Ahead Today

G3: Europe March Manufacturing PMI, US JOLTS Job Openings, US Durable Goods Orders, Germany CPI

Asia: India Manufacturing PMI, Singapore PMI

Market Highlights

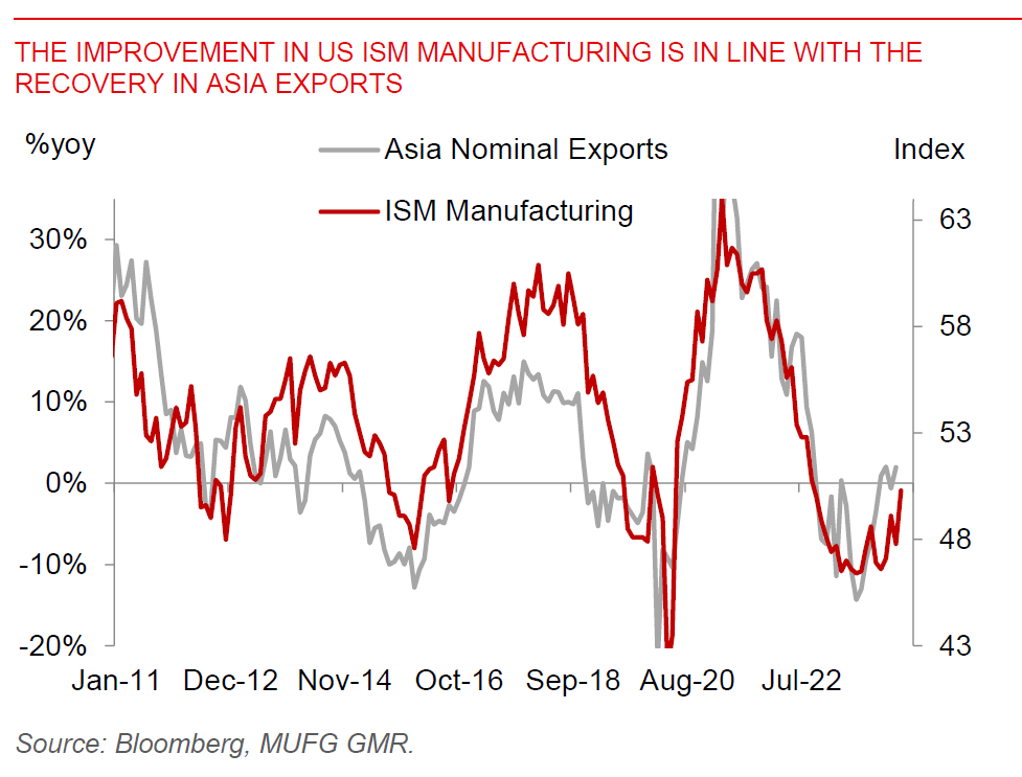

The US ISM Manufacturing Index rose into expansionary territory for the 1st time since Oct 2022 at 50.3 from 47.8 the previous month. This was driven up by both the production and also forward-looking new orders components, coupled by a smaller contraction in inventories. The colour from the ISM survey were also quite instructive, with a chemicals company saying that performance continues to “defy projections of a downturn in activity”, while a wood products company saying that “many manufacturers are anticipating better business in the second quarter and much better in the third quarter”. To be sure, not all the comments were positive, but it certainly jives with regional rebound in Asia exports and manufacturing that we have already seen.

The bad news was that the Prices Paid component rose further to 55.8 from 52.5, raising risk of sticky inflation moving forward. This is especially so when we have some supply chain disruptions already in pipeline in the Red Sea disruptions, the Baltimore Port shutdown, coupled with oil prices which have gradually inched up. Overall, US 10-year yields rose sharply to 4.30%, while the Dollar strengthened by 0.4% with EURUSD down to 1.073.

Regional FX

Asian FX markets traded on the backfoot against the Dollar with the stronger USD, with MYR (-0.5%), KRW (-0.5%), and IDR (-0.22%) underperforming. South Korea’s exports picked up to 3%yoy helped by semiconductor production, although it fell slightly short of expectations. This is also generally in line with improvement in Asia exports that we see, together with better China and US Manufacturing PMIs. Indonesia’s CPI was higher than expected, rising 3.05%yoy (vs consensus for 2.9%yoy rise), in part driven by higher food prices and the timing of Ramadan. IDR weakened sharply to 15,900 at some point. Last but not least, while we maintain a constructive view on INR, one key risk to watch out for is a forecasted heatwave over the coming months, which could add some upward pressure on electricity prices. Reservoir levels in South India in particular are far lower than normal, and this could also be a risk to economic activity in extreme scenarios.