Ahead Today

G3: US nonfarm payrolls, unemployment rate, average hourly earnings

Asia: Indonesia foreign reserves, Thailand CPI, Taiwan CPI and trade

Market Highlights

US initial jobless claims fell by 21,000 to 221,000 in the week ended 1 March, below Bloomberg consensus of 233k and remaining historically low. But efforts to improve government efficiency via overhauling the federal workforce could cool the US labour market. Job-cut announcements more than doubled in February from a year ago.

The key highlight today is the US nonfarm payrolls for February, with market expectations pointing to a decent month in job growth. Bloomberg consensus shows an increase of 160,000 jobs, the unemployment rate steadying at 4%, while average hourly wage growth to remain around the 4% pace. While consensus leans towards a decent set of US jobs data, a negative surprise could weigh on the US dollar.

Tariff delays and exemptions could also be a drag on the US dollar. US President Trump plans to defer the 25% tariffs on Canada and Mexico for goods covered by USMCA till 2 April.

In Europe, the ECB cut rates by 25bps to 2.50% yesterday, in line with market expectations. Policymakers said that the policy stance is now meaningfully less restrictive, implying the ECB could be close to ending its rate-cut cycle.

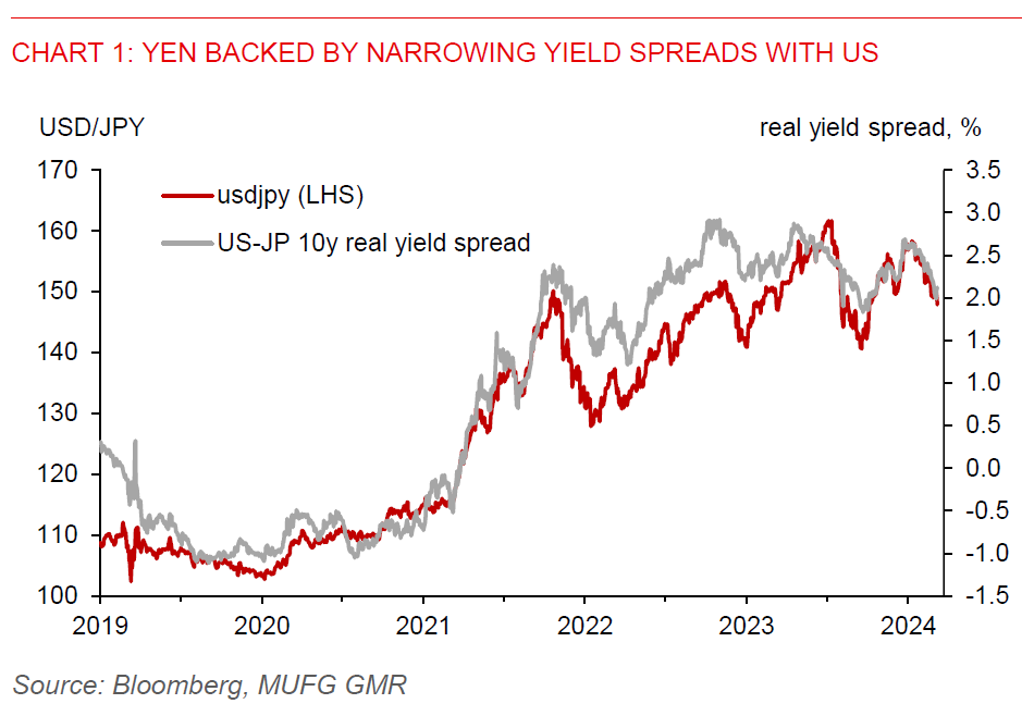

Meanwhile in Japan, the Japanese Trade Union Confederation, known as Rengo, has said that its member unions are demanding a 6.09% wage hike this year. This is higher than the 5.85% wage growth demand in 2024, and it is unheard of since 1993. Social norms of deflation appear to be ending in Japan, which will keep BoJ on its rate normalization path. Notably, Japan’s 10-year yield rose 9bps to 1.54%, a level not seen since mid-2009.

Regional FX

Asian ex-Japan currencies have been relative muted against the US dollar in Thursday’s session, as markets wait for the upcoming US jobs report later today.

There is limited impact on the ringgit following the central bank policy meeting yesterday. Bank Negara Malaysia kept its overnight policy rate unchanged at 3.00%. This is in line with our and market expectations. BNM has largely continued with its neutral tone in the monetary policy statement, despite the US raising tariffs by 20% on imports from China so far this year. The central bank assessed that at the current level of policy rate, it is consistent with their assessment of growth and inflation dynamics.

In terms of our USDMYR outlook, we maintain our forecast for it to rise to 4.5500 level by Q2, in anticipation of more US tariff actions in April and greater financial market volatility. A key risk will stem from Trump’s threat to impose 25% tariff on semiconductors, which could hurt Malaysia’s manufacturing and export outlook.

Meanwhile, Vietnam’s activity indicators for February point to continued robust growth momentum. Exports rose 25.7%yoy, industrial production was up by 17.2%yoy, while retail sales grew 9.4%yoy. Meanwhile, CPI inflation slowed to 2.9%yoy from 3.6% in January. But given Vietnam’s large trade surplus with the US, it remains at risk of US tariff hikes.