Ahead Today

G3: US nonfarm payrolls, unemployment rate, average hourly earnings, ISM survey

Asia: Indonesia CPI

Market Highlights

Recent US macro data points to economic resilience and still sticky core PCE inflation (+0.3%mom or +2.7%yoy in September). ADP employment data shows the private sector adding 233k jobs in October vs. 143k in September and Bloomberg consensus of 111k. Initial jobless claims fell to 216k in the week ending October 26. Advance estimates show GDP grew 2.8%qoq annualized in Q3 vs. 3% in Q2 and market consensus for +2.9%. But with real (inflation adjusted) policy rate at elevated levels, there’s scope for the Fed to ease monetary policy in 2025, which would help ease pressure on Asian FX. But the pace of US rate cuts may be slower in the event Trump wins the US election and raises import tariffs.

Meanwhile, BoJ left its policy rate unchanged at 0.25% on 31 October. There is no surprise as policymakers had earlier signalled for the policy rate to be on hold. BoJ expects CPI ex fresh food inflation at 2.5% in FY2024, and to be at 1.9% in FY2025 and FY2026, due to a virtuous cycle of wage growth, higher inflation, and rising inflation expectations. The bank has also kept its optimistic outlook for growth, forecasting GDP growth at 0.6% in FY2024, 1.1% in FY2025, and 1.0% in FY2026. We think BoJ will remain on a gradual path of rate normalization. During the press conference, Governor Ueda said that FX movements are having a huge impact on the economy and price trends. Markets have perceived that comment as a hint at a potential rate hike in the coming months, with JPY gaining 0.4% against the US dollar. Still, Japan’s large real yield differentials with the US will be a drag on the yen.

Regional FX

Asia ex-Japan currencies weakened modestly against the US dollar on 31 October. Markets have already priced in some risks of a second Trump presidency.as they await the US presidential election, which is less than a week away. A victory for Trump would likely hurt the outlook for Asian economies and FX via lower trade and investment, as well as the Fed potentially slowing the pace of rate cuts due to the inflationary consequences of Trump’s proposed economic policies (tariffs + wider fiscal deficits).

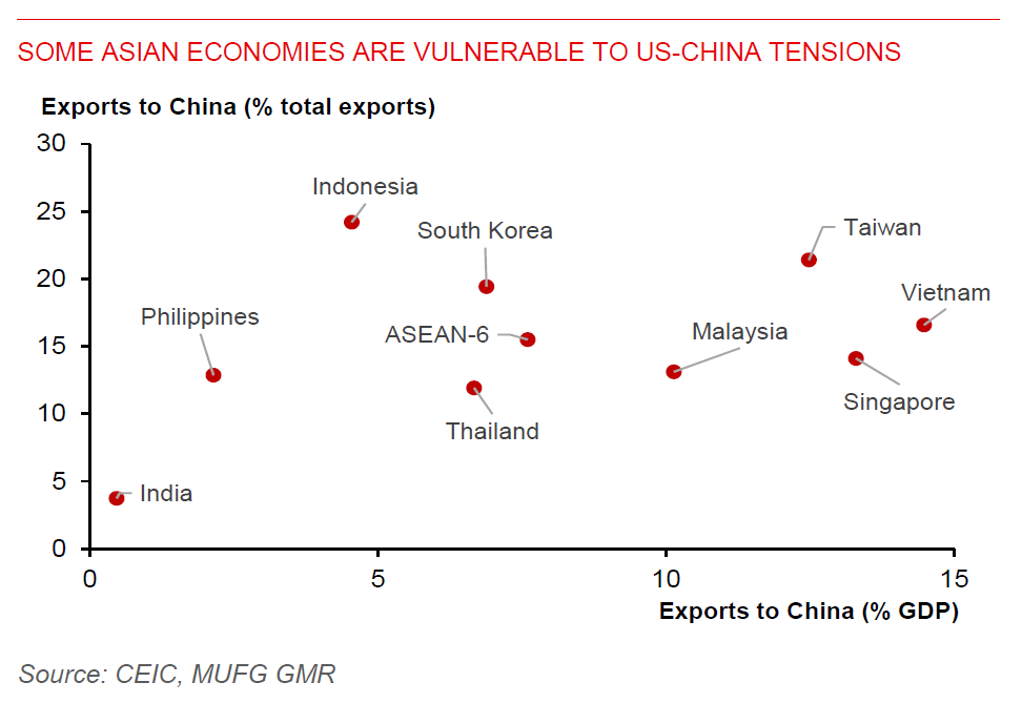

In the ASEAN region, we estimate that the largest negative growth impact from Trump’s proposed tariff hikes would be on Singapore and Malaysia, given their higher export exposure to both the Chinese and US markets, as well as sensitivity to US tariffs and the negative shock on China’s investment demand (see Asia FX: US tariffs would hurt growth, but may benefit ASEAN over the medium term - MUFG Research). This is followed by Thailand, Vietnam, Indonesia, and the Philippines. Mapping our analysis of the potential impact of Trump’s tariff on ASEAN FX, we expect larger depreciatory pressure on MYR, THB, and SGD, given the larger tariff impact on them and lower yields versus the US in the case of MYR and THB.

Elsewhere, Taiwan’s sequential growth picked up sharply to 1.1%qoq sa in Q3 following a 0.3% rise in Q2, underpinned by exports and investment. To meet the strong demand for AI applications and other high-tech products, semiconductor companies have been increasing their capacity at a faster pace, including setting up R&D facility and data centres. But from a year ago, GDP growth slowed to 4% from the 5.1% growth pace in Q2 as favourable base effects continue to fade.