Ahead Today

G3: Eurozone Manufacturing PMI, US ISM Manufacturing

Asia: Asia PMIs, Indonesia CPI

Market Highlights

Over the weekend, President-elect Donald Trump threatened to impose a 100% tariff on the BRICS group if they moved to replace the US Dollar. Trump wrote on his Truth Social website that he will “require a commitment… that they will neither create a new BRICS Currency, nor back any other Currency to replace the mighty US Dollar…” or they will face 100% tariffs. While BRICS has at times talked about creating a new unified BRICS currency, the latest summit in Kazan in October did not put an emphasis on creating a new currency, even as the group encouraged the “strengthening of correspondent banking networks within BRICS and enabling settlements in local currencies”. It’s unclear how 100% tariffs on a group of countries that make up 37% of global GDP would happen in practice, but serves as a possible preview of tariff diplomacy under Trump 2.0.

China’s Manufacturing PMI came in stronger than expected at 50.3 from 50.1, providing some signs of stabilization in the economy even as tariff risks abound in 2025. Meanwhile, Bank of Japan Governor Ueda said in a Nikkei interview published on Saturday that the next rate hike is “nearing in a sense that economic data are on track”, even as any further weakening of the Yen as inflation rises above 2% may pose a large risk and require “countermeasures” from the central bank.

Regional FX

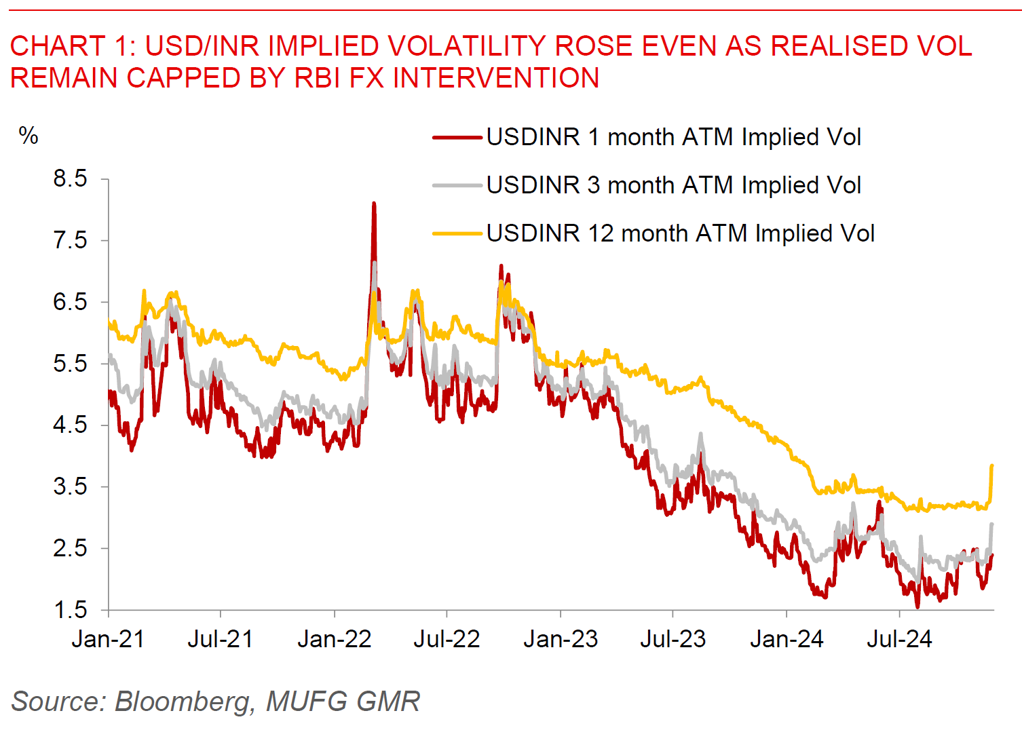

Asian currencies were weaker into the morning session, with MYR (-0.12%), SGD (-0.21%), and CNH (-0.2%) underperforming. India’s 3Q GDP came in materially weaker than expected at 5.4%yoy. This was softer than the RBI’s own forecast of 7%yoy and the weakest estimate of 6% in the Bloomberg survey of economists. The details showed the miss was driven by weaker manufacturing activity together with softer private consumption and investment. This GDP print certainly raises a significant conundrum for the RBI heading into its monetary policy meeting this week. For one, headline inflation has spiked above 6%yoy in part due to volatile vegetable and food prices. At the same time, RBI has continued to intervene heavily in the FX market and according to news reports in the offshore Non-deliverable Forward market as well. These have to some extent drained liquidity in banking system raising short-term rates. From a rates perspective, this week’s RBI December meeting is likely to be a close one, with possible increasing dissent out of some of its external MPC members. There may also be moves to cut Cash Reserve Ratio Requirements to help boost banking system liquidity. From an FX perspective, the key question is whether this growth blip proves to be short-lived or something more pernicious. We think at least part of the growth slowdown was due to slow disbursement of government spending post Elections and should as such improve over the next few months. Nonetheless, the growth slowdown is likely to have been driven also by restrictive monetary policy and the RBI’s moves to tighten macroprudential measures including on unsecured consumer credit as well and as such these factors could continue to weigh on portfolio flows moving forward.