Ahead Today

G3: US Retail Sales, US Industrial production

Asia: Indonesia Trade Balance, India Trade Deficit

Market Highlights

Global macro developments were reasonably muted yesterday, even as markets gyrated ahead of the Fed. USD/JPY at one point declined below 140 before recovering to 140.82, while the Dollar was generally weakening including against the Asian FX crosses such as THB, MYR and PHP. US yields were lower coupled with a steeper curve, while equities saw some rotation out of the megacap stocks. The US released data overnight that showed a stronger than expected print for the Empire Manufacturing Index, while commentary from the ECB’s Chief Economist Philip Lane suggests that the ECB should maintain gradual approach to rate cuts and hence December continues to sound more likely.

The US retail sales numbers out later today will likely be significant, and may perhaps help to settle the ongoing debate about whether the Fed may do 25bps or 50bps cut later this week. Consensus is expecting a modest rise in underlying retail sales of 0.2%mom from 0.4%mom previously, and any signs of cracks in the US consumer may lead to further declines in US rates and a weaker US Dollar. Meanwhile, Donald Trump criticized Joe Biden and Kamala Harris for “highly inflammatory language” that he said inspired an alleged weekend assassination attempt, even as Trump and Harris are virtually tied and within the margin-of-error in major battleground states such as Pennsylvania, Arizona and Michigan based on latest polls.

Regional FX

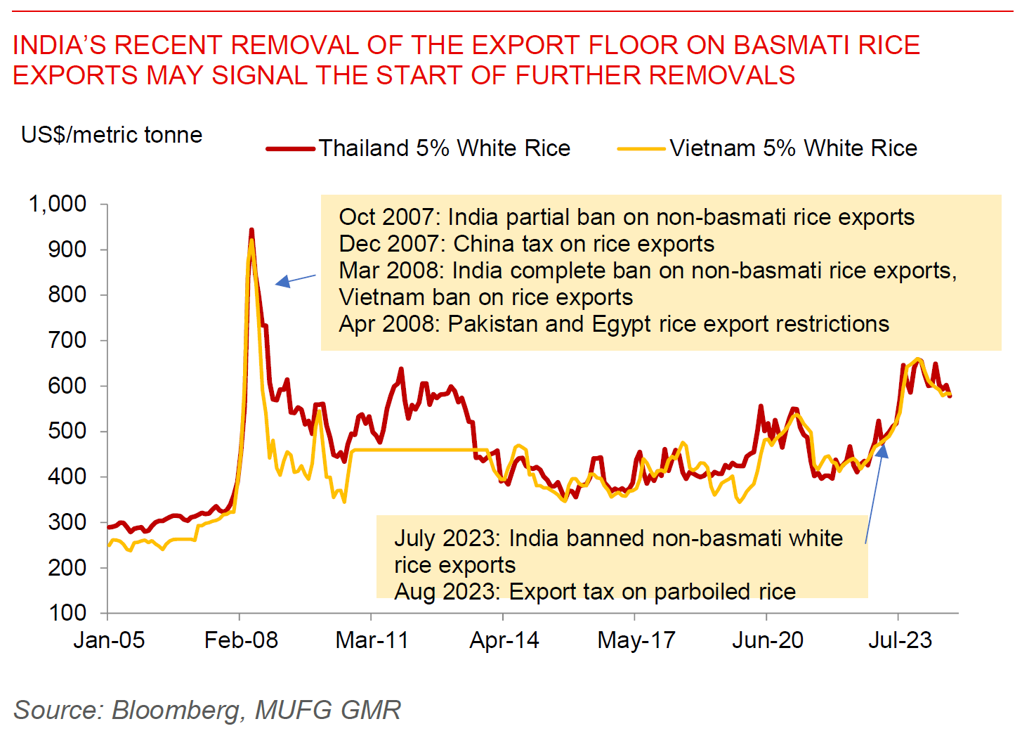

Asian FX markets traded stronger against the US Dollar through the Asian session, with THB (+1.56%), PHP (+0.55%), TWD (+0.77%) and KRW (+0.51%) outperforming. Thailand now expects the recipients of its two-part cash handout at no more than 40 million (from the original plan at as many as 50 million previously). The government will kick off the first phase by giving 10,000 baht (US$300) to 14.5 million Thais most in need of assistance from 25 Sep to 1 Oct, with the second phase to be implemented early next year expected to cover 36 million Thais. Meanwhile, in a 1st step towards removing rice export restrictions, and which could have some impact on global rice prices, India removed the export price floor on basmati white rice. The export ban on non-basmati white rice remains for now and could have a bigger impact if and when it is removed down the road. At the margin, this will be positive on PHP by lowering inflation pressures, notwithstanding the possible spillover to global rice prices from Typhoon Yagi and impact to rice fields in Vietnam. The Reserve Bank of India’s Governor Shaktikanta Das said that the Indian rupee’s resilience reflects the country’s strong economic fundamentals and the central bank isn’t artificially bolstering the currency.