Ahead Today

G3: Composite and services PMIs for eurozone and US, US ISM services survey

Asia: China’s Caixin services PMI, Indonesia 4Q GDP, Thailand CPI, Singapore retail sales

Market Highlights

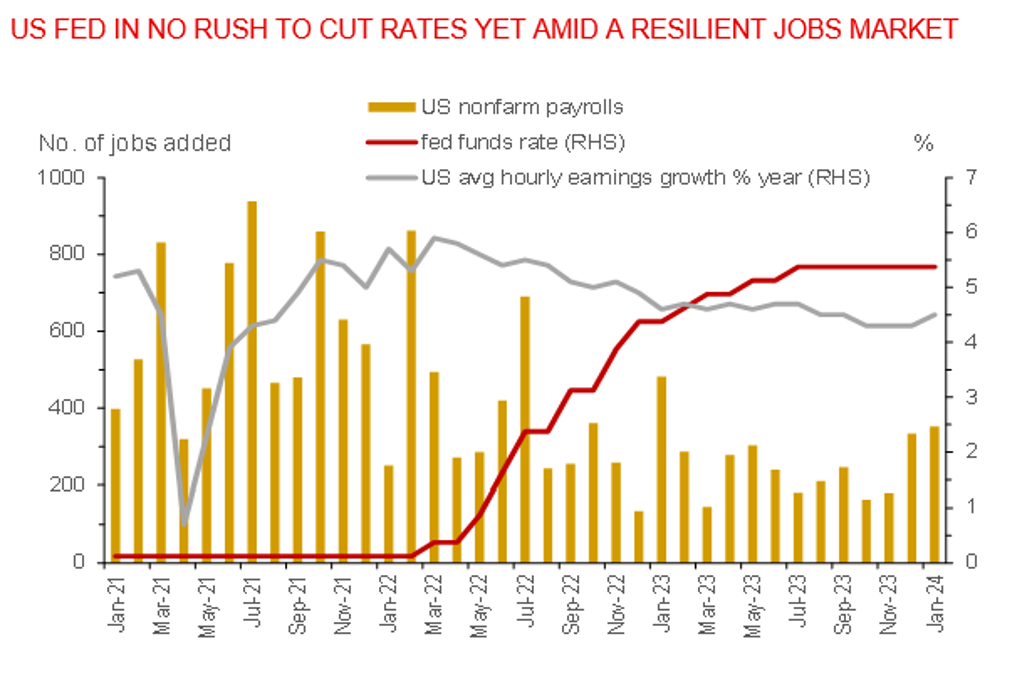

The strong US jobs report last Friday vindicated the US Fed’s decision to hold rates steady in January and push back against market expectations for a March rate cut. US nonfarm payrolls rose by 353k in January, accelerating from a revised 333k gain in December and soundly beating market consensus for a 185k expansion. Job gains were broad-based, led by professional and business services, healthcare, and retail trade. The unemployment rate held steady at 3.7%, while wages rose 0.6%mom (4.5%yoy), beating market consensus for a 0.3% gain (4.1%yoy).

The broad US dollar index (DXY) gained 1% on Friday, while 10-year US yields rose 14bps to 4.02%, and the S&P 500 index was up by 1.1%. In contrast, China’s CSI300 index were down 1.2%, with China pledging to stabilize its equity market amid weak investor sentiment.

Meanwhile, the ongoing crisis in the Red Sea continues to unravel, posing an upside risk to freight rates and oil prices. Iranian-backed Houthis has vowed to retaliate after US and its allies struck several Houthi sites in Yemen over the weekend.

Regional FX

Asian FX weakened against the US Dollar following the US jobs market report. Both USDCNH and USDKRW rose 0.4% to 7.2170 and 1337 respectively, while UDSSGD rose 0.5% to 1.3437. South Korea’s headline inflation moderated to 2.8%yoy in January, from 3.2% in December, beating market consensus of 2.9%. But this is still above the official 2% target.