP, China trade, foreign reserves for several economies

Market Highlights

Donald Trump has won the US presidential election, marking an impressive turnaround in his political fortunes. Republicans have also won control of the Senate with at least 52 seats (50 needed for a majority) and is now leading to take control of the House of Representatives. If the Republicans also take control of the House, it will give Trump broad powers to enact economic policies that require congressional approval, such as corporate tax cuts and large fiscal spending.

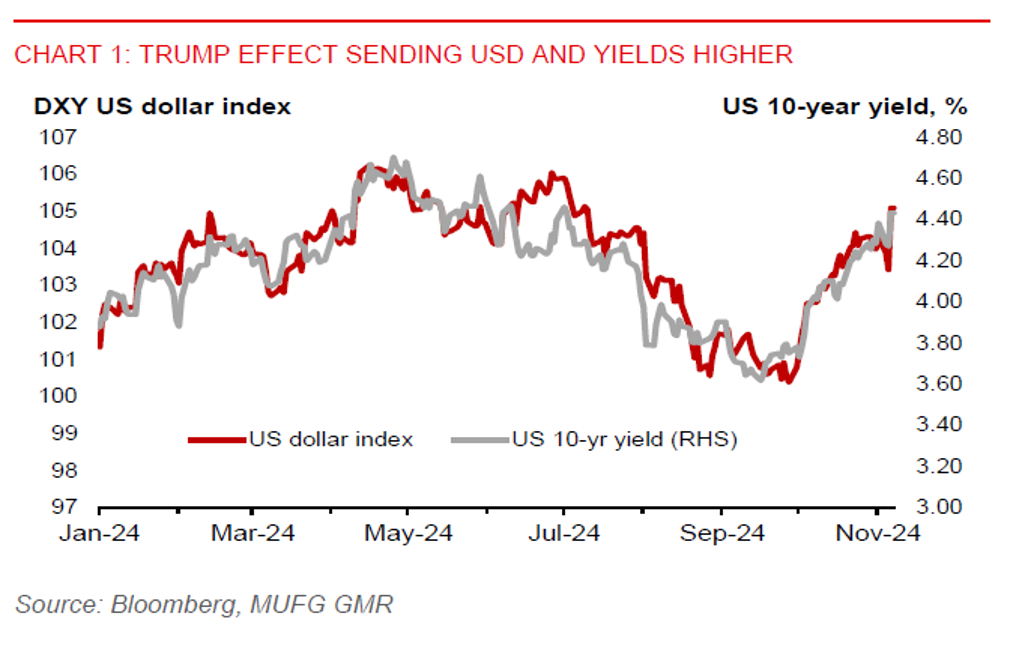

“Trump trades” dominated markets. The US dollar strengthened (+1.6%) on market expectation for higher inflation from Trump’s policies (tariff hikes + larger fiscal deficits), which would keep interest rates high. US yields were higher (2-year: +9bps to 4.26%; 10-year: +16bps to 4.43%). US equities rallied on expectations for more fiscal spending, tax cuts, and deregulation. EURUSD fell 1.8% towards the 1.07-handle amid a stronger US dollar and market concerns that Trump could impose tariffs on the EU, which could speed up ECB rate cuts. To begin with, EU’s growth has been weaker than that of the US, partly dragged down by Germany’s industrial slump.

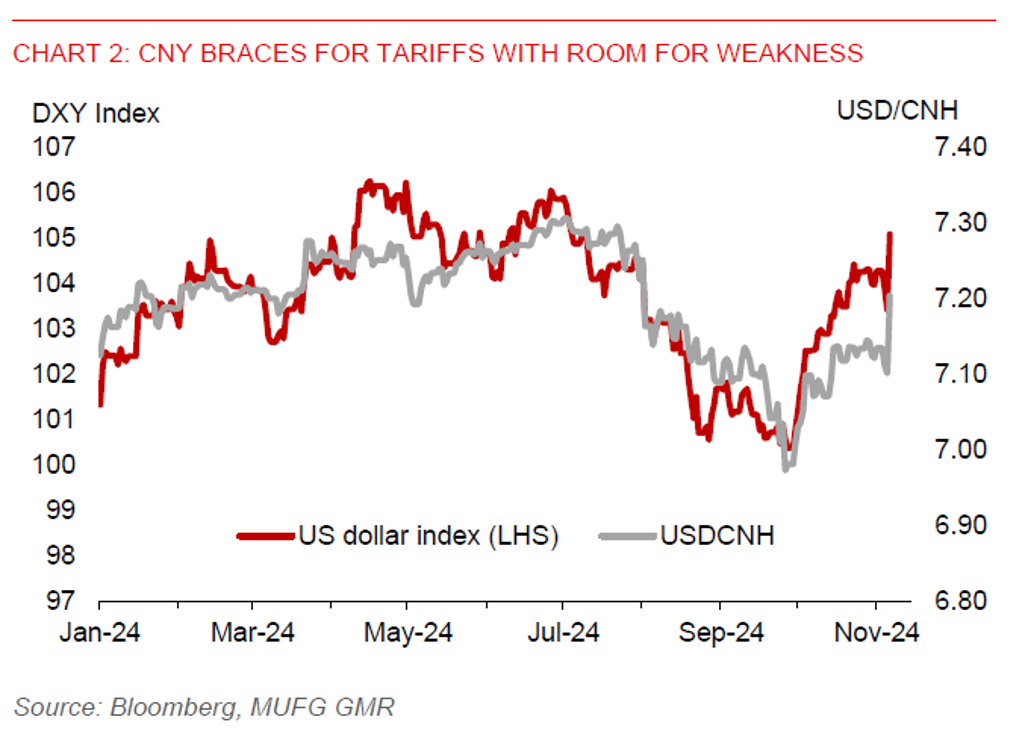

We look for markets to continue pricing in the prospects of higher tariffs and larger budget deficits, sending the US dollar and yields higher. The risk of a 60% tariff on China will also weigh on the CNY and Chinese equities. Markets will also focus on the FOMC meeting on 8 November, where we think the Fed could still lower the policy rate by 25bps, given a weaker than expected nonfarm payroll numbers and moderating inflation.

Regional FX

Asia ex-Japan currencies have weakened against the US dollar, as markets have further priced in the risk of higher trade tariffs and inflationary-type economic policies from a second Trump presidency. CNH (-1.4%), KRW (-1.5%), SGD (-1.5%), MYR (-1.2%), and THB (-1.7%) led losses in the region, partly driven by their sensitivity to broad US dollar strength and CNH weakness. Trump’s victory brings significant uncertainty, with some form of tariffs likely in the pipeline. While Trump has yet to give any hint of tariffs to come in his speech, we look for US dollar strength will linger on against Asian FX in coming days.

Amidst market focus on the US election results, Bank Negara Malaysia (BNM) held its policy rate at 3.00%, with advance estimates showing Q3 GDP growth staying strong at 5.3%yoy and inflation manageable at 1.8%yoy in September. This is in line with our and market expectations. However, Trumps’s victory, along with US trade policy uncertainty, poses downside risk to Malaysia’s economy over 2025. In the event of onerous tariff hikes, there would be scope for a lower BNM policy rate to cushion growth. We have one 25bps BNM rate cut for 2025 in our baseline, and we see risk to our policy rate outlook is to the downside.

October inflation data for several Asian economies were released yesterday. Headline inflation was manageable at 2.9%yoy in Vietnam, 0.8%yoy in Thailand, and 1.7%yoy in Taiwan. Elsewhere in the region, inflation has also been manageable. However, the potential for tariff hikes under a Trump administration could put pressure on Asian FX, constraining the space for rate cuts by central banks in the region.