Ahead Today

G3: Chicago Fed national activity index

Asia: China loan prime rates, Taiwan export orders

Market Highlights

Fed officials who spoke last Friday have been encouraged by the progress made in inflation. They think the economy is getting closer to a point where interest rates can be cut, but it is still not there yet, while there is a need to balance fighting inflation and preventing a sharp deterioration in labour market conditions. Fed Daly said the Fed has yet to achieve price stability and needs to be very confident that inflation can return to a sustainable path of 2% before a policy pivot.

Complicating the outlook for the Fed’s monetary policy is the rising odds of Trump returning to the White House. Trump’s proposed tariffs, along with a potential extension of his 2017 tax cuts and a deeper reduction of corporate tax, could pose an inflationary shock. This could in turn limit the room for Fed rate cuts and the extent of declines in long-term yields. This could also in turn keep the US dollar firm, notwithstanding market expectations for the Fed to cut interest rates. Meanwhile, President Joe Biden has decided to bow out of the presidential race over the weekend. He is now backing VP Kamala Harris to become the Democratic Party nominee for the presidential election.

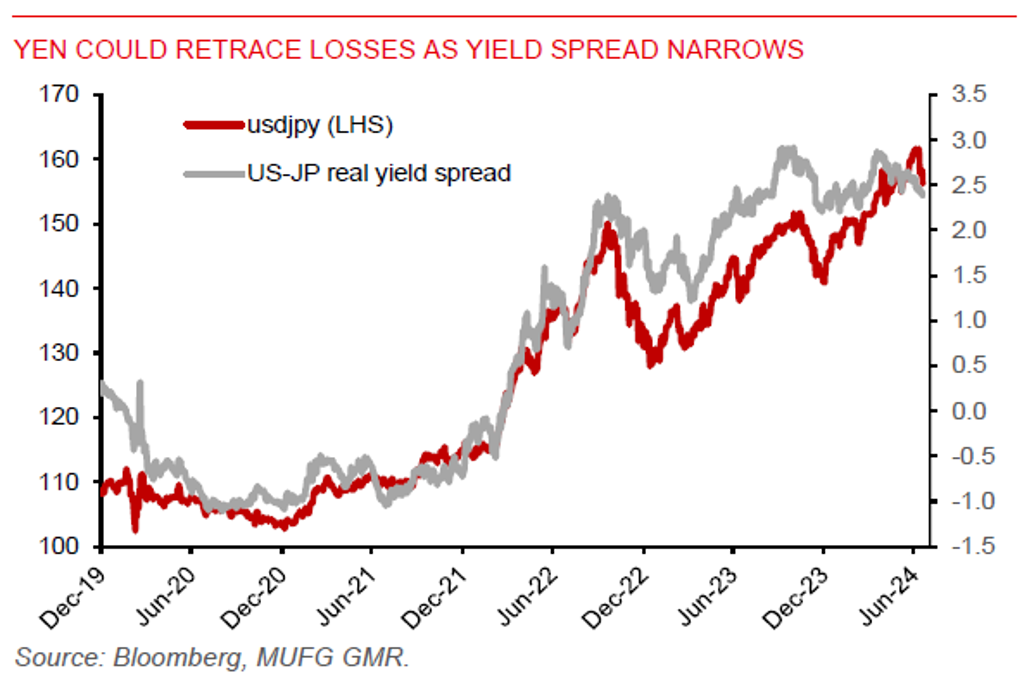

The DXY US dollar index gained about 0.8% over the past 2 trading sessions on Thursday and Friday. This helped the US dollar to post its first weekly gain during the month. We think the dollar may find it hard to outperform this year, with market expectations for the Fed to finally cut interest rates. With the BOJ set to cut JGB purchases and gradually normalize monetary policy amid rising inflation and wage expectations, monetary divergence between Fed and BOJ suggests scope for a stronger yen.

Regional FX

Asian currencies pared back some of their gains against the US dollar towards the end of last week, on the back of renewed broad US dollar strength. JPY (-0.8%), KRW (-0.8%), THB (-1.1%), and IDR (-0.6%) were leading losses in Asian currency pairs. The key data highlights for Asia today are China’s loan prime rates (LPRs) and South Korea’s 20-day trade data. We think China’s LPRs are likely to remain unchanged, taking cues from an unchanged 1y MLF rate of 2.50% last week.

Meanwhile, South Korea’s early trade data showed continued improvement in exports. This would bode well for the regional export outlook. The PBOC has also announced to cut the 7d reverse repo rate to 1.70% from 1.80%. And Malaysia’s Q2 GDP rose 5.8%yoy, beating market expectations for 4.7%yoy and was faster than the 4.2%yoy pace in Q1. The pickup in Malaysia’s growth was supported by resilient domestic demand and improving exports amid a global tech upturn. But the positive GDP data has not helped the ringgit, which fell 0.4% against the US dollar, as external pressures including from ongoing CNY weakness will continue to weigh on market sentiment towards the ringgit. Nonetheless, we think an improving outlook for Malaysia’s growth should support foreign inflows helping to contain ringgit weakness.