Ahead Today

G3: US mortgage applications, NAHB housing market index

Asia: Indonesia trade

Market Highlights

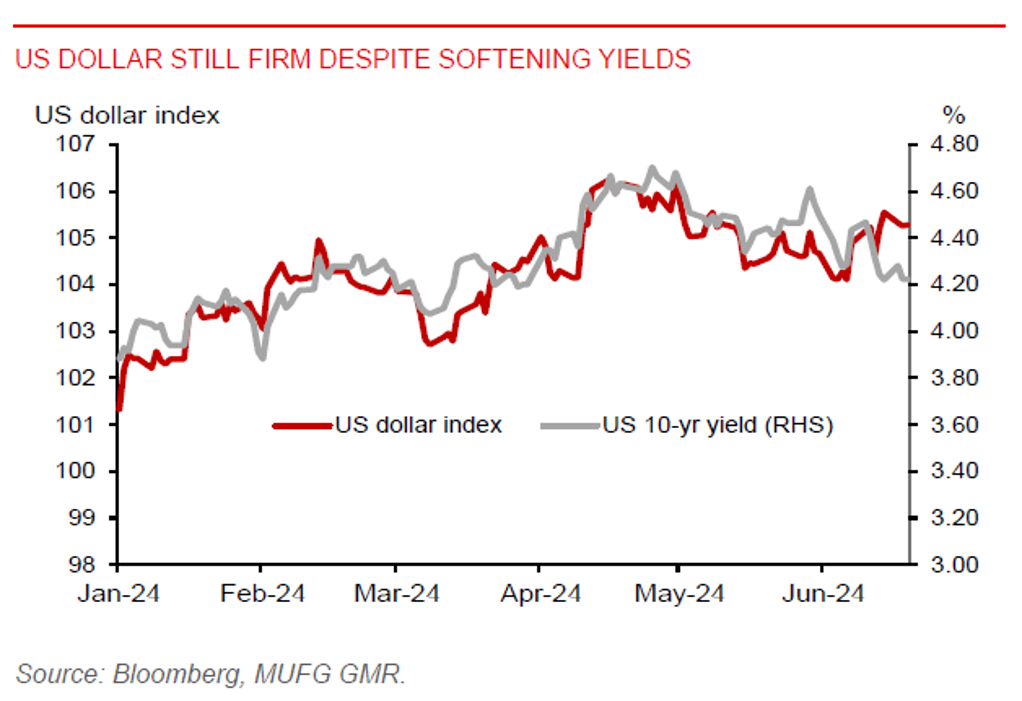

The latest US activity data point to an economy that is still largely resilient but showing signs of softening. Advance headline retail sales rose 0.1%mom in May, partially reversing a revised 0.2% fall (zero growth before revision) in April, and missing market consensus of a 0.3% increase. The retail sales control group – a better gauge of consumer spending and a barometer of inflationary pressures – also rose 0.4%mom, partially reversing a revised 0.5% fall (-0.3% before revision) in April, and missing market consensus of a 0.5% increase. Industrial production was also up by 0.9%mom from flat growth in April, beating market consensus of a 0.3% increase and providing support for the dollar. The USD was largely unfazed by the weaker than expected retail sales numbers, staying supported above the 50-day moving average.

Meanwhile, progress on taming inflation in the US has been slower than in other developed economies. Coupled with divergence in the growth outlook among developed peers, this sets up for a differing pace of central bank policy rate changes. Fed’s William said the US economy is strong and rate cuts will be data dependent. Markets are only fully pricing in the start of US rate cut in November. By comparison, markets expect ECB to cut again in October after its June cut, Bank of Canada to cut again in September after its June easing, and the RBA to stand pat this year.

Regional FX

While we expect the depreciating trend in the Indonesian rupiah will persist, the recent sharp pace of decline has surprised us. Softening US yields have also not provided much reprieve for the rupiah. We stay cautious on the rupiah, as markets have likely attached a higher risk premium on the currency. There is uncertainty regarding the ongoing political transition and fiscal plans by incoming President Prabowo Subianto. More clarity on the fiscal outlook is likely needed to ease market concerns. Markets have sold off the Jakarta composite index and Indonesian government bonds. But some moderate USD selling was seen against the rupiah in the 1m NDF market so far this week, following the sharp rupiah decline last Friday. Bank Indonesia will meet tomorrow, and the chance of another BI rate hike is high, especially if the rupiah weakens past 16,450 per US dollar.