Ahead Today

G3: US: new mortgage applications and 2nd 4Q GDP estimates; Eurozone: consumer confidence

Asia: Hong Kong 4Q GDP and 2024-2025 budget

Market Highlights

Yesterday’s US economic data showed some signs of potential growth headwinds. Durable goods orders fell 6.1%mom in January, larger than market consensus for 5% contraction and the steepest decline since Covid lockdowns. Notably, transport equipment led the decline by falling 16.2%mom. Durables excluding transportation goods fell by a smaller 0.3%mom. Meanwhile, US Conference Board consumer confidence index eased to 106.7 in February, from a revised 110.9 in January, and missing market consensus for a pickup to 115. A key spotlight for markets this week will be the US PCE core inflation data and initial jobless claims on Thursday, as well as the ISM survey on Friday, as markets will look to reassess the outlook for the path of fed funds rate this year.

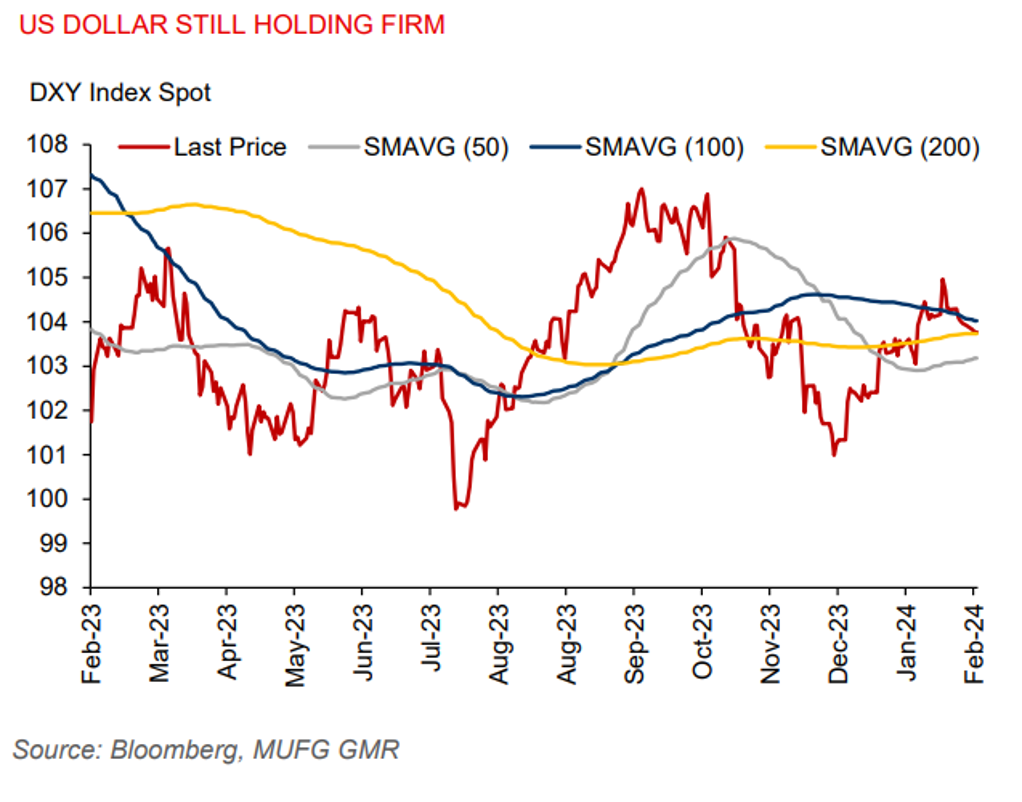

The US dollar index was little changed since the start of the week. The USDJPY continued to trade above the 150 level, with yesterday’s stronger than expected inflation data in Japan not providing much support for the yen.

Regional FX

Asian currencies were broadly little changed against the US dollar. But the Malaysian ringgit gained 0.3% against the US dollar, retreating from the 4.80 level, while the Thai baht gained 0.8% as markets resumed trading following a public holiday on Monday.

Bank Negara Malaysia said the ringgit is undervalued following the currency’s slide to a 26-year low, while it has engaged with government-linked companies and investors to encourage inflows. With market expectations for the quantity of US rate cuts this year moving more in line with the Fed’s December dot plot outlook for 3 cuts and the USDCNH showing signs of stabilizing, ringgit downside could be contained.

In Indonesia, Finance Minister Sri Mulyani has said the fiscal deficit will rise to 2.45%-2.8% of GDP in 2025 to finance new policies pledged by Prabowo (who won the presidential election on 14 February based on “quick count” polling result) during his election campaign, such as providing free lunches and milk for students across the country. This is in line with our outlook for the fiscal deficit to widen to 2.5% of GDP in 2025. We don’t think there will be significant weakness in the Indonesian rupiah resulting from a potentially larger fiscal deficit in 2025, since this would still fall within the fiscal cap of 3% of GDP deficit.

Taiwan’s export orders rose 1.9%yoy in January, beating market consensus of a 3.6% decline. This was driven by a surge in electronics exports orders (+16.1%yoy). This pace of growth in overall export orders was modest, however, considering the low base effects from a year ago.