Ahead Today

G3: US wholesale inventories, New York Fed 1yr inflation expectation

Asia: China PPI and CPI, Taiwan exports

Market Highlights

The latest US jobs data have confirmed that the US labour market has been healthy, consistent with a modestly expanding US economy and not signalling an imminent recession. US nonfarm payrolls rose 142,000 in August, normally considered to be a healthy pace of gains. This was higher than the 114,000 in July, but missed market expectation of 165,000, Meanwhile, the unemployment rate fell 0.1ppt to 4.2%, in line with market expectation and remained historically low. The labour force participation rate steadied at 62.7%, while wage growth picked up to 0.4%mom (3.8%yoy) from 0.2% (3.6%yoy) in July, faster than market expectation.

There has been “no red flashing light” for the financial system, according to US Treasury Secretary Janet Yellen. She has reiterated that the US economy will reach a soft landing despite moderating labour market condition. Fed’s Waller, who also spoke following the nonfarm payroll data, said the time has come to start cutting interest rates, but he supports starting “careful” rate cuts in September.

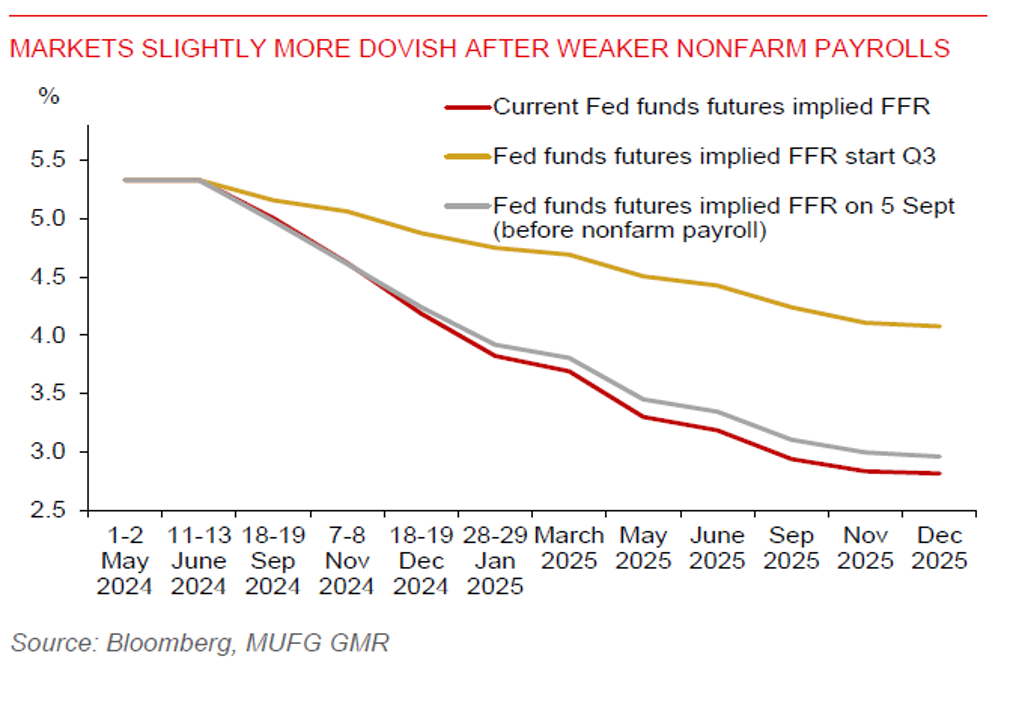

It’s looking like a 25bps Fed rate cut in September. But markets are still pricing about a 60% chance of a 50bps rate cut and have becoming slightly more dovish through 2025 following the weaker nonfarm payrolls. Markets remained concerned that the Fed might be behind the curve, with US equities selling off sharply on Friday. But the US dollar performance was mixed, falling 0.8% vs. JPY but gaining 0.2% vs. the euro on weaker than expected euro area final Q2 GDP (+0.2%mom vs.0.3% expected).

Regional FX

The US dollar did not catch a bid against most Asian currencies, with JPY (+0.8%), PHP (+0.6%), and VND (+0.5%) leading gains across the region on Friday, Key data highlights last Friday showed Vietnam’s activity data for August, including retail sales, industrial production, and exports, had all moderated but stayed solid. Indonesia’s foreign reserves rose US$4.8bn to US$150.2 in August, strengthening the buffer for the rupiah. A potential FX mover today is China’s inflation data, which could show subdued domestic price pressures, reflecting weak local sentiment. This could be a drag on regional currencies’ pace of appreciation against the US dollar. Meanwhile, Thailand’s new government plans to tackle the high level of household indebtedness, provide financial assistance to small businesses, and accelerate fiscal stimulus to boost growth. This would be a positive for the THB heading into peak tourism season in Q4.