Ahead Today

G3: US CPI

Asia: Bank Indonesia

Market Highlights

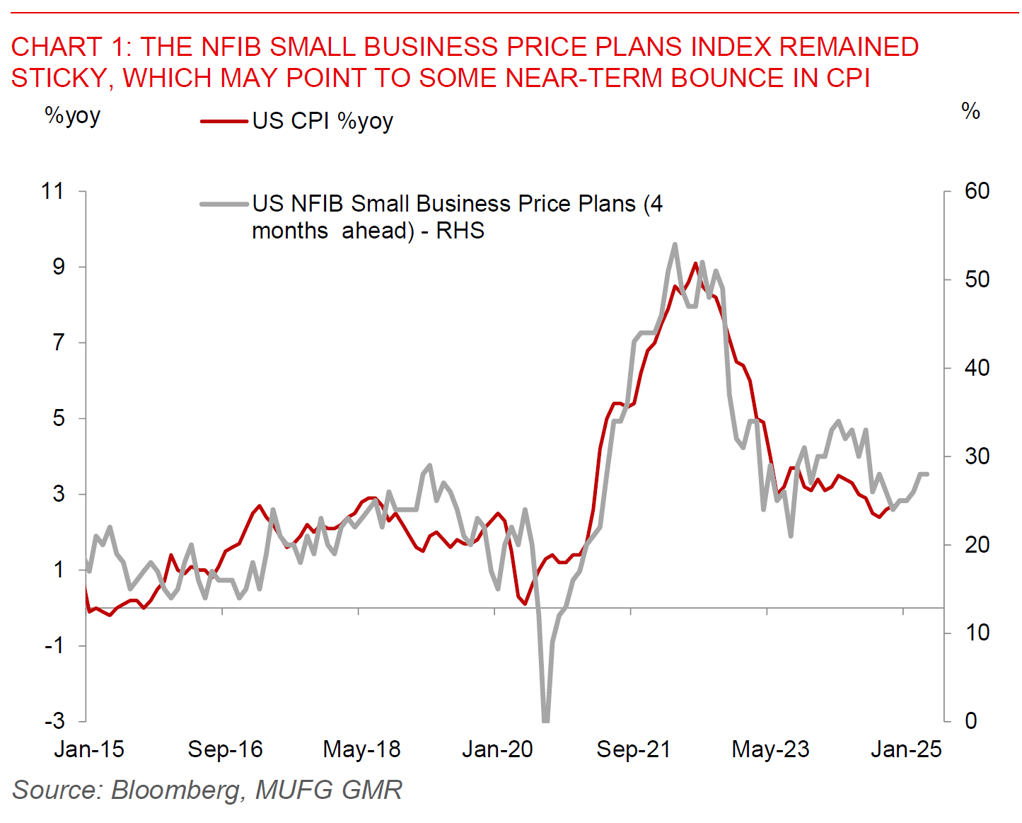

US PPI inflation came in softer than expected at 0.2%mom. More importantly for markets, the components which feed into the Fed’s preferred measure of inflation the core PCE was somewhat stickier in particular for airfares. As such, latest estimates are that core PCE could rise 0.22%mom – a decent inflation print still, but not providing the Fed any incremental signal to change its current policy stance. Meanwhile, US NFIB Small Business index rose to its highest since 2018, on the back of a post US Election bounce. Seven of 10 index components improved with a significant jump in businesses expecting better conditions and a drop in uncertainty. The 3 months ahead price plans sub-component, which has a good leading relationship with CPI, was somewhat sticky, pointing to some possible signs of a near-term bounce in US inflation.

On that last point, we will have US CPI inflation out which may help set the tone for the next move in markets. There are some signs that goods inflation have bottomed out with used car prices rising over the past few months, but more broadly normalising labour market conditions, moderating wage growth, coupled with the lagged impact of lower rents should still imply continued disinflation through 2025.

Regional FX

Asian currencies were somewhat mixed, with SGD (+0.3%) and KRW (+0.6%) outperforming, while IDR (-0.5%), INR (-0.7%) and PHP (-0.5%) underperforming. Bloomberg News reported that India’s new central bank governor Sanjay Malhotra is willing to allow the Indian rupee to move more freely in tandem with pers in the region, while still intervening in the foreign exchange market to curb excessive moves. According to the report, Governor Malhotra has held multiple meetings with departments in RBI ahead of his first monetary policy meeting, and showed keen interest in the RBI’s currency intervention. Overall, these developments are in line with our view that RBI will likely turn less interventionist and allow INR to adjust weaker, and we maintain our forecast for USD/INR to rise further to 88.50 by 4Q2025 (see INR – Let it go?). Meanwhile, we will have Bank Indonesia’s monetary policy meeting today. We expect BI to keep policy rates on hold at 6% to help maintain Rupiah stability given the weak global sentiment for Asian currencies. More generally, we expect BI to continue to prioritise rupiah stability and show resolve in defending IDR, by issuing SRBI securities at attractive yields to support foreign inflows and FX reserves, with the government also issuing new rules for commodity exporters to keep part of their foreign earnings onshore for at least 1 year (see IndonesiaPulse – Trump, Prabowo, and Perry to sway rupiah’s outlook in 2025).