Ahead Today

G3: US: empire manufacturing index, retail sales, initial jobless claims, and industrial production; Japan: industrial production

Asia: Trade data for India and Indonesia, BSP policy meeting

Market Highlights

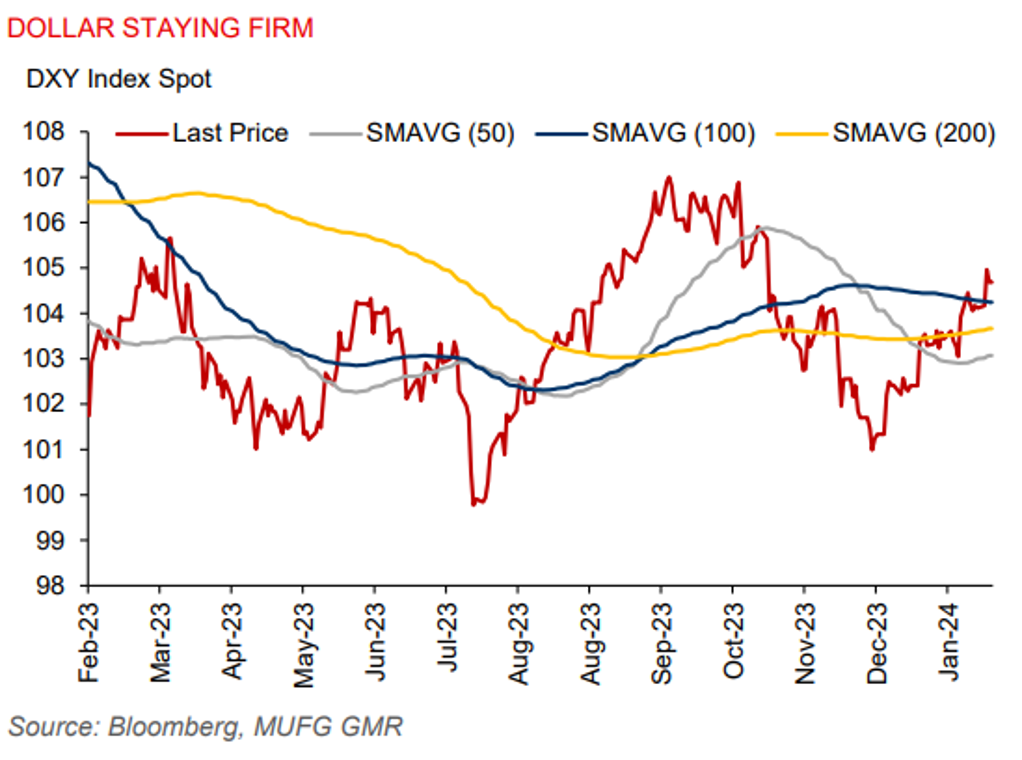

The broad US dollar index (DXY) weakened 0.2% yesterday, but still largely holding on to recent gains, as markets have pared back US rate cut bets. Mortgage applications fell 2.3% in the week ending 9 February, following a 3.7% rise in the week before. Federal Reserve Vice Chair for supervision Barr said he supports Fed Chair Powell’s cautious approach to rate cuts and sees no US banking liquidity stress.

Meanwhile. preliminary second estimates for eurozone GDP shows growth stagnating in Q4. But eurozone industrial production jumped 2.6%mom in December, from -0.3% in November.

Advanced estimates show Japan slipped into a technical recession in 4Q. Japan’s 4Q GDP fell 0.1%qoq sa, from -0.7%qoq in Q3. This was mainly dragged down by domestic demand, which was only partially offset by net exports (contributed 0.2ppts to growth). Private consumption fell 0.2%qoq, while business investment was also down by 0.1%. Authorities have made verbal interventions after USDJPY broke through 150 for the first time since November.

Regional FX

Asian FX performance was mixed. CNY and SGD gained 0.1% and 0.2% respectively against the US dollar, but both THB (-1.1%) and KRW (-0.5%) underperformed.

In Indonesia, ‘quick count’ polling results show current Defense Minister Prabowo Subianto (age 72) has won the 2024 presidential election in the first round by securing nearly 60% of the votes. His running mate, Gibran (son of Jokowi), is poised to assume the vice president position. A presidential election run-off is not needed, helping to reduce political uncertainty and contain rupiah volatility. But we remain cautious on the USD/IDR, with markets further paring back expectations for US rate cuts this year. Moreover, we remain mindful of potential political transition risks stemming from the forming of a governing coalition among the different political parties and the appointment of key cabinet members.

Singapore’s final Q4 GDP growth was 1.2%qoq sa (2.2%yoy), weaker than market consensus for 1.4%qoq (2.5%yoy) and down from 1.7%qoq in Q3. This brought full-year 2023 GDP growth to just 1.1%, with the manufacturing sector contracting and services growth slowing. We will have the BSP policy meeting later today, where we expect no change to the policy rate of 6.50%.