Ahead Today

G3: US PCE inflation, US Personal Spending, US Personal income, US University of Michigan Sentiment

Asia: China Loan Prime rate, Taiwan Export orders

Market Highlights

The US data overnight pointed to a relatively resilient US economy for now, with applications for US unemployment benefits falling to 220,000 after spiking earlier this month. Continuing claims also fell to 1.87 million. In addition, US 3Q GDP was revised up to 3.1% from 2.8%, helped by stronger than expected personal consumption spending. Resilience in the US labour market and strong economic growth at least so far reduces the need for imminent rate cuts. Given that Chair Jerome Powell said future easing would require fresh progress on inflation, markets are watching for November's PCE inflation later today.

Meanwhile even as we approach the holiday season, the US House rejected a Trump-backed funding plan, which included suspending the federal debt limit, with 235 votes against and 174 in favor. Importantly, over 30 Republicans joined Democrats in opposition and without congressional action, government funding will lapse on Friday.

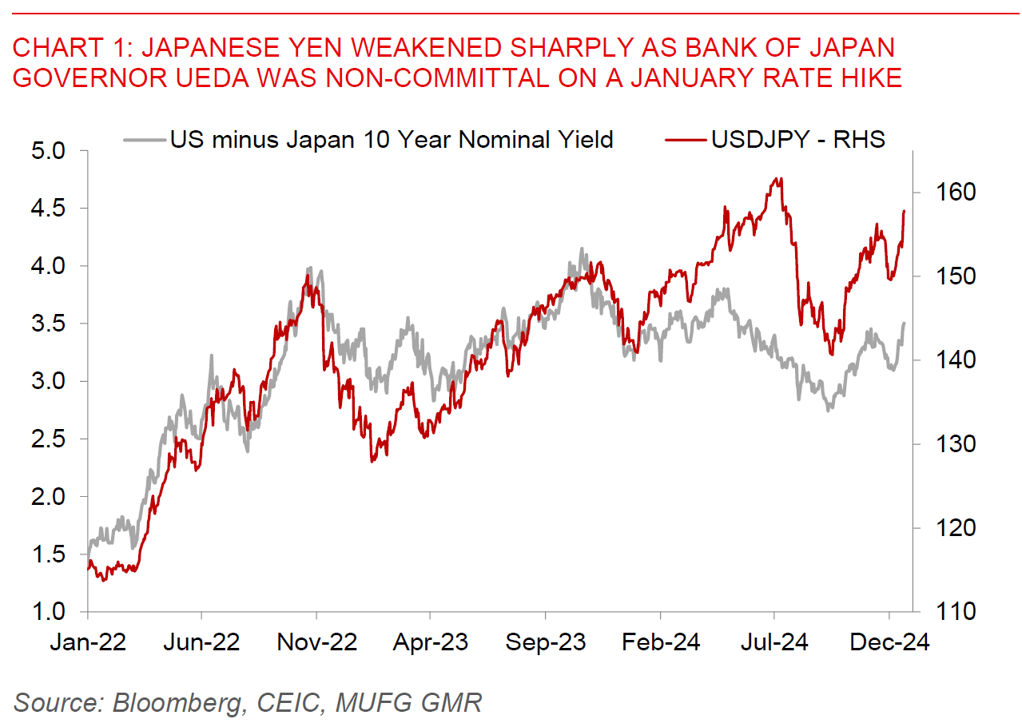

Last but not least, the Japanese Yen weakened sharply to 157 levels as Governor Kazuo Ueda was non-committal on a January 2025 rate hike in the Bank of Japan meeting, citing the need for higher pay in next year's wage negotiations. Ueda also mentioned uncertainty about President-elect Trump's policies.

Regional FX

Asian currencies were generally mixed to weaker, with MYR (-0.9%), THB (0.9%), IDR (-1.4%) and KRW (-0.8%) underperforming. Weaker Asian currencies have come on the back of the recent hawkish Fed meeting, a more dovish Bank of Japan, coupled with uncertainty around US’ fiscal trajectory with a possible government shutdown. We had two Asian central banks meeting yesterday – the Philippines and Taiwan. The BSP cut rates by 25bps as expected by both the markets and ourselves. Nonetheless, the communication for 2025 was less dovish, with Governor Remolona highlighting that the 100bps cuts the BSP was previously communicating for 2025 was probably too much, but also said that no cuts are too little. On our end, we are forecasting the BSP to bring rates down to 5% by end-2025, with continued moderation in domestic rice prices and contained inflationary pressures helping. The Taiwan central bank kept rates on hold at 2%, but importantly highlighted the elephant in the room – Trump 2.0 – in terms of its outlook for 2025 and implications for policy. For the CBC, the strong and somewhat overheated property market remains a key policy challenge, and it has opted to use targeted macroprudential measures, policies such as raising the RRR and also monitoring mortgage loan books of banks to try to contain it and maintain financial stability. The CBC remains more hawkish relative to other Asian central banks in this respect. Meanwhile, South Korea’s central bank agreed with the National Pension Service to expand the size and duration of a currency swap deal to US$65bn from US$50bn, with the duration extended by another year to end 2025. This could help manage the weakness in the KRW.