Ahead Today

G3: US NFBI small business optimism, Germany CPI, Italy industrial production

Asia: Philippines trade, Malaysia industrial production, China trade

Market Highlights

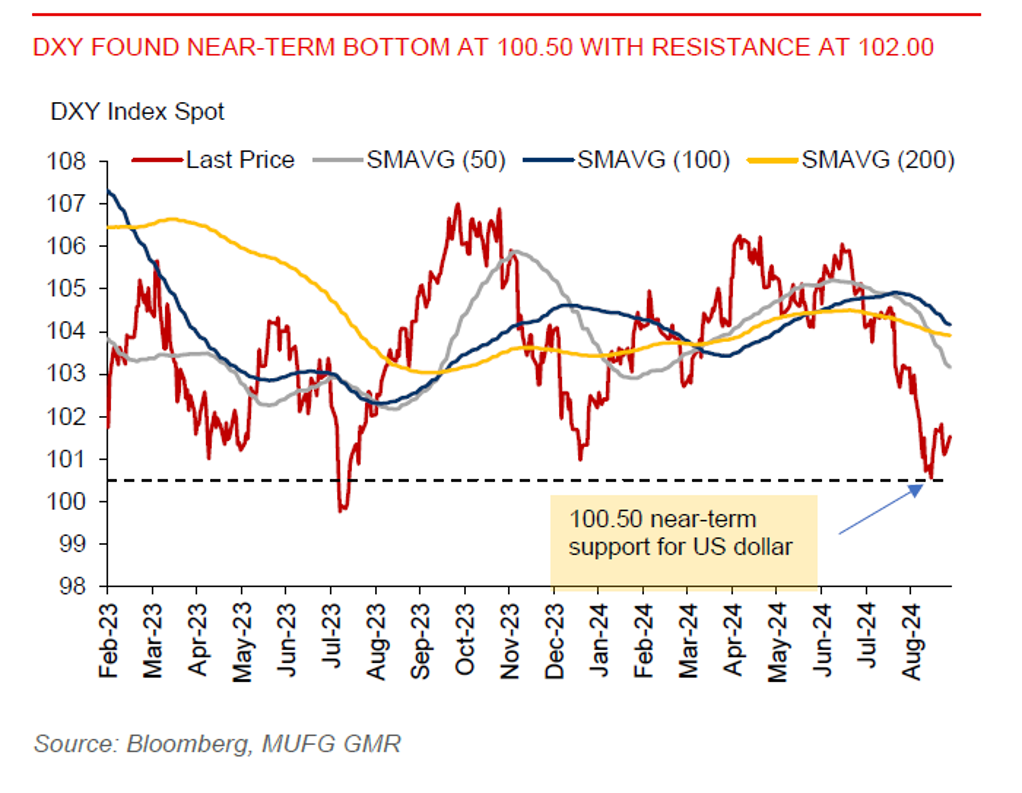

The DXY US dollar index gained 0.4% to above 101.50, after finding support at the 100.50 level. EUR, JPY, SEK, and CHF all declined versus the US dollar, with the euro weakness contributing the most to DXY strength. The upward DXY momentum has extended, as the US nonfarm payroll data last Friday did not justify a larger 50bps Fed rate cut in September. Indeed, US August nonfarm payroll data last Friday still show a healthy labour market at +142k vs. +114k in July. The New York 1-year inflation expectation steadied at 3%yoy. Also, eurozone Sentix Investment Confidence index worsened this month. And Japan’s economy grew 2.9%qoq annualized in Q2, revised lower from advance estimate of 3.1%. The downward revision to Japan’s Q2 GDP was mainly due to slightly slower growth in domestic demand. Meanwhile, market focus will turn to Wednesday’s US CPI inflation data for signs of continued progress that will keep the Fed on the cusp of starting its rate cuts. Any decline in core CPI inflation could increase bets for a larger rate cut in September, while a rise would make it much difficult.

Regional FX

Asia ex-Japan (AXJ) currencies weakened against the US dollar on Monday’s trading session on the back of renewed US dollar strength. THB (-1.3%), PHP (-1%), and MYR (-1%) led losses in the region. The outlook for AXJ currencies may continue to be negative ahead as positive US dollar momentum continues and markets await the US inflation data to gain more clarity on the size and pace of US rate cuts ahead.

THB losses could have been partly contributed by comments from Thai finance minister Pichai (who has retained his post under the new government) that he dislikes the excessive Thai baht appreciation seen over a short-term period since this could hurt Thai exports. USDTHB at 33.50 likely marks a near-term bottom with the resistance level at 34.60.

For the PHP, a combination of narrower policy rate differentials with the US, softer inflation raising more rate-cut bets, and technical support has likely led to the PHP sell-off. USDPHP at 55.90 likely marks a near-term bottom with 57.00 being the next resistance level.

Meanwhile, CNH weakness has likely spilled over to the ringgit, given their close correlation. CNH weakened 0.4% to 7.1164 vs. the US dollar following growing risk of deflation in China. China’s PPI fell 1.8%yoy amid lower commodity prices, while consumer price inflation rose just 0.6%yoy, only slightly faster than the 0.5% pace. While lower US policy rates and China’s fiscal measures to boost growth could help ease depreciatory pressure on CNH, there’s a downside risk from onerous US tariffs should Trump win the US presidential election in November.