Ahead Today

G3: US annualized GDP second estimate, durable goods orders, initial jobless claims; eurozone consumer confidence, Spain CPI

Asia: -

Market Highlights

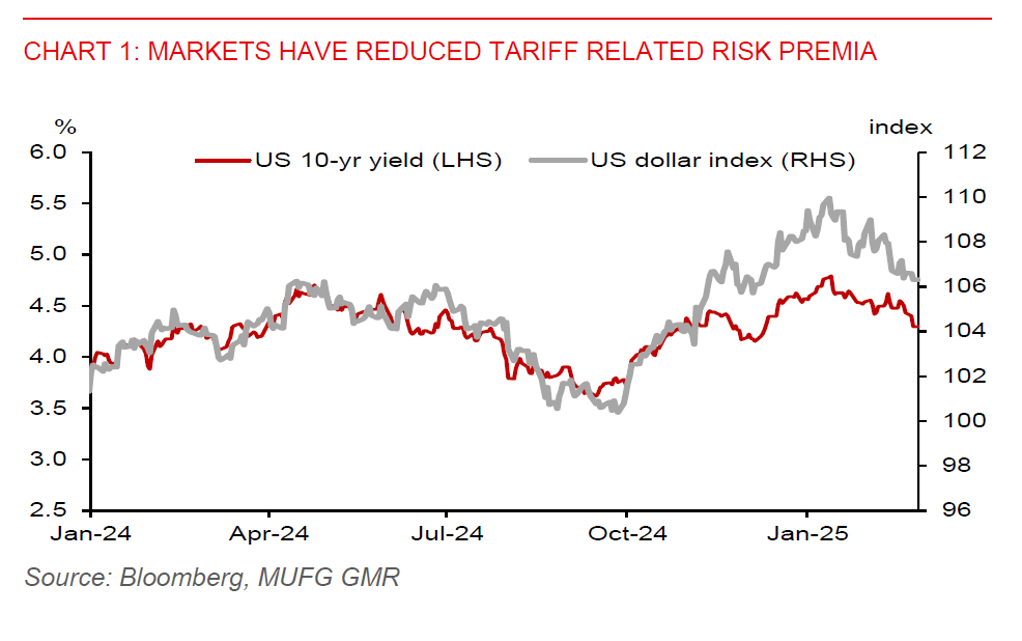

Markets have reduced some tariff related risk premia for now, with the US 10-year yield falling back to nearly the pre-US election level at 4.27%, from a mid-January peak of 4.80%. The broad US dollar index (DXY) has also fallen to the 106.30-level after peaking at 110.00. But the latest news is that Trump will not be stopping tariffs. He has said that “tariffs will go on, not all but a lot of them”. He has also announced that the 25% delayed tariffs on Canada and Mexico will come into effect on 2 April, while he plans to impose tariffs on EU, with 25% on autos, among other things.

Meanwhile, US President Trump has signed a memorandum that includes curbing Chinese investment into critical tech, infrastructure, and strategic sectors, push Mexico to impose tariffs on China, and to slap port fees on Chinese-built ships stopping at US ports. The latest move could hurt the chance of US forging a trade deal with China. China President Xi has ordered authorities to maintain social and economic stability.

China plans to recapitalize three of its largest banks over the coming months, namely Agricultural Bank of China Ltd., Bank of Communications Co., and Postal Savings Bank of China Co. via injecting at least RMB400 billion ($55bn) of fresh capital. This is an initial move that seek to strengthen the banking sector, despite the six largest local banks having adequate capital that exceed requirements. Indeed, the banking sector’s net interest margins have fallen to lows of around 1.60% on the back of reductions to key policy rates and mortgage rates.

Regional FX

IDR (-0.2%) and MYR (-0.1%) weakened modestly against the US dollar in Wednesday’s session, while rest of Asia ex-Japan currencies had not moved much against the US dollar.

The Bank of Thailand cut its policy rate by 25bps to 2.00% this month, given weaker than expected CPI inflation and economic recovery. This is in line with our out-of-consensus view for a policy rate cut as early as at this policy meeting. BoT assesses that this rate adjustment is consistent with current economic conditions and remains robust to economic risks going forward. We think there will be less pressure for the Bank of Thailand to ease its policy further for now. The policy rate cut will likely help the Thai economy to better cope with increasing economic risks stemming from US trade policies and weakening domestic credit growth. In terms of our USDTHB outlook, we maintain our outlook for it to rise to 35.30-level in Q1 and 36.00 in Q2. We think markets are currently underpricing the risk of more US tariff actions in the coming months.