Ahead Today

G3: US empire manufacturing

Asia: China: GDP, activity data, unemployment rate, 1y MLF, start of Third Plenum; trade data from Indonesia and India

Market Highlights

The US dollar fell 1.7% this month, respecting seasonality pattern, which has been reinforced by more dovish market expectations for Fed rate cuts. Markets are now almost fully pricing in a first Fed rate cut in September and 62bps cut this year, versus 50bps before the US CPI data release. This follows from recent cooling US consumer price pressures and weakness that has been creeping into the US economy. In the latest sign of macro weakness, US consumer confidence eased in June to the lowest level in eight months amid elevated interest rates and prices. PPI rose 2.6% yoy in June from 2.4%yoy in May. If the broad US dollar index breaks the key technical support level at 104, this could presage a further down move. Meanwhile, the attempted assassination of presidential candidate and former President Donald Trump over the weekend is a shocker for the presidential race. A potential risk-off mood in markets could lead to the US dollar extending its early gains through the day.

China will start its Third Plenum today, which could outline key economic reform measures for the coming years. These measures could aim at revitalizing the economy, creating “high-quality growth”, narrowing the urban-rural divide, and advancing economic transformation towards higher global value chain. But the impact of these potential measures is likely more medium-term in nature and possibly won’t have an immediate impact on the exchange rate.

Regional FX

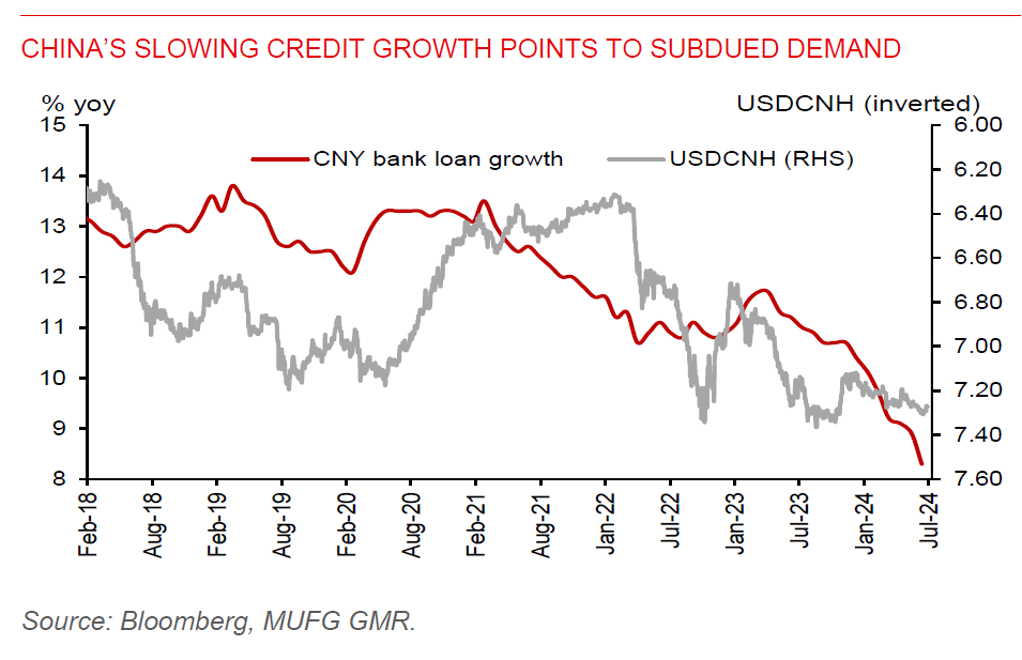

China’s domestic economy continues to face headwinds, with CNY bank loan growth slowing to 8.3%yoy in June from 8.9% in May, while imports fell 2.3%yoy. While Chinese exports rose 8.6%yoy in June, helping to support the monthly trade surplus, this was partly due to favorable base effects from a year ago. China will release several key economic activity indicators later today, including Q2 GDP data. China’s economic growth could ease in Q2, driven by retail sales decelerating on the back of low consumer confidence while fixed asset investment will continue to be weighed down by declines in property sector investment. With CPI staying muted, a slower Q2 growth would increase expectations for more macro policy support to engineer a sustained revival of China’s growth and exchange rate.

In Singapore, advance estimates showed Q2 GDP growth picked up to 0.4%qoq (2.9%yoy), from an upward revised 0.3%qoq (3.0%yoy) in Q1. This was aided by a sequential improvement in the manufacturing (+0.6%qoq from -5.3% in Q1) and construction (+2.4%qoq from - 1.9% in Q1) sectors, while services sector growth was flat (+2.2%qoq in Q1). The growth pickup in Singapore may give MAS a reason to keep its exchange rate policy setting tight at this month’s meeting.