Ahead Today

G3: Germany ZEW survey expectations

Asia: Taiwan export orders, HK CPI

Market Highlights

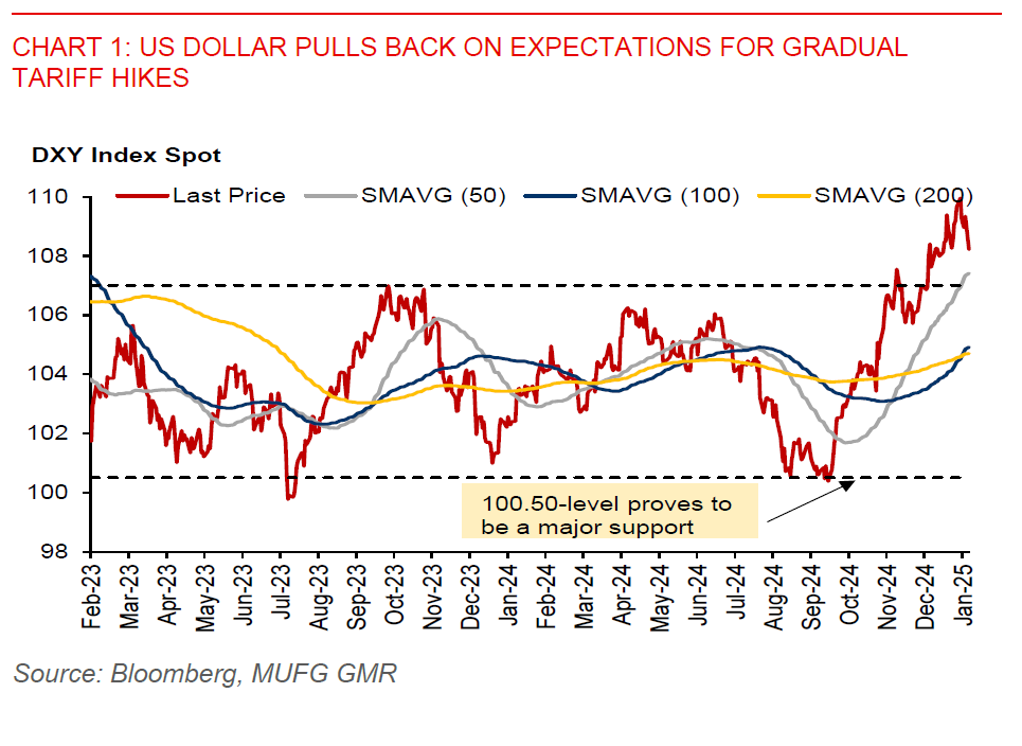

The broad US dollar index fell 1% on news reports that President Donald Trump would stop short of imposing tariffs immediately after his inauguration. This has helped provided reprieve for the rest of the G10 currencies. The euro, GBP, CAD, and SEK gained more than 1% against the US dollar.

With long US dollar positioning looking stretched, the US dollar is vulnerable to a less aggressive pace of tariff hikes from the Trump administration. Trump’s call with China President Xi last Friday might have also helped reduce some trade tensions between the two countries for now. The US 10-year bond yields have also fallen 13bps since last week, following a softer US core CPI print.

Meanwhile, Trump has ordered federal agencies to examine existing tariff policies and re-evaluate current trade relationships with China, Canda, and Mexico. Notably, the assessment will include the “phase one” trade deal with China. This shift in stance seems to suggest that President Trump may be less aggressive with tariff hikes than what he had signalled during his election campaign, and that he could use tariffs as a negotiating tool with China.

Regional FX

Risk sentiment has improved following reports suggesting that Trump won’t rush into raising tariffs on China. Notably, KRW (1.1%), CNH (+0.9%) and SGD (+0.9%) have led gains in the region. Nonetheless, with some form of tariffs likely to still be in the pipeline, the US dollar decline may be contained.

Meanwhile, China kept its 1y and 5y loan prime rates unchanged at 3.10% and 3.60%, respectively. Malaysia’s exports also jumped 16.9%yoy in December, while imports were up 11.9%yoy, leading to a larger trade surplus of MYR19.2bn, from MYR11.8bn a year ago.