Ahead Today

G3: Eurozone CPI

Asia: China loan prime rates, Taiwan export orders

Market Highlights

The balance of risks for the Fed appears to have shifted away from inflation and towards the risk of further labour market weakness. The US leading index also fell 0.6%mom, following a 0.2% drop in June and 0.5% decline in May. The ISM new orders and consumer confidence were among the factors that were dragging down the leading index, pointing to an economic slowdown ahead.

Meanwhile, Fed’s Daly has said that she has more confidence that US inflation is coming under control, while Fed’s Kashkari has said a weaker labour market could pave the way for a September rate cut. Fed governor Waller spoke yesterday, but he did not touch on the US economy and monetary policy. Chair Powell’s speech at the upcoming Jackson Hole Economic Policy Symposium will be crucial. He is likely to portray a Fed that is on top of their game, will continue to monitor closely recent economic and price development, while leaving optionality for a September rate cut.

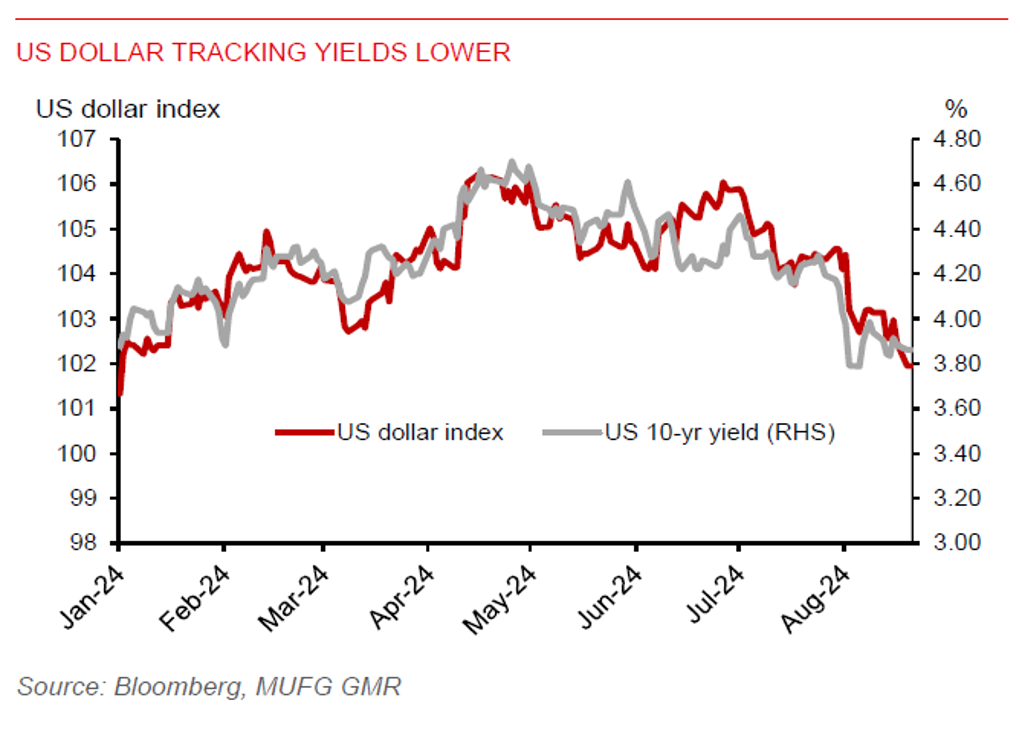

The DXY US dollar index fell 0.6% to break below the102.00-level, extending its weakness seen since July. Notably, the euro extended its gains after breaking above the 1.1000-level against the US dollar. Meanwhile, the US 2y yield remained slightly above 4%, the 10y yield was around 3.85%, while the 2y-10y yield spread widened.

Regional FX

Asian currencies have continued to strengthen against the US dollar on the back of broad US dollar weakness and risk-on sentiment. Indeed, the THB (+1.6%), KRW (+1.3%), MYR (+1.1%), and PHP (+1%) led gains in the region. CNH also strengthened to 7.1350-level vs. the US dollar. Thailand’s economy grew 2.3%yoy in Q2, driven by the tourism recovery. On a sequential basis, growth was 0.8%qoq sa, slower than 1.1% in Q1 and market expectation for 1%. But a new leadership change and uncertainty about the US$14bn cash handout program have clouded the outlook for growth. Malaysia’s trade surplus has narrowed further as import growth of 25.4%yoy far outpaced 12.3%yoy export growth. With the recent slump in USDMYR looking stretched and in oversold territory, there could be scope for a near-term bounce.