Ahead Today

G3: US retail sales, housing prices, eurozone industrial production

Asia: China 1-year MLF rate, India wholesale prices

Market Highlights

US consumer sentiment has weakened, with the University of Michigan sentiment index falling to 77.9 in April from 79.4 in March. This has likely been driven by still high inflation and uncertainty over when the US Fed will cut rates, at a time when excess savings by US households have mostly been drawn down.

Atlanta Fed President Bostic has reiterated one US rate cut toward the end of this year, as he anticipates the US economy will continue to expand, while inflation will moderate but at a much more gradual pace than markets expect.

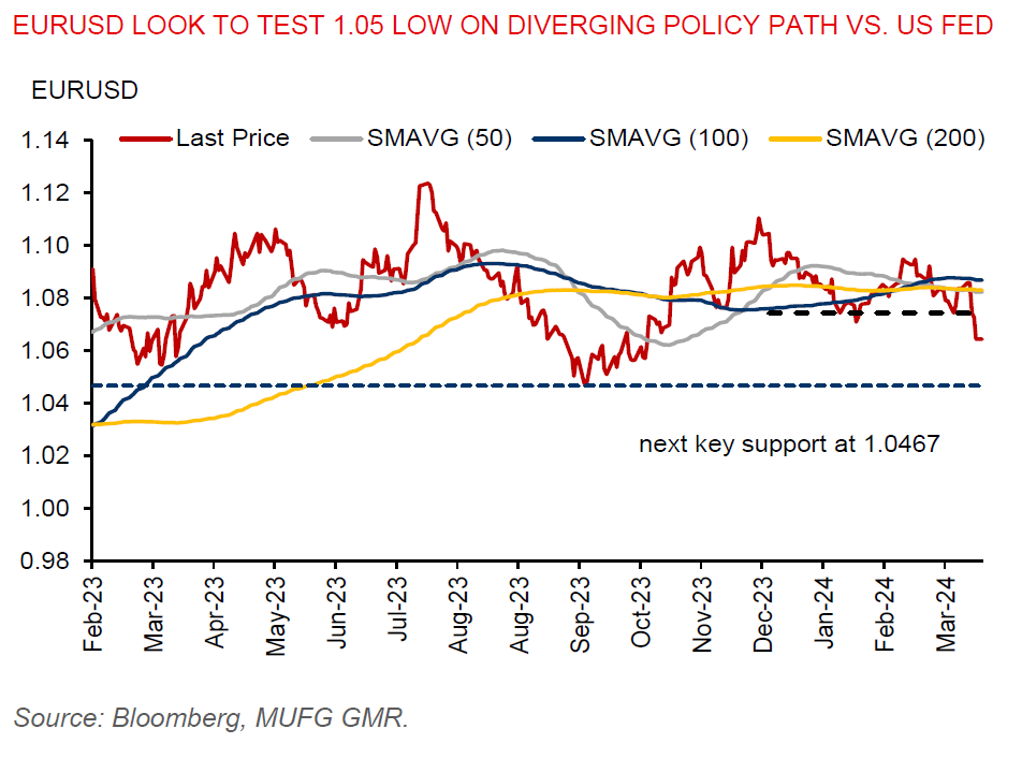

The market continues to position itself for a Fed rate cut later this year, though expectations for the number of cuts have been reduced to 2. With the ECB signaling a rate cut in June, EUR/USD broke support at the 1.07 level and will likely look to test the low at around 1.05. Moreover, escalating geopolitical tensions in Middle East could fuel higher Brent prices, which are negative for Asian FX.

Also, EURSGD has come under some depreciatory pressure. With the MAS maintaining a tightening policy bias for now and the ECB signaling to cut rates in June, EUR/SGD could look to test the 1.4350 level.

Regional FX

Asian FX markets weakened versus the US dollar. Notably, KRW (-0.8%), SGD (-0.6%), and MYR (-0.5%) underperformed regional currencies. Meanwhile, markets will turn their attention to China’s 1-year medium-term lending facility rate, ahead of China’s GDP and activity data on 16 April. We expect the 1-year MLF will remain at 2.50%. But a PBOC rate cut to support growth could worsen capital outflows pressures. The USDCNH has traded around the 7.26 level, and it could weaken to the 7.30 level.