Ahead Today

G3: US PCE Deflator, US Personal Spending

Asia: China Manufacturing PMI, China Non-Manufacturing PMI, Thailand Current Account, India GDP

Market Highlights

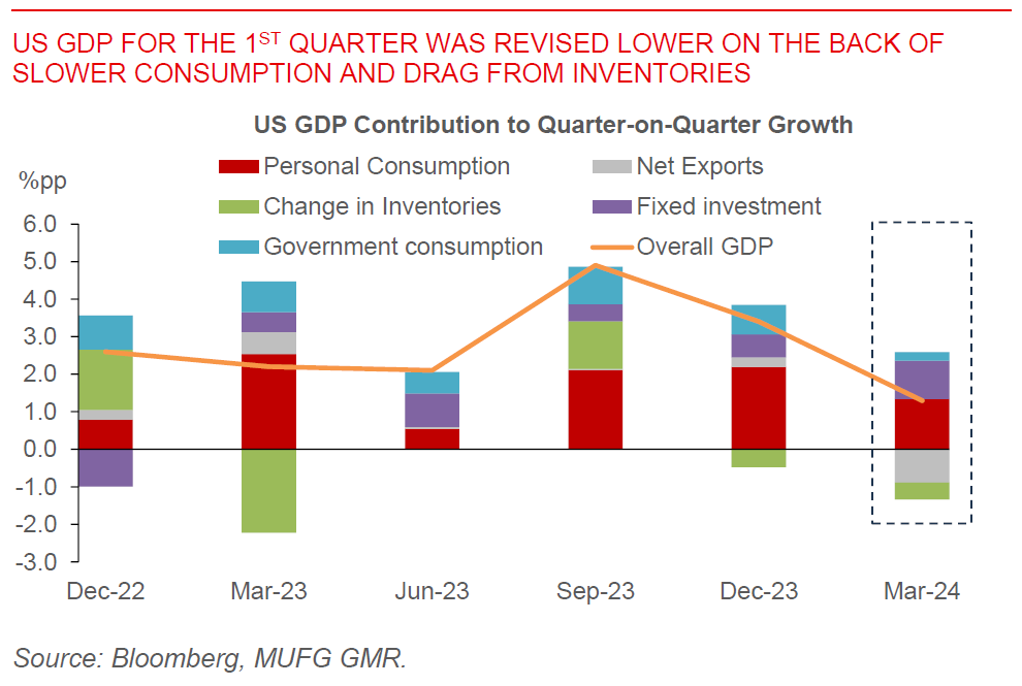

The US economy grew at a slower pace in the first quarter than initially estimated, primarily reflecting softer consumer spending on goods, with the Dollar weakening and US yields coming off. GDP rose 1.3% annualised in the 1st 3 months of the year, with consumption rising 2% compared with the provisional estimate of 2.5%, with also a larger drag from inventories. Nonetheless, this was partially offset by stronger business and residential investment. Meanwhile, the Fed speakers overnight including NY Fed President John Williams continue to highlight that policy is in a good place to continue to bring inflation down, with some also giving a nod to recent signs of a slowdown as evidence of that. There was a range of views and debates on the neutral rate with Bostic and Logan highlighting the possibility that the long-term rate had risen, but John Wiliams cited demographic factors as structural reasons why the neutral rate was still low.

Just five months before the US elections, Former President Donald Trump was found guilty of all 34 counts in his New York hush-money trial, making him the first former US president to be convicted of crimes, with sentencing scheduled for 11 July. While Trump is all but certain to appeal, Trump cannot pardon himself if elected because he was convicted on state and not federal charges, even as the US constitution is nebulous on having a convicted felon as a standing President.

Regional FX

Regional FX

Asian FX markets were mixed heading into the US session, with PHP (-1.2%), KRW (-1.5%) and IDR (-1.05%) underperforming. The underperformance in PHP was a continuation from the more dovish than expected shift by the BSP, with also some signs that the central bank’s FX intervention strategy had changed somewhat, focusing more on addressing liquidity stress rather than correcting any specific levels of misalignment. Markets will focus on China’s official manufacturing and non-manufacturing PMI numbers to gauge the extent of economic stabilization. Meanwhile, India’s GDP estimates for the Jan-Mar quarter are expected to show some modest slowdown to 7%yoy from 8.4%yoy but still remain quite strong overall.