Ahead Today

G3: US leading index

Asia: Thailand GDP, Malaysia trade

Market Highlights

The US economy has largely shown resilience. Consumer confidence picked up in early August, with future expectations rising to the highest level in 4 months. Notably, consumer expectations about personal finance and the general outlook for the economy have strengthened. This corroborates with the latest data on US retail sales, which rose 1% mom in July vs. -0.2% mom in June, beating market expectations for a 0.4% increase.

However, with pandemic savings being used up, coupled with uncertainty from US elections and unrest in the Middle East, consumer resilience will be tested. US retail giant Walmart has modestly lifted its full-year estimates for sales after its Q2 earnings beat market expectations, but it remains cautious about the outlook. Moreover, consumers are still expecting prices to rise by around 3% in the next 12 months.

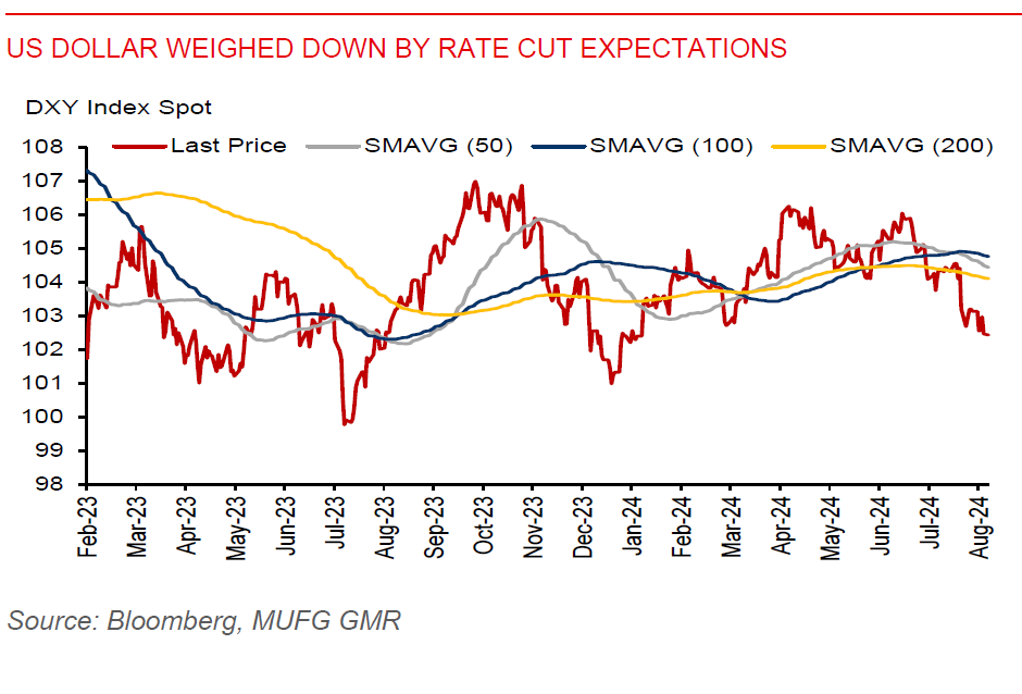

All eyes will be on the Jackson Hole economic symposium meeting this week, where major central banks will gather while Chair Powell is expected to provide his latest outlook for the US economy and inflation. With US macro data showing disinflation and growth still largely resilient, Chair Powell could provide a stronger signal that the Fed will proceed with rate cuts at the September FOMC meeting. The US dollar has been weaker since July, currently consolidating around the 102.00-103.50 level, while US 2y yield was slightly above 4%, with markets paring back some rate-cut expectations.

Regional FX

Asian currencies have broadly strengthened against the US dollar on the back of broad US dollar weakness. However, Thailand’s fresh political turmoil has weighed on the Thai baht. The Constitutional Court has dismissed ex-Prime Minister Srettha, who is now replaced by Paetongtarn Shinawatra, daughter of ex-Thai PM Thaksin. But we think tourism, not politics, will likely continue to drive the outlook for the Thai baht. The quick political transition will also likely reduce market uncertainty, though that now also leaves the THB500bn cash handout program from the previous administration hanging in the balance. Meanwhile, the rupiah weakened to 15,690 per US dollar last Friday after opening lower at around 15,615 on 15 August. Apart from the pace of Fed rate cuts, Indonesia’s fiscal policy under incoming president Prabowo will hold the key to the rupiah outlook in 2025 and beyond.