Ahead Today

G3: US: CPI, jobless claims; Germany CPI

Asia: policy rate decisions from S Korea and Malaysia

Market Highlights

With the Fed staying patient with its restrictive monetary policy stance, the mortgage rate in the US – currently fixed at 7% for a 30y tenor - is set to remain high for quite some time. As a result, mortgage applications have been very subdued, with the latest data showing a 0.2% week-on-week decline.

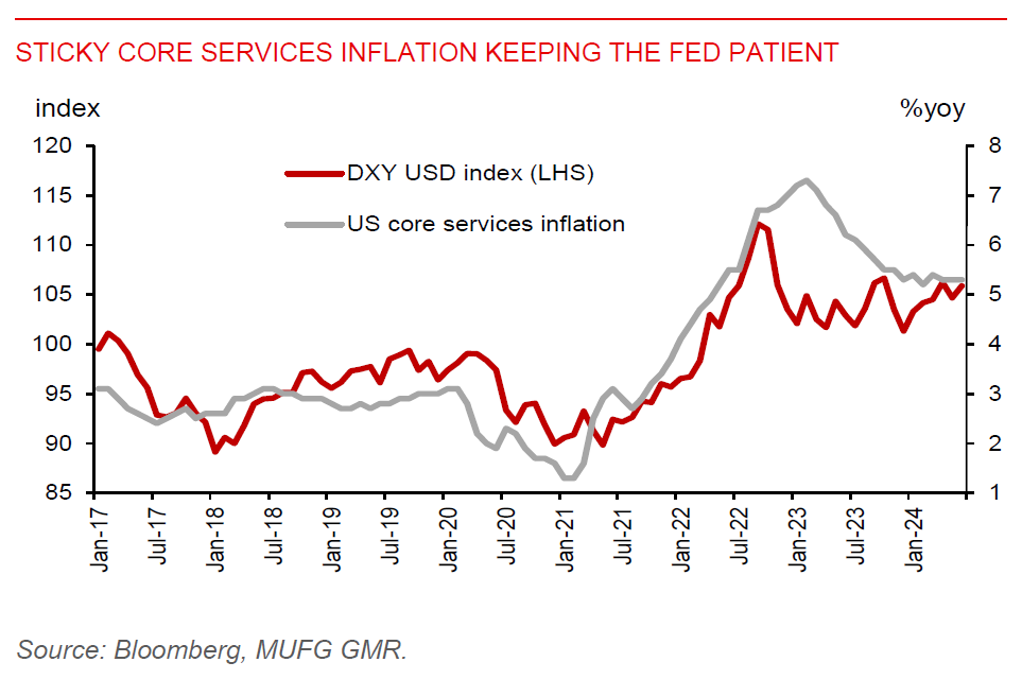

Markets will now shift their focus to the upcoming US CPI data due later today. Bloomberg consensus is for a slight uptick in CPI inflation to 0.1%mom (3.1%yoy) in June, from flat growth (3.3%yoy) in May, while core inflation (ex-volatile food and energy) will remain sticky at 3.4%yoy. We also think disinflation in the US will continue, but it will be a bumpy and gradual descent. Indeed, core services inflation was still stuck at around 5.3%yoy in the first five months, housing rent growth has stayed at around 3.4%yoy since Q4 2023, while money supply has also turned modestly higher.

We currently see a two-way risk to US inflation, with tighter monetary conditions and softer labour market bringing inflation down more, while the upside risks stem from geopolitical tensions that could lift commodity prices and increase shipping costs. Markets continue to price for 2 US rate cuts this year, attaching an 80% chance of a first rate cut starting in September. The DXY USD index has stayed firm at around the 105 level, while US equities have made record highs.

Regional FX

Asian FX movement was muted yesterday after Fed Chair Powell’s testimony. The key highlights for Asia today are the policy rate decisions from the BOK and BNM. CPI inflation in both economies has been contained. South Korea’s headline inflation has fallen to 2.4%yoy in June, albeit still higher than the BOK’s 2% target. Malaysia’s headline inflation was at 2%yoy in May, though creeping higher from just 1.5%yoy at the start of the year. Still, we expect both central banks will continue to stand pat at this meeting and adopt a neutral policy tone, with the Fed likely staying patient while ongoing weakness in their respective currencies will be a major constraint to cutting interest rates ahead of the Fed. BNM will also have to contend with upside risk to inflation from a potential rationalisation of RON95 fuel subsidies. Every 10% increase in RON95 fuel price will add 0.6ppt to CPI inflation.